Cashback Calculator

Calculate Your Cashback

See how much you could earn with the American Express Platinum Cashback Card. This calculator shows real value based on your everyday spending habits.

Your Cashback Summary

At 2% cashback on all purchases, your spending translates to:

- Monthly Cashback $

- Annual Cashback $

What this means for you

With $ monthly spending, you'd earn $ annually. That's like:

- $ toward a vacation

- $ toward savings

- $ toward car registration

Compare to other cards:

Citi Double Cash

1% on purchases + 1% when paid

Annual Cashback: $

NAB Rewards Visa

0.5% - 1.5% (category-based)

Annual Cashback: $

Amex Platinum Cashback

2% on all purchases

Annual Cashback: $

There’s no single "best" credit card for everyone. But if you’re asking what card most people should have right now - the one that gives the most value across the most situations - the answer is the American Express Platinum Cashback Card (Australia version). It’s not the fanciest, it doesn’t have airport lounges, and it won’t make you feel rich. But it makes you smarter with money. And that’s what matters.

Let’s cut through the noise. You’ve seen lists with 12 cards that all claim to be #1. One is for travel, one is for dining, one is for groceries. But real life doesn’t work like that. Most people don’t spend 70% of their money on flights. They spend it on petrol, groceries, bills, and coffee. The card that wins isn’t the one with the fanciest perks. It’s the one that pays you back for what you actually buy.

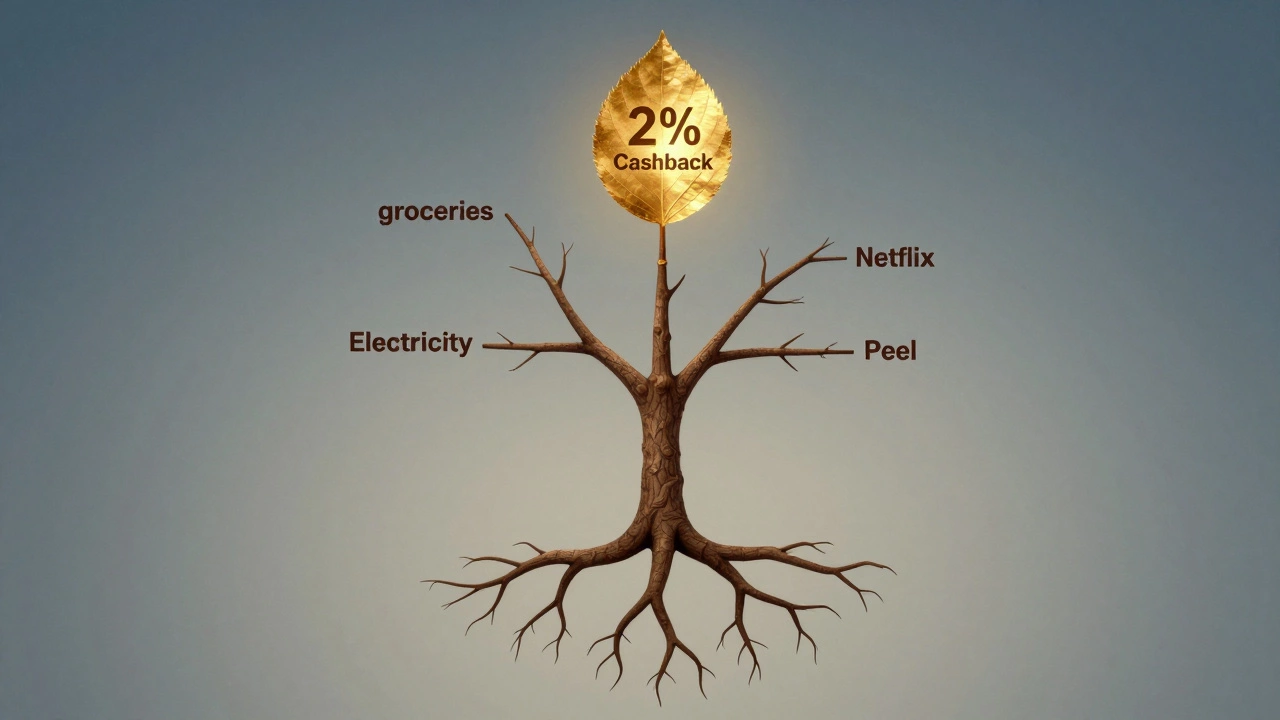

Why the American Express Platinum Cashback Card leads

This card gives you 2% cashback on all purchases. No categories. No caps. No rotating limits. Just 2% on everything - from your Coles grocery run to your Netflix subscription, from your electricity bill to your weekly takeaway. That’s not a gimmick. That’s real money back.

Let’s say you spend $500 a week. That’s $26,000 a year. At 2% cashback, you get $520 back. That’s like getting a free vacation every year. Or paying off your car registration. Or putting $10 a week into savings without even trying.

Compare that to other popular cards. The Citi Double Cash gives 1% back on purchases and another 1% when you pay your bill. Sounds good, right? But you have to remember to pay on time every month. Miss one payment? You lose the second 1%. The Amex Platinum Cashback? You get the 2% no matter what. No strings.

And unlike reward points cards - where you need to book flights months in advance or hunt for redemption slots - cashback is instant. It lands in your bank account. You can use it for anything. No blackout dates. No minimum spend requirements. No expiration.

Who this card is NOT for

This isn’t the card for people who want luxury perks. If you’re flying international every month and care about lounge access, priority boarding, or hotel elite status, this isn’t your card. Those benefits exist - but they come with fees. The Amex Platinum Cashback has no annual fee. Period.

