Debt Consolidation Impact Calculator

Current Debt Situation

Consolidation Plan

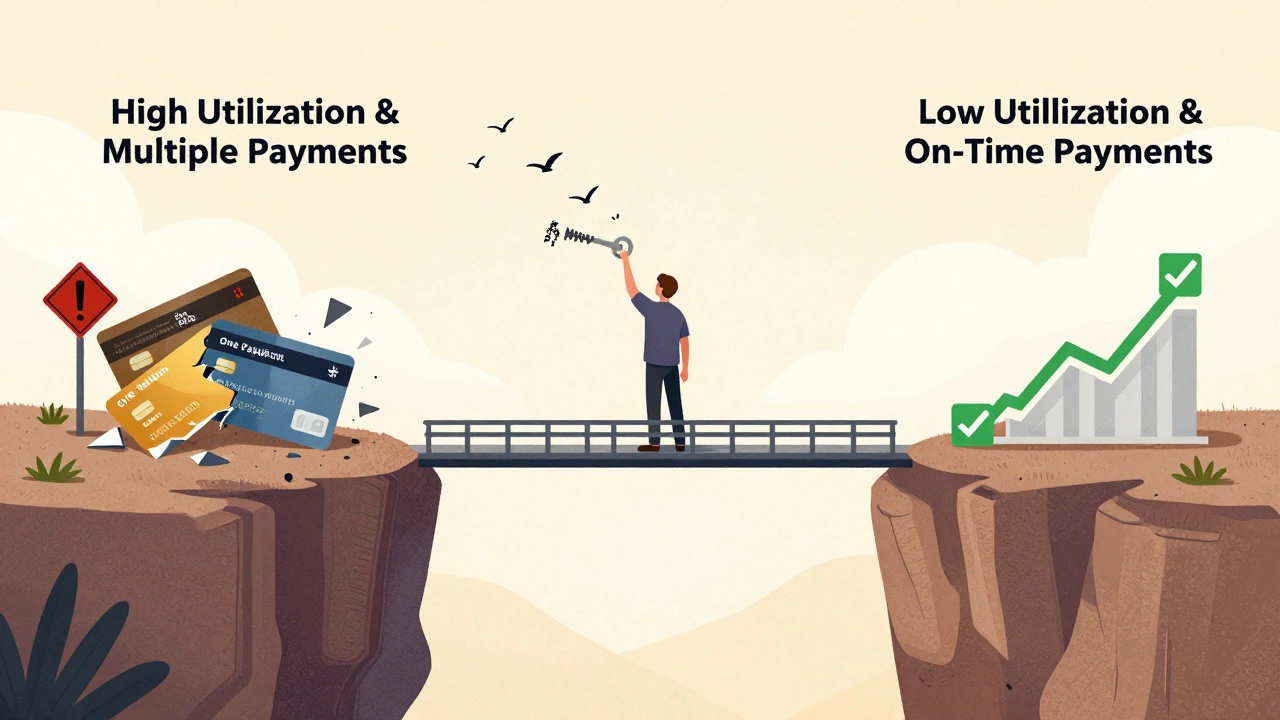

When you’re juggling multiple credit cards, personal loans, or medical bills, the idea of debt consolidation sounds like a lifeline. Combine all your debts into one payment. Lower interest. Simpler math. But does it actually lift your credit score? The short answer: it can-but not automatically, and not always right away.

How Debt Consolidation Works

Debt consolidation means taking out one new loan to pay off several smaller ones. Instead of five different due dates and interest rates, you get one monthly payment with a single rate. In Australia, this is often done through a personal loan, a balance transfer credit card, or a home equity loan if you own property.For example, imagine you’re paying:

- $500/month on a credit card at 22% APR

- $300/month on a medical bill at 18% APR

- $200/month on a store card at 24% APR

You total $1,000 a month in payments, and your credit utilization is hovering at 80%-way above the 30% threshold lenders like to see. Now you take out a $10,000 personal loan at 10% APR and pay off all three debts. Suddenly, your credit card balances are at $0. Your monthly payment drops to $250. That’s the dream, right?

Why Your Credit Score Might Go Up

Your credit score in Australia is calculated by Equifax, Experian, and illion. They look at five main things: payment history, credit utilization, credit age, credit mix, and new credit inquiries. Debt consolidation can help three of these.1. Lower credit utilization

Credit utilization is the percentage of your available credit you’re using. It makes up 30% of your score. If you’ve got $10,000 in credit limits across three cards and you owe $8,000, you’re at 80% utilization. That’s a red flag. Paying those off with a consolidation loan brings those balances to zero. Your utilization drops to maybe 5% or less. That alone can boost your score by 50-100 points in a few months.

2. On-time payments become easier

One payment is easier to track than five. Missed payments hurt your score more than any other factor. If you’ve been late twice in the last year, that’s a major ding. With consolidation, you’re more likely to pay on time every month. That builds a clean payment history-and that’s 35% of your score.

3. Simplified credit mix

Having different types of credit (revolving like credit cards, and installment like loans) helps your score. If you’re only using credit cards, adding a personal loan can improve your mix. That’s a small factor, but it helps.

