Savings Doubling Calculator

Time to Double $5,000

16 years

with $0 monthly contributions

Your Growth Timeline

Double $5000? That’s not a fantasy - it’s a math problem with real answers. But most people get it wrong. They think it’s about finding the next big crypto coin or betting on a stock tip. The truth? Doubling $5,000 doesn’t need hype. It needs time, the right account, and a clear plan. And yes, you can do it without risking everything you’ve saved.

What doubling $5000 really means

Doubling $5,000 means turning it into $10,000. Sounds simple. But how long will it take? That depends on one thing: interest. Not hype. Not luck. Just interest.

If you stick $5,000 in a regular savings account with 0.1% annual interest, you’ll have $5,005 after a year. After 10 years? Still barely $5,050. You’re not even keeping up with inflation. That’s not a path to doubling - it’s a path to losing buying power.

But if you find a high-yield savings account paying 4.5% APY? That changes everything. With compound interest, your money grows faster each year. After 15 years, $5,000 becomes $9,700. Close. After 16 years? $10,150. There it is. No trading. No apps. Just a bank account that actually pays you.

High-yield savings accounts: your best starting point

Not all savings accounts are created equal. In Australia, the average savings account pays less than 0.5%. But some online banks and fintechs offer rates over 4%. Why? Because they don’t have branches. They don’t pay for fancy lobbies. They pass the savings to you.

Here’s what to look for:

- APY (Annual Percentage Yield) of 4% or higher

- No monthly fees

- Easy transfers in and out

- FDIC-equivalent protection (in Australia, that’s covered under the Financial Claims Scheme up to $250,000 per person per institution)

As of early 2026, accounts from banks like ING a digital bank in Australia offering high-yield savings accounts with competitive interest rates, ME Bank an Australian retail bank known for its high-interest savings products, and UBank a digital banking service under NAB that offers tiered interest rates on savings are consistently paying 4.5% to 5.1% on balances over $5,000.

Set up automatic transfers. Even $200 a month into a 5% account will get you to $10,000 in under 20 months - with interest doing half the work. That’s the power of compound growth.

Can you double $5000 faster? Yes - but with trade-offs

Waiting 16 years might feel too slow. You want results. So what else works?

Let’s say you put $5,000 into a term deposit at 5.2% for 3 years. At the end, you get $5,820. Not doubled. But it’s safe. Then you roll it into another term. After 14 years, you’re over $10,000. Still slow. But zero risk.

Now, consider a managed fund a pooled investment vehicle that invests in a mix of stocks, bonds, or other assets, managed by professionals. If you invest $5,000 in a balanced fund averaging 7% annually (historically accurate for diversified portfolios), you hit $10,000 in about 10 years. That’s faster. But you’re exposed to market swings. If the market drops 15% in year two, you’re down to $4,250. You have to stick with it.

Or try a share market a regulated marketplace where publicly traded companies’ stocks are bought and sold. Buy $5,000 worth of ETFs like ASX 200 the benchmark index of the 200 largest companies listed on the Australian Securities Exchange. Over the last 20 years, the ASX 200 returned about 8% per year. That means $5,000 becomes $10,000 in roughly 9 years. But you’ll see your balance drop during recessions. Are you ready for that?

What doesn’t work

Let’s be clear: some paths look fast but are traps.

- Cryptocurrency: Bitcoin might go up 10x in a year - but it might also lose 60%. You’re gambling, not investing.

- P2P lending: Platforms like RateSetter an Australian peer-to-peer lending platform that connects borrowers with investors offer 7-9% returns, but if a borrower defaults, you lose money. No government protection.

- Get-rich-quick schemes: “Buy this software, recruit 10 people, and you’ll double your money!” These are pyramid models. They collapse.

These aren’t investments. They’re lotteries with worse odds.

