Home Insurance Satisfaction Comparison Tool

This tool helps you compare home insurance companies based on key satisfaction factors from the 2025 J.D. Power study. Select what matters most to you, and see which insurers rank highest for your priorities.

Your Priorities

Top Insurance Companies

Remember: The highest satisfaction scores (like Amica's 891) come from companies that treat you as a person, not a policy number. Mutual insurers (Amica, Auto-Owners, USAA) often outperform traditional insurers because they're owned by policyholders, not shareholders.

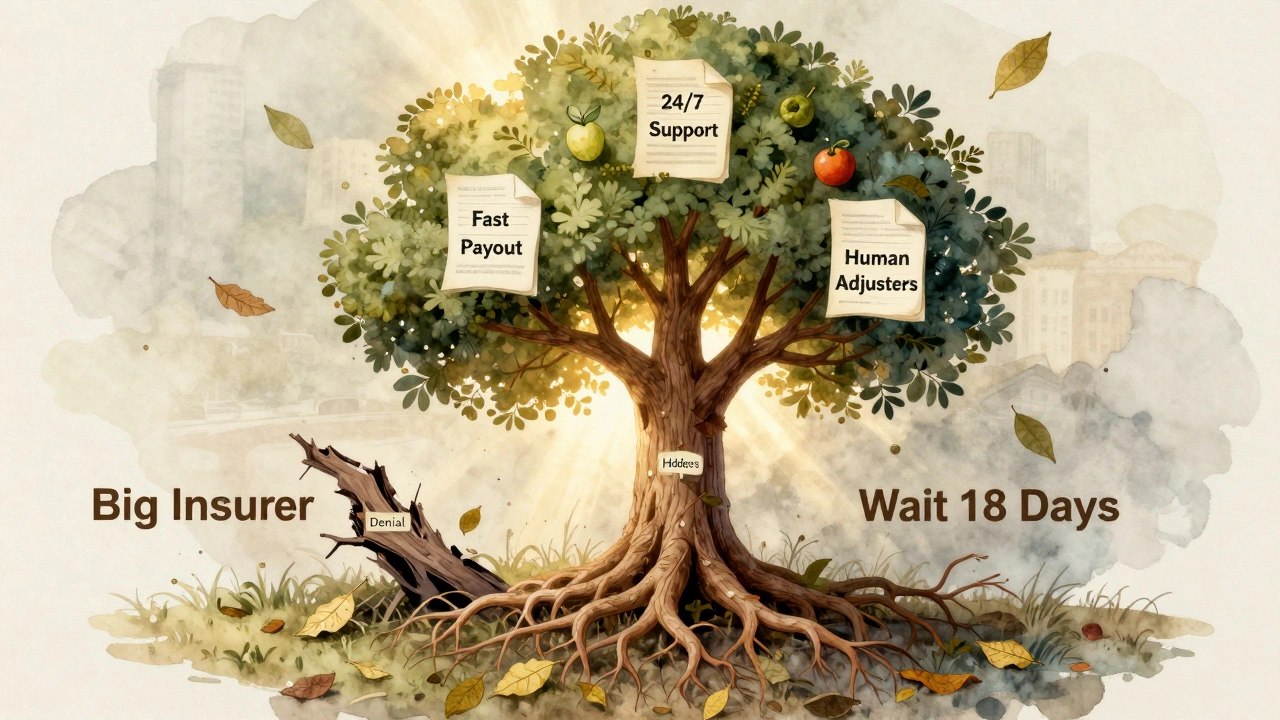

When you’re paying for homeowners insurance, you don’t just want coverage-you want peace of mind. And that peace of mind doesn’t come from a low premium alone. It comes from knowing your insurer will show up when you need them, answer your calls, fix things quickly, and treat you like a person, not a policy number. So which company actually delivers on that promise?

Customer satisfaction isn’t about price-it’s about experience

You might be tempted to pick the cheapest quote. But a $500 savings on your annual premium means nothing if you’re stuck on hold for 45 minutes after a storm damages your roof, or your claim gets denied because of a tiny paperwork error. Real satisfaction comes from how an insurer handles the messy, stressful moments-not the smooth ones. In 2025, J.D. Power’s U.S. Home Insurance Study surveyed over 40,000 policyholders. The results showed that customer satisfaction scores jumped significantly for companies that invested in digital tools, faster claims response, and clearer communication. The top performer? Amica Mutual. They scored 891 out of 1,000, beating out giants like State Farm and Allstate. Why? Their customers reported fewer delays, more personal service, and claims adjusters who actually showed up on time.What makes a home insurance company truly satisfying?

It’s not just one thing. Satisfaction comes from a mix of factors:- Claims speed: How fast do you get money after filing? Top companies pay out within 5-7 days for straightforward claims.

- Claims accuracy: Do they cover what they promised? Only 12% of satisfied customers reported claim denials they didn’t expect.

- Communication: Are you updated at every step? Or left guessing?

- Customer service: Can you reach a real person without navigating ten menus?

- Digital tools: Can you file a claim via app? Upload photos? Track progress in real time?