When Debt Consolidation Can Hurt Your Score

It’s not all good news. There are real risks.1. Hard inquiries

When you apply for a consolidation loan, the lender pulls your credit report. That’s a hard inquiry. Each one can drop your score by 5-10 points. If you apply to three lenders in a month, that’s 15-30 points gone. And if you’re rejected, it looks like you’re desperate for credit-another red flag.

2. Closing old accounts

Some people close their credit cards after paying them off with a consolidation loan. Bad move. Your credit history length matters. If you close a card you’ve had since 2018, you lose six years of positive history. That can make your average account age drop, and that hurts your score.

3. New debt temptation

Pay off your credit cards. Now you’ve got $10,000 in available credit again. If you start charging again, you’re digging a deeper hole. You still owe the consolidation loan, plus new debt. That’s worse than before.

A 2024 study by the Australian Competition and Consumer Commission (ACCC) found that 23% of people who consolidated debt ended up with more total debt within 12 months-mostly because they kept using credit cards.

What Actually Moves the Needle

The score boost doesn’t come from the loan itself. It comes from what you do after.- Keep your old credit cards open (even if you don’t use them)

- Pay your consolidation loan on time, every month

- Don’t use your credit cards unless you can pay them off in full

- Keep your total debt-to-income ratio under 35%

People who follow these rules see their scores rise by an average of 68 points within six months, according to data from Equifax Australia. Those who close accounts or run up new debt? Their scores stay flat or drop.

Alternatives to Consolidation Loans

Not everyone qualifies for a low-interest consolidation loan. If your credit score is below 600, lenders might not approve you-or they’ll charge you 20%+ interest. In that case, consider:- Debt management plan (DMP): Work with a nonprofit credit counselor. They negotiate lower interest rates with creditors and bundle your payments. No new loan needed.

- Balance transfer card: If you have decent credit, move high-interest balances to a 0% intro APR card. Watch the fees and the end date.

- Debt settlement: Only as a last resort. It slashes your debt but tanks your score for years.

Debt management plans, for example, are used by over 40,000 Australians each year. They don’t hurt your score as much as a consolidation loan if you’re already struggling to qualify.

When to Avoid Consolidation

Don’t consolidate if:- Your total debt is under $5,000-you might be better off paying it off yourself with a budget.

- You’re not ready to stop using credit cards.

- You’re planning to apply for a mortgage in the next six months-new debt and inquiries can delay approval.

- Your income is unstable. If you lose your job, one payment is still one payment you can’t make.

There’s no magic. Debt consolidation isn’t a quick fix. It’s a tool. And like any tool, it can help or hurt depending on how you use it.

Real-World Example: Sarah from Sydney

Sarah had $15,000 in credit card debt across four cards. Her credit score was 520. She applied for a $15,000 personal loan at 11% APR, paid off all her cards, and kept all four accounts open. She set up automatic payments and stopped using cards entirely. Six months later, her score was 685. A year later, it hit 740. She got approved for a car loan at 6.5% interest-down from 19%.She didn’t get lucky. She changed her habits.

Does debt consolidation hurt your credit score?

It can, temporarily. Applying for a new loan causes a hard inquiry, which may lower your score by 5-10 points. Closing old credit accounts can also hurt your credit history length. But if you manage the new loan responsibly and don’t accumulate new debt, your score will likely recover and improve within 6-12 months.

How long does it take for your credit score to improve after consolidation?

Most people see improvement within 3-6 months if they pay on time and keep credit utilization low. The biggest boost usually comes from lowering credit card balances to near zero. Full recovery and significant gains (like 100+ points) often take 9-18 months of consistent on-time payments.

Should I close my credit cards after consolidating?

No. Closing cards reduces your total available credit, which can raise your credit utilization ratio. It also shortens your credit history. Keep them open with zero balances. You don’t need to use them-just don’t close them.

Can I consolidate debt if I have bad credit?

Yes, but it’s harder. You may only qualify for high-interest loans, which could make your situation worse. If your score is below 600, consider a debt management plan through a nonprofit credit counselor instead. They can negotiate lower rates without a hard inquiry.

Is debt consolidation better than bankruptcy?

Almost always. Bankruptcy stays on your credit report for seven years and makes it nearly impossible to get loans, credit cards, or even rent an apartment. Debt consolidation, if handled well, improves your credit over time. It’s a step toward recovery, not a financial dead end.

Next Steps: What to Do Now

If you’re thinking about consolidation, do this:- Check your credit report for free at Equifax or Experian. Know your current score.

- List every debt: balance, interest rate, minimum payment.

- Calculate your total monthly debt payments.

- Get quotes from at least two lenders. Compare interest rates, fees, and terms.

- Ask: Can I afford the new payment? Will I stop using credit cards?

- If yes, apply for one loan. Don’t apply to five.

- After approval, pay off all debts. Keep old accounts open.

- Set up autopay. Track your progress.

Debt consolidation doesn’t fix your spending habits. But if you’re ready to change them, it can be the turning point. It’s not about the loan-it’s about what you do after you sign the papers.