FAFSA Eligibility Calculator

Estimate your potential financial aid eligibility based on your household income, family size, and other factors. Don't assume you don't qualify—many families earning $50,000+ receive aid!

Your Estimated Financial Aid

Estimated Student Aid Index (SAI)

$3,200

Potential Aid Amount

$17,895

What You Might Qualify For

- Pell Grant: $7,395

- Direct Subsidized Loan: $5,500

- State Grant: $2,000

- Work-Study: $3,000

Why This Matters: Your income is just one factor. With $50,000 income, 4-person family, and 1 college student, your SAI is calculated at $3,200. This qualifies you for significant aid, including Pell Grants and state assistance. Even if you don't get a Pell Grant, you'll likely qualify for other aid options.

Many families hear FAFSA and immediately think: "We make too much to qualify." If you’re bringing in $50,000 a year, you might assume financial aid isn’t for you. But that’s a myth-and it’s costing families thousands in free money.

FAFSA isn’t just for low-income families

The Free Application for Federal Student Aid (FAFSA) doesn’t have a strict income cutoff. There’s no official "$50,000 rule." Even families earning $100,000 or more get some form of aid-sometimes enough to cover half their tuition. What matters isn’t just your income, but your family size, number of kids in college, assets, and where you live.For example, a family of four making $50,000 with two kids in college at the same time has a much better shot at aid than a family of two making the same amount with one child. The government looks at your whole picture, not just your paycheck.

How FAFSA actually calculates your aid

The FAFSA uses a formula called the Expected Family Contribution (EFC), now called the Student Aid Index (SAI). This number tells colleges how much your family can reasonably afford to pay for school. It’s not a simple income test. Here’s what it considers:- Parent and student income (from two years ago-2023 for the 2025-2026 school year)

- Assets like savings, investments, and second homes (but not retirement accounts or your primary home)

- Family size

- Number of family members attending college at the same time

- State of residence (cost of living adjustments vary)

Let’s say you made $50,000 in 2023. That’s below the national median household income, which was about $74,000 in 2023. But if you have $20,000 in savings and one child going to college, your SAI might still be low enough to qualify for a Pell Grant-or at least subsidized loans.

What aid can you actually get at $50K income?

Even if you don’t qualify for the Pell Grant (which typically goes to families under $30,000), you can still get other types of aid:- Subsidized Direct Loans: The government pays the interest while your child is in school. Available to students with demonstrated need.

- Unsubsidized Direct Loans: Available to everyone, regardless of income. No need-based requirement.

- Work-Study Programs: Part-time jobs on campus. Often awarded based on need, but not always.

- State Grants: Many states offer aid even to middle-income families. For example, California’s Cal Grant can go to families making up to $110,000.

- College-Specific Scholarships: Many private schools give merit or need-based aid-even if you don’t qualify for federal aid.

At $50,000, you’re not rich. You’re in the middle class-and colleges know it. They want students from families like yours. That’s why many schools use FAFSA data to offer their own grants. A student at a private university with $50,000 in household income might get $15,000-$25,000 in institutional aid just because they applied.

Why people miss out-and how to avoid it

The biggest mistake families make? Not filling out FAFSA at all.Over 3 million students who qualified for aid in 2023 didn’t apply. Why? They assumed they made too much. Others thought it was too complicated. Some waited until the last minute and missed deadlines.

Here’s what you need to do:

- Apply as early as possible-FAFSA opens October 1 each year.

- Use the IRS Data Retrieval Tool to auto-fill your income. It’s faster and more accurate.

- Include all children applying to college. If you have two kids in college, your aid eligibility jumps.

- Don’t skip the asset questions. Even small savings can affect your SAI-but not as much as people think.

- File even if you think you won’t qualify. You might be surprised.

What about private scholarships?

Private scholarships don’t use FAFSA, but they often ask for it anyway. Many scholarship providers use FAFSA data to verify financial need. Even if you’re not getting federal aid, having a FAFSA on file can help you win outside scholarships.For example, the Jack Kent Cooke Foundation gives up to $55,000 per year to high-achieving students with financial need. Their application requires FAFSA. So even if you’re not getting Pell Grants, you’re still eligible for life-changing scholarships if you file.

What if you’re divorced or separated?

If you’re a single parent, your income is the only one that counts-even if your ex earns more. That can work in your favor. If you make $50,000 and your ex makes $100,000 but doesn’t live with you, only your $50,000 is used in the FAFSA calculation.On the flip side, if you’re remarried, your spouse’s income counts-even if they’re not the biological parent. That’s a common trap. If your new partner makes $80,000, your household income jumps to $130,000, which can reduce aid eligibility.

What about assets? Should I hide money?

No. Don’t try to hide assets. FAFSA checks tax returns and bank statements. If you transfer money to avoid reporting it, you risk penalties or losing aid.But you can legally reduce your reportable assets:

- Pay off credit card debt before filing.

- Use savings to fix your car or home-those aren’t counted.

- Move assets into a parent’s retirement account (401(k), IRA)-those don’t count on FAFSA.

- Don’t put money in the student’s name. Student assets are assessed at 20%, parent assets at up to 5.64%.

That’s a big deal. If your child has $10,000 in a savings account, it could cost you $2,000 in aid. If that same $10,000 is in your account, it might cost you $564.

