Student Loan Repayment Calculator

HELP Loan Calculator

Income-based repayment

Private Loan Calculator

Fixed interest rate

Results

You’re staring at your student loan statement. The balance is huge. The minimum payment? Way more than $50. You’re wondering: Can I pay $50 a month for student loans? The short answer? Maybe. But only under very specific conditions-and not without consequences.

Most Student Loans Don’t Allow $50 Payments

In Australia, the main student loan system is HELP (Higher Education Loan Programme). If you’re repaying a HELP debt, your repayments are tied to your income. You don’t get to pick your monthly amount. The government calculates it automatically when you file your tax return. If you earn under $51,550 in 2025-26, you pay nothing. Once you earn above that, repayments start at 1% of your income and rise with your salary. That means if you’re working part-time or earning $45,000 a year, your actual repayment could be under $50 a month. But it’s not because you chose it-it’s because your income is low.That’s not the same as choosing to pay $50. If you’re on an income-based plan and your repayment comes out to $48, you’re not making a $50 plan-you’re just earning less than the threshold. If you earn $60,000, your repayment will be about $600 a month, no matter how much you want to pay less.

Private Student Loans Are a Different Story

If you took out a private student loan from a bank or lender (like a personal loan used for tuition), then yes-you might be able to negotiate a $50 monthly payment. But here’s the catch: those loans rarely offer income-based repayment. They come with fixed terms. A typical private student loan in Australia might require $300-$600 a month over 5-10 years. Paying $50 would mean stretching the term out for 20+ years, which could cost you tens of thousands more in interest.Some lenders offer hardship options. If you’ve lost your job, had a medical emergency, or are studying part-time with no income, you can ask for a payment pause or reduced amount. But $50 isn’t a standard option. You’d need to prove financial hardship, and even then, the lender might offer $100 or $150-not $50. And if you’re approved, your balance keeps growing because interest still accrues.

What Happens If You Only Pay $50?

Let’s say you have a $30,000 HELP debt. You earn $48,000 a year. Your repayment is $38 a month. You decide to pay $50 anyway. Great. You’re paying more than required. That’s smart. You’ll pay off your debt faster and save on interest.Now imagine you have a $45,000 private loan with 7% interest. You pay $50 a month. Your minimum payment should be $520. You’re paying less than 10% of what you owe. Here’s what happens:

- Interest adds $262.50 every month

- You pay $50

- Your balance grows by $212.50 each month

- In one year, your debt jumps to $47,550

That’s not repayment. That’s debt expansion. You’re making it worse. This is called negative amortization. It’s not a strategy-it’s a trap.

When a Month Actually Makes Sense

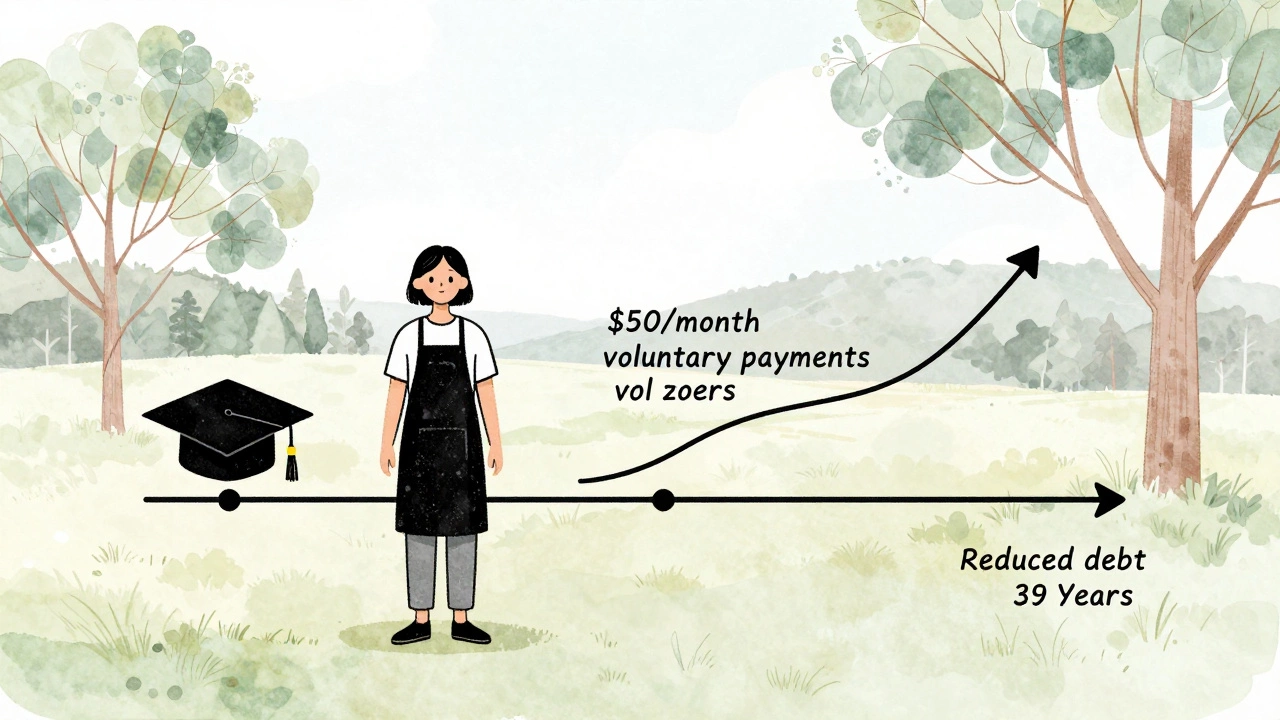

There are real cases where $50 a month is the right move:- You’re on a HELP plan and earning under $51,550. Your repayment is $0. Paying $50 voluntarily reduces your balance and saves future interest.

