Home Equity Calculator

Calculate Your Home Equity

Determine your home equity and see if you qualify for equity access options in Australia.

You can start pulling equity out of your home as soon as you have enough ownership built up-usually when you’ve paid down at least 20% of your home’s value. But that’s just the technical starting point. The real question isn’t when you can, but whether you should. And that depends on your situation, your goals, and the tools available in Australia right now.

How much equity do you actually have?

Equity is the part of your home you truly own. If your house is worth $800,000 and you still owe $500,000 on your mortgage, your equity is $300,000. That’s 37.5% of the home’s value. Most lenders in Australia want you to have at least 20% equity before they’ll let you tap into it. Some might go as low as 10%, but those deals usually come with higher fees or stricter terms.

It’s not just about the numbers. Lenders also look at your income, your credit history, and what you plan to use the money for. If you’re using it to renovate your kitchen, that’s one thing. If you’re using it to pay off credit card debt or fund a holiday, they’ll ask harder questions.

Three main ways to pull equity out in Australia

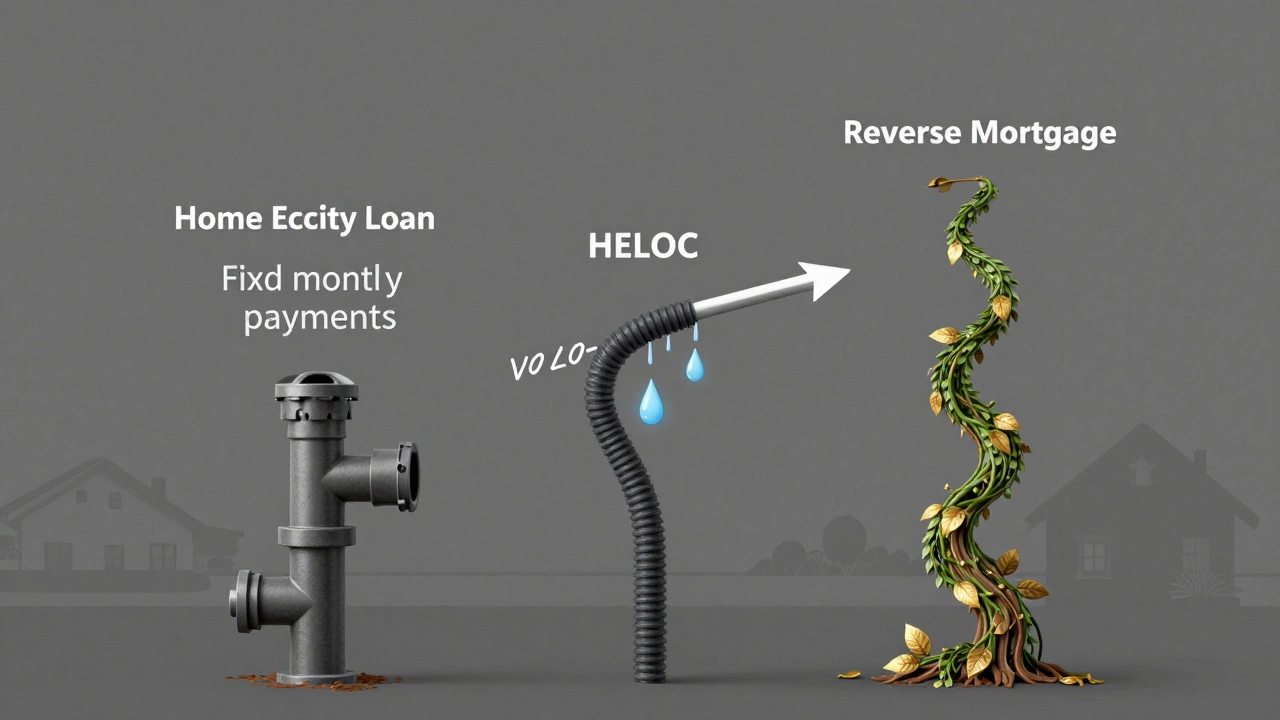

There’s no single way to access your home’s equity. Three options dominate the market, each with different rules, risks, and costs.

- Home equity loan: This is a second loan on top of your existing mortgage. You get a lump sum, usually at a fixed rate, and repay it over 5 to 25 years. It’s straightforward, but you’re adding another monthly payment.

- Home equity line of credit (HELOC): Think of this like a credit card secured by your house. You can draw money as you need it, up to a set limit. Interest only applies to what you’ve used. This works well for unpredictable expenses like medical bills or home repairs.

- Reverse mortgage: Available to homeowners aged 60 and over. You don’t make repayments. Instead, the loan grows over time and is paid back when you sell the home, move out, or pass away. This is common among retirees who want to stay in their homes but need extra cash.

Each option has trade-offs. A home equity loan gives you certainty. A HELOC gives you flexibility. A reverse mortgage gives you freedom-but at a cost.

Why people pull equity out (and why they regret it)

People tap into home equity for all kinds of reasons. In Sydney, the most common uses are home renovations (42%), paying off high-interest debt (28%), funding education (15%), and covering medical expenses (8%). A small percentage use it for travel, investments, or even gambling.

Here’s the thing: renovations often pay off. A well-planned kitchen or bathroom upgrade can add 80-120% of its cost back to your home’s value. Paying off a credit card with 20% interest using a home equity loan at 5%? That’s smart financial hygiene.

But using equity to fund a lifestyle you can’t afford? That’s where things go sideways. I’ve seen people take out $150,000 to pay off debt, then run up $100,000 in new credit card balances within two years. Now they’re deeper in trouble, with two loans to repay and a house that’s worth less than they thought.

