Remortgage Cost Calculator

Calculate Your Potential Savings

See how much your credit score could save you on your next remortgage

When you’re thinking about remortgaging your home in Australia, one question keeps popping up: credit score really matter? The short answer is yes - and it can make a big difference in what deals you qualify for, how much you pay, and even whether you get approved at all.

What Does Remortgaging Actually Mean?

Remortgaging is when you switch your existing mortgage to a new deal, either with your current lender or a different one. People do this for all kinds of reasons - to get a lower interest rate, release equity from their home, consolidate debt, or escape a high-cost variable rate. It’s not a new loan; it’s a replacement. But lenders treat it like a fresh application. That means they look at your financial picture all over again - and your credit score is right at the top of their checklist.

How Lenders Use Your Credit Score

When you apply to remortgage, lenders don’t just check your income or how much equity you have. They pull your credit report from one of the three main agencies in Australia: Equifax, Experian, or illion. These reports show:

- Your payment history - did you pay on time?

- How much debt you currently carry

- How many credit applications you’ve made recently

- Any defaults, bankruptcies, or court judgments

Your credit score is a number that sums this up. In Australia, scores range from 0 to 1,200. A score above 800 is considered excellent. Between 700 and 799 is good. Below 500? That’s a red flag.

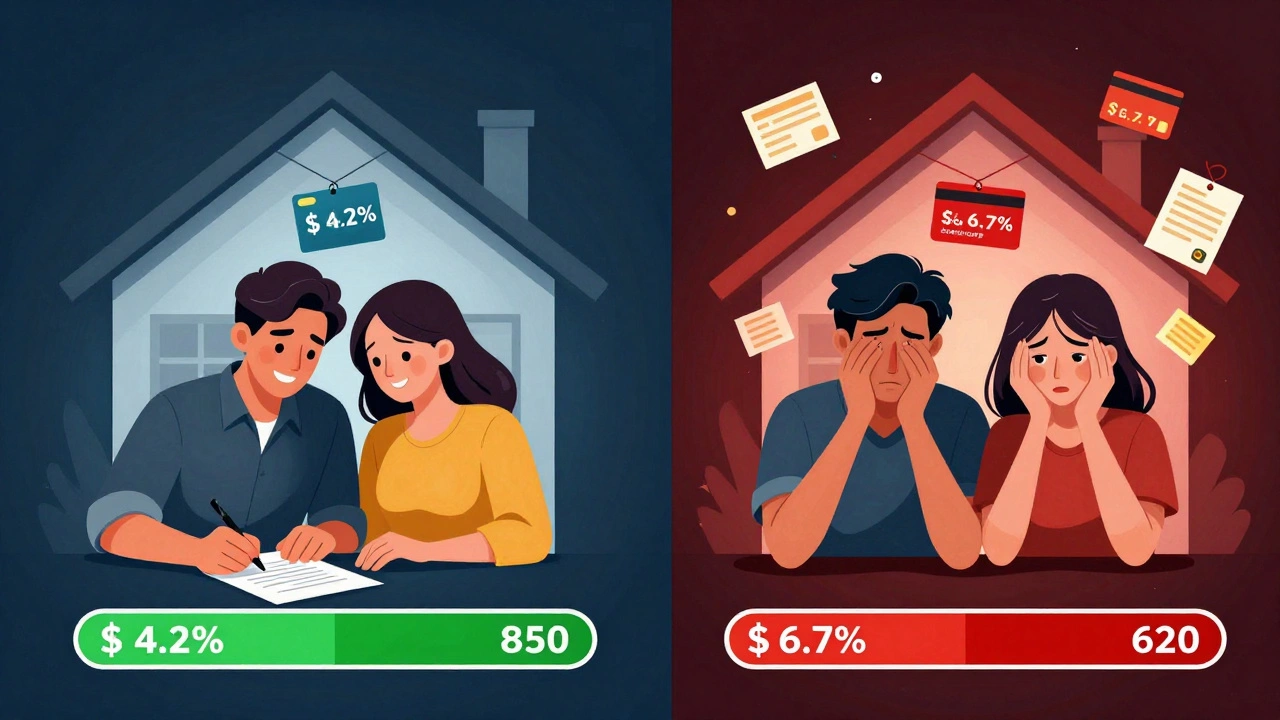

Lenders use this number to quickly decide whether you’re a low-risk borrower. If your score is high, they’ll offer you their best rates. If it’s low, they might refuse you outright - or offer you a rate that’s 1.5% to 2% higher than what someone with a great score would get.

Why a Lower Score Could Cost You Thousands

Let’s say you have a $500,000 mortgage at 5.5% interest. Your monthly payment is about $2,830. Now imagine your credit score drops to 650, and the best rate you can get is 6.8%. Suddenly, your monthly payment jumps to $3,200. That’s an extra $370 a month - or over $4,400 a year. Over the life of a 25-year loan, that’s more than $110,000 in extra interest.

That’s not a hypothetical. It’s happening to people right now in Sydney, Melbourne, and Brisbane. One client I spoke with last year switched lenders after her credit score fell to 620. She was offered a rate 1.8% higher than her old deal. Her monthly payment went up by $410. She ended up paying $137,000 more over 20 years.

What’s Considered a Good Credit Score for Remortgaging?