It’s also not for people who carry a balance. This card has a variable interest rate of 19.99% p.a. That’s high. If you don’t pay your balance in full each month, you’ll pay more in interest than you’ll earn in cashback. That’s a net loss. This card only works if you pay it off every month. If you can’t do that, focus on paying down debt first. Then come back.

What you’re really getting

With this card, you’re not buying a status symbol. You’re buying a financial tool. It’s like having a personal assistant who tracks every dollar you spend and sends you a cheque for 2% of it. You don’t need to change your spending habits. You don’t need to use a new app. You don’t need to learn complicated rules.

You just swipe. Pay on time. Get cashback. Repeat.

It also comes with free purchase protection and extended warranty coverage. If your new TV breaks within two years, Amex will replace it. If your online order gets lost, they’ll refund you. These aren’t flashy perks - but they’ve saved people hundreds of dollars in out-of-pocket costs.

How it stacks up against other top cards in 2026

| Card | Cashback Rate | Annual Fee | Interest Rate | Best For |

|---|---|---|---|---|

| American Express Platinum Cashback | 2% | $0 | 19.99% | Everyday spending |

| Citi Double Cash | 2% (1% + 1% on payment) | $0 | 20.99% | Disciplined payers only |

| NAB Rewards Visa | 0.5% - 1.5% (category-based) | $150 | 21.99% | Travel enthusiasts |

| Bankwest Breeze | 1% | $0 | 18.99% | Low-rate seekers |

| St. George Amplify | 0.5% - 2% (rotating categories) | $0 | 20.49% | People who track spending |

The table shows why the Amex card stands out. It’s the only one with flat 2% cashback, no fee, and no tricks. The others either charge you, limit your rewards, or make you jump through hoops. In 2026, simplicity wins. People are tired of complicated systems. They want cards that work without effort.

Real people, real results

One user in Melbourne spends $4,200 a month on groceries, petrol, and bills. With the Amex Platinum Cashback, she gets $84 back every month. That’s $1,008 a year. She uses it to cover her kids’ school excursions. No extra budgeting. No sacrifice.

A single dad in Adelaide pays his phone, internet, and electricity bills with his card. He gets $65 back monthly. He puts it into a high-interest savings account. In 18 months, he saved $1,200 - just by switching cards.

These aren’t outliers. They’re people who made one smart change. No side hustles. No budgeting apps. Just a better card.

How to get it

You need a good credit score - usually above 650. You need to be over 18. And you need to be an Australian resident. You can apply online in under 10 minutes. Approval often takes less than 48 hours.

Don’t apply for multiple cards at once. Each application leaves a mark on your credit file. One smart choice beats five rushed ones.

Once approved, set up auto-pay. Link it to your main checking account. Set a reminder if you need to. But don’t let it sit unused. Use it for everything you normally buy. The more you spend (and pay off), the more you get back.

What to avoid

Don’t use this card as a loan. Don’t treat it like free money. That’s how people get into trouble.

Don’t chase sign-up bonuses. The Amex card doesn’t offer one. And that’s fine. Sign-up bonuses often require you to spend $3,000 in three months. That’s not smart spending - that’s forced spending. This card rewards your real life, not a temporary spike.

Don’t switch cards every year. The benefits compound. The longer you hold it, the more cashback you earn. After three years, you’ll have over $1,500 back. That’s more than most people get from their entire savings account.

Final thought

The #1 credit card isn’t about prestige. It’s about power. The power to get money back on what you already spend. The power to reduce stress about bills. The power to build savings without changing your lifestyle.

If you pay your balance in full every month, this card gives you more than any other. It’s not flashy. It’s not trendy. But in 2026, that’s exactly what most people need.

Is the American Express Platinum Cashback Card really the best for everyone?

No - it’s the best for people who pay off their balance every month and spend regularly on everyday items like groceries, petrol, and bills. If you carry a balance, travel often, or need travel insurance, other cards might suit you better. But for most Australians living on a regular income, this card delivers the most consistent value.

Can I use this card overseas?

Yes. The Amex Platinum Cashback Card works anywhere Mastercard or Visa is accepted. It charges a 3% foreign transaction fee on purchases made in foreign currencies. That’s higher than some travel cards, but since you’re getting 2% back on everything, you still come out ahead on most spending. For frequent international travelers, it’s still worth using - just avoid large cash advances.

What happens if I miss a payment?

You’ll be charged interest on your balance at the standard rate of 19.99% p.a. You’ll also lose your cashback for that month. More importantly, missed payments hurt your credit score. This card rewards responsible use. If you can’t pay on time, consider a lower-rate card or a personal loan to get back on track.

Do I need a high income to qualify?

Not necessarily. Amex looks at your credit history, employment stability, and debt-to-income ratio more than your salary. A steady income of $40,000+ with a clean credit file is often enough. What matters most is that you don’t have unpaid debts or recent defaults.

Can I get this card if I’m self-employed?

Yes. Self-employed people can apply as long as they can prove income with tax returns or bank statements from the last 12 months. Many self-employed Australians use this card to separate business and personal spending - and earn cashback on both.

Is there a limit to how much cashback I can earn?

No. There’s no cap on cashback. The more you spend (and pay off), the more you earn. Some users report earning over $1,200 a year just from regular household spending. It adds up quietly - and consistently.

Next steps

If you’re ready to switch:

- Check your credit score using a free service like Equifax or Experian.

- Review your monthly spending - especially on groceries, petrol, and bills.

- Apply for the American Express Platinum Cashback Card online.

- Once approved, set up automatic payments from your main account.

- Use the card for everything you normally buy - and watch the cashback roll in.

Don’t wait for the perfect card. The best card is the one you use - and pay off - every month. This one makes that easy.