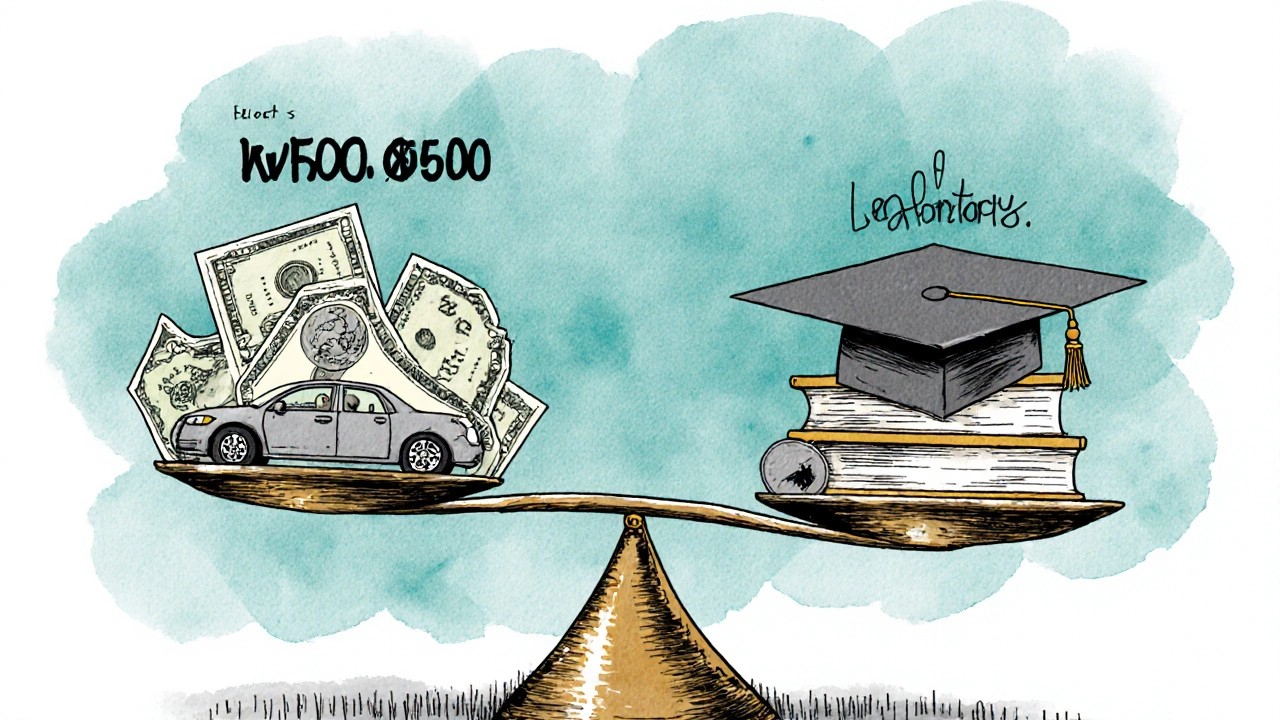

Real-world example: $50K income, one child in college

Let’s say you’re a single parent making $50,000 a year. You have $8,000 in savings. You file FAFSA for your child going to a public university that costs $25,000 a year.- Your SAI: $3,200

- Cost of attendance: $25,000

- Financial need: $21,800

You qualify for:

- $7,395 Pell Grant (maximum for 2025-2026)

- $5,500 Direct Subsidized Loan

- $2,000 state grant

- $3,000 work-study

Total aid: $17,895. That’s $7,105 you still need to cover. But you’re not paying $25,000 out of pocket. You’re paying less than $30% of the cost.

Bottom line: File FAFSA no matter your income

If you make $50,000, you’re not too rich for FAFSA-you’re exactly who it was designed to help. The system doesn’t cut you off at a magic number. It looks at your whole life. And if you don’t apply, you automatically get nothing.Every dollar you leave on the table because you assumed you didn’t qualify is a dollar your child will have to borrow later. Fill out FAFSA. Even if you think you won’t get anything. You might be wrong.

Do I make too much for FAFSA if I earn $50,000?

No, $50,000 is not too much for FAFSA. Many families earning between $50,000 and $100,000 qualify for federal student loans, work-study, and state grants. The government looks at your whole financial picture-not just your income.

Can I get a Pell Grant with a $50,000 income?

It’s unlikely but not impossible. Pell Grants are mostly for families under $30,000, but if you have multiple children in college or high living expenses, you might qualify. Even if you don’t get the Pell Grant, you’ll likely still get other aid.

Does having savings hurt my FAFSA eligibility?

Yes, but not as much as people think. Parent assets are assessed at up to 5.64%, so $10,000 in savings could reduce aid by about $564. Student assets are assessed at 20%, so it’s better to keep money in the parent’s name. Retirement accounts and your home don’t count at all.

Should I wait until my child applies to college to file FAFSA?

No. File FAFSA as soon as it opens on October 1 each year. Many states and colleges give aid on a first-come, first-served basis. Waiting could mean missing out on grants and scholarships you’re eligible for.

What if my spouse makes more than me? Does that count?

Yes. If you’re married and living together, your spouse’s income is included-even if they’re not the biological parent. If you’re divorced and don’t live together, only the custodial parent’s income counts.

Can I still get aid if I’m not a U.S. citizen?

Only certain non-citizens qualify, like permanent residents, refugees, or those with specific visas. U.S. citizens and eligible non-citizens must file FAFSA. International students on student visas cannot get federal aid but may qualify for school-specific scholarships.

Does FAFSA cover graduate school?

Yes. Graduate students can file FAFSA for federal loans and work-study, but they’re not eligible for Pell Grants. Parent income is not considered for graduate students-only the student’s own income and assets.

What happens if I don’t file FAFSA?

You lose access to all federal student aid: grants, subsidized loans, work-study, and many state and college scholarships. You’ll likely end up paying more out of pocket or taking out expensive private loans.