What lenders won’t tell you

When you apply for equity release, the lender will show you the monthly repayments. They won’t always show you the long-term cost. For example, a $100,000 home equity loan at 6% over 20 years means you’ll pay $86,000 in interest alone. That’s almost as much as the original loan.

Reverse mortgages carry even steeper hidden costs. Interest compounds over time. If you take out $200,000 at 6% compounded annually, after 10 years you could owe $360,000-even if you never made a single payment. That leaves less for your heirs.

Also, most equity products require you to maintain your home. If you stop keeping up repairs, the lender can call the loan. That’s not something most people think about until it’s too late.

When it’s a bad idea

There are clear red flags that tell you to hold off:

- Your home value is falling or stagnant. If your property is losing value, you’re not building equity-you’re losing it.

- You’re under 40 and have no emergency fund. Tapping equity now might feel like a quick fix, but you’ll be paying for it for decades.

- You’re using it to cover regular living expenses. If your income doesn’t cover your bills, borrowing against your home won’t fix that-it’ll just delay the crash.

- You’re planning to move in the next 3-5 years. The fees to set up a home equity loan or HELOC can be $2,000-$5,000. You need time to recoup that cost.

And if you’re considering a reverse mortgage before age 60? Don’t. The rules in Australia are strict for a reason. These products are designed for older homeowners who won’t be moving again. Using them early locks you into a path that’s hard to undo.

What to do before you sign anything

Before you touch a single form, do this:

- Get a professional valuation of your home. Don’t rely on online estimates. A licensed valuer gives you the real number.

- Check your credit report. Even a small error can cost you thousands in interest.

- Compare at least three lenders. Rates and fees vary wildly. Some banks offer lower rates but charge $3,000 in setup fees. Others have higher rates but no fees.

- Ask for a full cost breakdown: interest rate, fees, repayment term, penalties for early repayment.

- Get independent financial advice. A fee-for-service adviser (not tied to a lender) can show you alternatives you didn’t know existed.

And never sign anything on the spot. If a rep says, “This deal expires today,” walk away. Real lenders don’t pressure you like that.

What happens if things go wrong?

Worst-case scenario: you can’t keep up with repayments. If you have a home equity loan or HELOC and miss payments, the lender can force you to sell. That’s not theoretical. In 2023, over 1,200 Australian homeowners lost their homes to equity loan defaults.

With a reverse mortgage, if the loan balance grows beyond the home’s value (which happens in falling markets), your estate is protected by the “no negative equity guarantee.” That’s a legal requirement in Australia. You or your heirs won’t owe more than the house sells for. That’s one big safety net.

But that guarantee doesn’t cover other debts. If you’ve used your equity to co-sign a loan for your child, or if you’ve taken out multiple loans, you’re still at risk.

Alternatives you should consider first

Before you borrow against your home, ask: is there another way?

- Can you sell an asset? A second car, jewellery, or investment shares might give you the cash you need without touching your home.

- Can you refinance your main mortgage? Sometimes you can roll your debt into a new home loan at a lower rate, with better terms.

- Is there government help? In NSW, the Home Equity Access Scheme lets seniors get a part-pension top-up by using their home equity as collateral-without taking out a loan.

- Can you work part-time or freelance? Extra income doesn’t add debt. It adds freedom.

These options don’t put your home at risk. They don’t lock you into decades of repayments. And they don’t cost you the peace of mind that comes with owning your home outright.

Final thought: Equity is a tool, not a solution

Your home isn’t a cash machine. It’s your shelter, your security, your legacy. Pulling equity out isn’t wrong-it’s just serious. The best decisions aren’t made when you’re desperate. They’re made when you’ve planned ahead, compared options, and understood the full cost.

If you’re thinking about accessing your home’s equity, do it because it moves you closer to your goals-not because you’re trying to escape your problems. The house will still be there tomorrow. But the debt you take on today? That’s for life.

Can I pull equity out of my home if I still have a mortgage?

Yes, you can. Most people who access home equity still have an existing mortgage. Lenders look at your total loan-to-value ratio (LVR). As long as your combined loans don’t exceed 80% of your home’s value (or sometimes up to 90% with lender’s mortgage insurance), you’re eligible. For example, if your home is worth $800,000 and you owe $500,000, you can usually borrow up to $140,000 more (bringing your total debt to $640,000, or 80% LVR).

What’s the minimum age to access home equity in Australia?

There’s no minimum age for home equity loans or HELOCs-you just need to be legally able to sign a contract (18+). But for reverse mortgages, the minimum age is 60. Some lenders require you to be 65 or older, especially if you’re applying for a government-linked product like the Home Equity Access Scheme.

How long does it take to get equity out of my home?

It typically takes 3 to 6 weeks from application to funds in your account. The process includes valuation, documentation, legal checks, and lender approval. Reverse mortgages can take longer-up to 8 weeks-because they involve more compliance, including mandatory financial counselling. If you’re in a rush, a HELOC with a pre-approved limit can sometimes be accessed within a few days after approval.

Will pulling equity out affect my Centrelink payments?

It depends on how you use the money. If you withdraw equity as a lump sum and keep it in a bank account, it counts as an asset and could reduce your pension under the assets test. But if you use it to pay off debt, renovate your home, or buy a car, it usually doesn’t count. The Home Equity Access Scheme is designed specifically to top up your pension without affecting your eligibility. Always check with Centrelink before making a move.

Can I pay back the equity I’ve withdrawn early?

Yes, you can usually repay early-but check the fine print. Some home equity loans charge early repayment fees, especially if they’re fixed-rate products. HELOCs typically don’t have penalties. Reverse mortgages often allow early repayment without penalty, but since no payments are required during your lifetime, most people don’t repay until the home is sold. Always ask about fees before signing.