There’s no official cutoff, but here’s what lenders actually look for in 2026:

- 800+ - You’ll get the lowest rates. Lenders are competing for you.

- 700-799 - You’ll qualify for most deals, but maybe not the absolute best.

- 600-699 - You can still get approved, but you’ll be limited to specialist lenders with higher fees.

- Below 600 - Most mainstream lenders will decline you. You’ll need a guarantor or a very large deposit.

Some lenders, like Pepper Money and Liberty, specialize in borrowers with lower scores. But they charge more - higher interest, application fees, and sometimes mandatory mortgage insurance. You’re not getting a better deal. You’re paying for the risk.

How Your Credit Score Is Calculated

It’s not magic. It’s based on five clear factors:

- Payment history (35%) - Missed payments hurt the most. One late payment can drop your score by 50-100 points.

- Credit utilization (30%) - How much of your available credit are you using? Keep it under 30%. If you’ve maxed out your credit cards, that’s a red flag.

- Length of credit history (15%) - The longer you’ve managed credit responsibly, the better.

- New credit applications (10%) - Applying for multiple loans or credit cards in six months looks desperate. Lenders think you’re in financial trouble.

- Credit mix (10%) - Having different types of credit (mortgage, car loan, credit card) helps - but only if managed well.

So if you’ve been using your credit card to pay for groceries and only paying the minimum, that’s going to show up. If you’ve missed a couple of utility payments or had a phone bill go to collections, that’s also going to hurt.

What You Can Do to Improve Your Score Before Remortgaging

It’s not too late. Even if your score is in the 600s, you can boost it in 3-6 months. Here’s how:

- Pay every bill on time - Set up direct debits. Even one missed payment can undo months of progress.

- Reduce your credit card balances - Pay down to under 20% of your limit. If you have $10,000 available, aim to owe less than $2,000.

- Don’t open new credit accounts - No new credit cards, personal loans, or store financing in the 6 months before you apply.

- Check your credit report - Go to Equifax or Experian’s website and get a free copy. Look for errors - like accounts you don’t recognize or payments marked late that weren’t. Dispute them.

- Keep old accounts open - Even if you don’t use them, closing old credit cards shortens your credit history and raises your utilization rate.

One homeowner in Perth paid off a $3,000 credit card balance in three months. Her score jumped from 610 to 740. She remortgaged two weeks later and saved 0.9% on her rate - cutting her monthly payment by $190.

When Your Credit Score Won’t Help - Even If It’s Good

There’s one big catch: your credit score isn’t the only thing that matters. Lenders also look at:

- How much equity you have in your home (you need at least 20% for the best rates)

- Your income stability - are you employed? Self-employed? On a fixed contract?

- Your total debt load - if you’ve taken on new debt since getting your mortgage, that’s a problem

- Property value - if your home has dropped in value, you might not have enough equity

So even if your score is 800, if you’ve borrowed $40,000 on a personal loan this year and your home’s value fell 15%, you might still be turned down. Your credit score opens the door - but it doesn’t guarantee you’ll walk through.

What If You’re Denied?

If you get rejected, don’t panic. Ask for a reason. Most lenders will tell you why - whether it’s your score, your debt-to-income ratio, or your loan-to-value ratio. Then:

- Wait 3-6 months and improve your finances

- Use a mortgage broker who knows which lenders are more flexible

- Consider a guarantor - a family member who agrees to cover payments if you can’t

- Wait until your home’s value increases or you pay down more debt

One Sydney couple was denied twice because their score was 630 and they had $25,000 in credit card debt. They paid off the cards, waited four months, and reapplied. They got a rate 1.2% lower than their original deal.

Final Takeaway

Your credit score doesn’t just affect remortgaging - it controls how much you pay over the long term. A score below 700 can cost you tens of thousands in extra interest. A score above 800 can save you the same amount. It’s not about being perfect. It’s about being predictable. Lenders want to see stability, responsibility, and control.

Don’t wait until you’re ready to remortgage to check your score. Start now. Pay down debt. Keep your bills current. Avoid new credit. In six months, you might not just qualify for a better deal - you might get the best one on the market.

Can I remortgage with a bad credit score?

Yes, but it’s harder. Lenders like Pepper Money and Liberty offer deals to borrowers with scores below 600, but they charge higher interest rates, fees, and may require mortgage insurance. You’ll pay more overall, and your options will be limited. It’s better to fix your score first.

How long does it take to improve my credit score?

You can see improvements in as little as 30 days if you pay down credit card balances or fix errors on your report. But to move from a fair score (600-699) to a good one (700+), you’ll typically need 3-6 months of consistent on-time payments and lower debt usage.

Does checking my credit score hurt it?

No. Checking your own credit report is a "soft inquiry" and doesn’t affect your score. Only when lenders check your report during an application does it count as a "hard inquiry," which can lower your score by a few points. You can check your score as often as you like without penalty.

Do I need a perfect credit score to remortgage?

No. You don’t need a perfect score - just a good one. A score of 700 or higher will give you access to most competitive rates. The highest scores (800+) get the absolute best deals, but you don’t need to be perfect to save money.

What if I’ve had a default on my credit report?

A default stays on your report for five years. If it’s less than two years old, most lenders will decline you. If it’s older than three years and you’ve rebuilt your credit since, you may still qualify - especially if you have strong equity and income. Some lenders specialize in this situation, but expect higher rates.