- You’re on a repayment holiday because you’re overseas or studying. You can still make voluntary payments at any time-even $20 or $50. Every dollar helps.

- You have multiple debts and $50 is all you can spare. Paying $50 to your student loan keeps it active and avoids default, even if it’s not enough to shrink the balance.

Voluntary payments on HELP loans are always a good idea. There’s no penalty. No fee. No catch. You can pay $50, $200, or $2,000 anytime. The government applies it directly to your principal. No interest added. No late fees. It’s the only student loan system in Australia where paying more than required is 100% beneficial.

What to Do If You Can’t Afford More Than $50

If you’re struggling and $50 is your max, here’s what to do:- Check your HELP balance on the ATO website. You might be surprised how small it is if you’ve been paying for years.

- If you’re earning under $51,550, you’re already paying $0. Don’t panic. You’re not behind.

- If you’re on a private loan and can’t pay the minimum, contact your lender immediately. Ask for a repayment plan, deferment, or hardship arrangement. Don’t wait until you miss payments.

- Use the ATO’s online repayment estimator to see how much you’ll pay based on your income. It’s free and instant.

- Consider side gigs, tutoring, or freelance work-even $100 extra a month can make a difference.

Don’t ignore your loan. Even if you can only pay $50, make the payment. It shows responsibility. It keeps your record clean. And if you ever get a raise, you’ll be glad you didn’t let it balloon.

Myths About Student Loan Payments

There are a lot of myths out there:- Myth: "You can refinance your HELP loan to get lower payments." Truth: HELP loans can’t be refinanced. They’re government-backed. You can’t switch lenders.

- Myth: "If I pay $50 a month, my loan will be forgiven in 10 years." Truth: HELP loans are forgiven when you die, or if you’re permanently disabled. There’s no forgiveness after 10 or 20 years.

- Myth: "Paying $50 means I’m avoiding my debt." Truth: If you’re on income-based repayment and paying $50 because your income is low, you’re doing exactly what the system designed. You’re not avoiding-you’re complying.

Real-Life Example: Sarah’s Story

Sarah graduated in 2023 with $28,000 in HELP debt. She works part-time as a barista and earns $42,000 a year. Her HELP repayment is $19 a month. She pays $50 a month voluntarily. That’s $600 extra a year. In three years, she’s paid off $1,800 of her debt. She’s saved about $800 in interest she would’ve paid later. She didn’t get rich. But she got ahead. And she didn’t stress about it.She didn’t wait for a raise. She didn’t take on a second job. She just paid $31 more than she had to. That’s all it took.

Final Answer: Yes, But Only If You’re Doing It Right

Can you pay $50 a month for student loans? Yes-if you’re on a HELP loan and your income is low, or if you’re making voluntary payments. No-if you’re on a private loan and $50 is below your minimum. Paying $50 on a private loan with high interest will make your debt worse. Paying $50 on a HELP loan when you’re earning under $51,550 is the smartest thing you can do.The system isn’t broken. It’s designed to match your ability to pay. You don’t need to pay more than you can. But if you can spare $50-even just a little extra-you’ll thank yourself later.

Can I pay $50 a month on my HELP loan?

Yes. HELP loans don’t have fixed monthly payments. Your repayment is based on your income. If you earn under $51,550, you pay nothing. You can choose to pay $50 a month voluntarily at any time-there’s no penalty, and it reduces your balance faster.

Will paying $50 a month clear my student loan?

Only if your total debt is small and your income stays low. For most people, $50 a month won’t be enough to pay off a typical HELP debt of $20,000-$50,000. But every extra dollar reduces interest and shortens your repayment period. It’s not about clearing it fast-it’s about making steady progress.

What happens if I pay less than my required amount?

On a HELP loan, you don’t have a required monthly amount-you pay based on income. If you earn under the threshold, you pay $0. On a private loan, paying less than the minimum will trigger late fees, damage your credit, and may lead to default. Always check your loan type before deciding how much to pay.

Is $50 a month too little for student loans?

It depends. If you’re on a HELP loan and earning under $51,550, $50 is more than enough-you’re paying extra. If you’re on a private loan with a $600 minimum, $50 is far too little and will make your debt grow. Know your loan type and terms before deciding.

Can I get my student loan forgiven if I pay $50 a month?

No. HELP loans are only forgiven if you die or become permanently disabled. There’s no forgiveness program based on payment amount or time. Private loans may have forgiveness options, but they’re rare and usually tied to specific jobs or programs-not low payments.