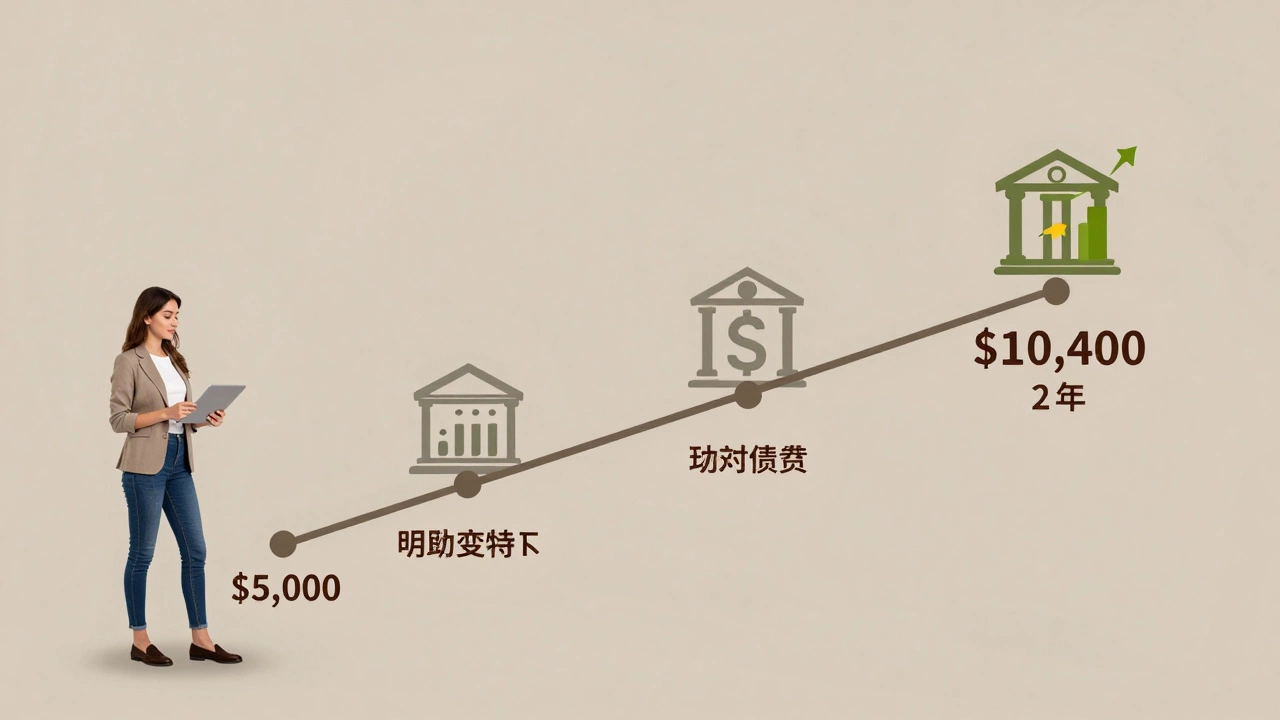

Real-world example: How one Sydney mum doubled her $5K

Jenny, 38, works in admin in Marrickville. She had $5,000 saved from her tax refund. She didn’t want to risk it. She didn’t want to wait 20 years.

She opened a high-yield savings account with UBank a digital banking service under NAB that offers tiered interest rates on savings at 4.95% APY. She set up auto-deposits of $150 every pay cycle. After 18 months, her balance hit $8,200. She added $1,000 from a side gig. Then she moved the whole $9,200 into a 2-year term deposit at 5.3%. After 14 months, it matured at $9,700. She rolled it into another term. Two years later? $10,400.

She didn’t trade. She didn’t chase trends. She just kept adding money and chose accounts that paid fairly.

Step-by-step plan to double ,000

- Open a high-yield savings account with at least 4.5% APY. Compare rates on RateCity an Australian comparison website for financial products including savings accounts or Canstar a financial comparison service that rates savings accounts and other products.

- Deposit your $5,000. Don’t touch it.

- Set up a weekly or monthly auto-transfer of at least $100. Even $50 helps.

- After 12-18 months, if you’ve grown the balance to $6,000-$7,000, consider moving part of it into a low-risk managed fund or ETF.

- Rebalance every year. Keep 50-70% in savings for safety. Let the rest grow.

Why time is your secret weapon

The magic isn’t in the interest rate. It’s in time. Compound interest doesn’t care how smart you are. It only cares how long you stay in.

Start at 25? Double $5,000 in 14 years at 5%. Start at 45? It takes 20 years. Start at 55? You’ll need to add money every month just to hit $10,000.

That’s why starting now matters more than picking the perfect account. A 4.5% account today is better than waiting for a 6% account next year - because next year, you’re still at $5,000. This year, you’re already earning interest.

Final truth: Doubling $5,000 is about discipline, not luck

You don’t need to be rich. You don’t need to be a financial expert. You just need to choose a smart account, leave the money there, and keep adding to it. Most people fail because they move their money too soon - chasing a new app, a new trend, a new promise.

Double $5,000? It’s possible. Not because of magic. Because of math. And you’ve already done the hardest part: you’re asking the question.

Can I double $5000 in a year?

It’s extremely unlikely without taking serious risk. To double $5,000 in 12 months, you’d need a 100% return. That’s only possible through gambling - crypto, options, or speculative startups. These carry a high chance of losing your money. No legitimate financial product guarantees that kind of return. If someone says they can, they’re selling something.

What’s the safest way to double $5000?

The safest way is through a combination of high-yield savings accounts and low-risk term deposits. While it takes 14-18 years, you won’t lose money. You’ll earn interest with government-backed protection. If you add money regularly, you can reach $10,000 faster and with zero risk of loss.

Are online banks safe for savings?

Yes - if they’re licensed in Australia. Online banks like UBank, ING, and ME Bank are fully regulated and covered under the Financial Claims Scheme. Your money is protected up to $250,000 per person per institution. They’re often safer than big banks because they have fewer overheads and focus solely on savings products.

Should I use a term deposit or a savings account?

Use both. Start with a high-yield savings account for flexibility - you can add money anytime. Once you’ve saved $6,000-$8,000, lock part of it into a term deposit for a higher rate. Term deposits give you better returns, but you can’t touch the money. Savings accounts give you control. Combine them for balance.

How does inflation affect doubling $5000?

Inflation eats away at your money’s value. If inflation is 3% and your account pays 2%, you’re losing 1% each year. To truly double your purchasing power, you need returns above inflation. A 5% return with 2.5% inflation means you’re gaining real value. Always check the real interest rate - not just the headline rate.

If you’re serious about doubling $5,000, start today. Open one account. Set up one auto-transfer. That’s all it takes. The rest? It just grows.