How the top players stack up

Here’s how the major insurers ranked in 2025 based on customer satisfaction (out of 1,000):| Company | Satisfaction Score | Claims Speed | Customer Service Rating |

|---|---|---|---|

| Amica Mutual | 891 | Fast (5-7 days) | Excellent |

| Auto-Owners | 879 | Fast | Excellent |

| USAA | 875 | Very Fast | Excellent |

| State Farm | 852 | Average | Good |

| Allstate | 841 | Average | Good |

| Lemonade | 828 | Fast (AI-driven) | Good |

Notice something? The top three-Amica, Auto-Owners, and USAA-are all mutual insurers. That means they’re owned by their policyholders, not shareholders. Their goal isn’t to maximize quarterly profits. It’s to keep you happy so you stay with them for years. That’s a big difference.

Lemonade, the app-based insurer, ranks high for speed thanks to AI claims processing. But if your claim is complex-say, fire damage with mold issues-you might miss having a human guide you through it. Their satisfaction drops for claims over $10,000.

Who should avoid the big names?

State Farm and Allstate dominate the market. You see their ads everywhere. But their satisfaction scores tell a different story. They handle the most claims-so they have the most complaints. One in five customers reported being told their claim was denied due to “policy exclusions” they never understood. That’s a red flag. If you’re in a high-risk area-coastal flood zones, wildfire-prone regions, or cities with rising burglary rates-bigger insurers may drop you or raise rates unfairly. Smaller mutuals like Amica and Auto-Owners are more likely to stick with you, even if your home is older or in a tough location.What about discounts and coverage?

Satisfaction doesn’t mean you have to pay more. Amica’s average premium is only 7% higher than State Farm’s, but their claims payout rate is 22% higher. That’s because they don’t nickel-and-dime you with hidden fees or force you to buy extra add-ons just to qualify for a discount. You also get more flexibility. Amica lets you bundle home and auto insurance without forcing you into a specific plan. Auto-Owners gives you a 10% discount just for paying in full upfront. USAA offers military families unmatched rates and service-but you have to be active duty, veteran, or a family member to qualify.

What to look for when choosing your insurer

Don’t just pick the top name. Ask yourself:- Can I file a claim online or via app, or do I need to call during business hours?

- Do they offer 24/7 claims support?

- Are adjusters local, or do they fly someone in from another state?

- What’s their average claim payout time?

- Do they offer guaranteed replacement cost, or just actual cash value?

Real stories from real customers

In 2024, a homeowner in Ohio lost her kitchen to a water leak. Her insurer, a major national brand, took 18 days to send an adjuster. Then they said the damage was “pre-existing.” She had to hire an independent inspector-costing her $600-to prove otherwise. She switched to Amica the next month. Another man in Texas had his garage destroyed in a hailstorm. Amica sent a local adjuster within 24 hours. They paid him $12,000 on the spot. He didn’t need to send a single receipt. He got a call two days later asking if he needed help finding a contractor. That’s the difference.Bottom line: Satisfaction is earned, not bought

The best homeowners insurance company isn’t the one with the lowest price. It’s the one that treats you like family when things go wrong. Amica Mutual leads in satisfaction because they’ve built their business around that principle-not marketing gimmicks or flashy ads. If you’re looking for peace of mind, don’t just shop for price. Shop for trust. Ask questions. Read the fine print. Talk to people who’ve filed claims. And if you find a company that answers your call before the third ring, pays without arguing, and actually fixes things right-hold onto them.Your home is your biggest investment. Your insurance should protect it-not just your wallet.

Which home insurance company has the highest customer satisfaction in 2026?

As of 2025, Amica Mutual leads in customer satisfaction with a score of 891 out of 1,000 according to J.D. Power’s annual study. They outperform larger insurers like State Farm and Allstate by offering faster claims service, clearer communication, and more personalized support. While newer digital insurers like Lemonade are fast, Amica’s combination of human service and digital tools makes them the top choice for overall satisfaction.

Why do mutual insurance companies rank higher in satisfaction?

Mutual insurers like Amica, Auto-Owners, and USAA are owned by their policyholders, not shareholders. This means their goal isn’t to maximize profits each quarter-it’s to keep customers happy so they stay loyal. They’re less likely to deny claims for small technicalities, more likely to offer flexible coverage, and often pay claims faster because they don’t have to answer to investors. This long-term focus builds trust, which directly boosts satisfaction scores.

Is USAA the best home insurance for everyone?

No. USAA offers excellent service and low rates, but you must be active military, a veteran, or an immediate family member to qualify. If you don’t meet their eligibility requirements, you can’t sign up-even if you’re a perfect customer. That’s why Amica and Auto-Owners are better choices for the general public. They offer similar service without membership restrictions.

Should I switch insurance companies if I’m happy with my current one?

Only if your current company has shown poor claims handling or hidden fees. If you’ve never had to file a claim, you won’t know how they really perform. Wait until you need them. When you do, pay attention to how fast they respond, whether they understand your situation, and if they follow through. If they don’t, it’s time to switch-even if your premium is low.

Do online-only insurers like Lemonade really work well?

For simple claims-like a broken window or stolen bike-they’re fast and easy. Lemonade uses AI to approve claims in minutes. But for complex issues-fire, flood, or structural damage-they often transfer you to a third-party adjuster, which slows things down. If your home is older or in a high-risk area, a company with local human adjusters will give you better results. Online insurers are great for convenience, but not always for reliability.

How do I know if my insurance company is treating me fairly?

Check three things: 1) Did they pay out the full amount you were promised in your policy? 2) Did they explain any denials clearly and in writing? 3) Did they follow up without you having to chase them? If the answer to any of these is no, you’re not being treated fairly. Also, look up your insurer’s complaint rate with your state’s insurance department. A high number of complaints is a red flag.