Home Insurance: What You Need to Know to Save Money and Stay Protected

Did you know that two homeowners in the UK can pay up to 30% more for the same coverage just because of a credit score difference? It’s a real money‑saver to understand what drives your premium and where policies fall short. Below you’ll find the most useful info to keep your house safe without overpaying.

How Your Credit Score Impacts Premiums

Insurers treat a good credit score like a sign of financial responsibility. If your score is high, you’re seen as less likely to file claims, so the company offers a lower rate. The opposite happens with a low score – premiums climb, sometimes dramatically.

What can you do? Start by checking your credit report for errors. Dispute any mistakes, pay down lingering balances, and avoid opening new lines of credit right before you apply for insurance. Even a 10‑point boost can shave a few pounds off your yearly bill.

Common Gaps and How to Fill Them

Standard home insurance usually leaves out flooding, earthquakes, and mold damage. Those exclusions bite many homeowners when a disaster hits. The simple fix is a separate rider or an added policy that covers the missing risks. Ask your insurer for a “flood endorsement” or look into a standalone flood policy if you live near water.

Another hidden gap is the 80% rule. Insurers expect you to insure at least 80% of your home’s replacement cost. If you fall short, you could face reduced payouts after a claim. Use an online estimator or ask a professional appraiser to get the right coverage amount. It’s better to pay a slightly higher premium than to watch a claim get cut.

Deductibles work the same way. A $2,500 deductible might look attractive, but make sure you can afford that out‑of‑pocket amount after a loss. If you’re comfortable with a higher deductible, you’ll see lower premiums. Just keep a reserve fund ready.

Switching insurers can also bring savings, but do it wisely. Compare renewal offers with new quotes, watch out for cancellation fees, and make sure there’s no coverage gap during the switch. A side‑by‑side spreadsheet helps you see where you win and where you might lose protection.

Finally, check the insurer’s financial strength and claims handling record. A company that looks good on paper but delays claims can cost you more in stress than a slightly pricier policy that pays out quickly. Look for ratings from agencies like Standard & Poor’s or check online reviews for real‑world experiences.

Putting these steps together gives you a clear roadmap: know your credit, fill coverage gaps, pick an appropriate deductible, and pick a trustworthy insurer. You’ll end up with a policy that protects your home, fits your budget, and avoids nasty surprises when you need it most.

Which homeowners insurance company has the highest customer satisfaction?

Amica Mutual leads in customer satisfaction for homeowners insurance in 2025, offering faster claims, better communication, and personalized service. Learn why mutual insurers outperform big names and how to choose the right provider for your needs.

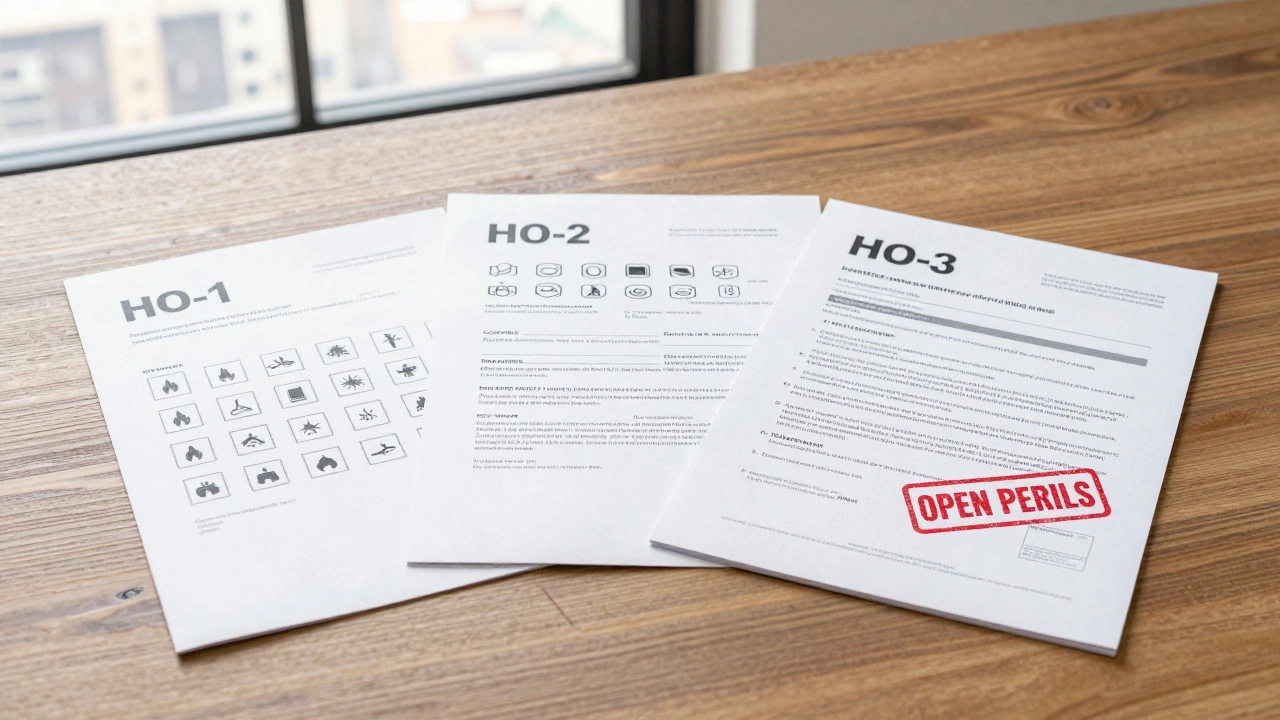

Read More >>What Are the Three Main Types of Homeowners Insurance?

Learn about the three main types of homeowners insurance-HO-1, HO-2, and HO-3-and understand which one offers real protection for your home and belongings. Know what’s covered, what’s not, and how to avoid costly gaps.

Read More >>Do Home Insurance Quotes Run Your Credit? What You Need to Know

Home insurance quotes typically don’t hurt your credit score. Most insurers use soft inquiries to assess risk, not hard credit checks. Learn how credit affects your premium and how to find quotes without penalty.

Read More >>Is Home Insurance Tax Deductible? What You Can and Can't Claim

Home insurance is usually not tax deductible in Australia-but if you rent out part of your home, run a business from it, or own an investment property, you may be eligible to claim a portion. Learn the rules and avoid common mistakes.

Read More >>Does Credit Score Affect Home Insurance? The Truth Every Homeowner Should Know

Wondering if your credit score affects home insurance? Learn what really happens behind the scenes, how your rating could change your premium, and tips to protect your wallet.

Read More >>Is a $2500 Deductible the Right Choice for Your Home Insurance?

Wondering if a $2500 deductible is smart for home insurance? Find out exactly what it means, how much you could save or risk, and who it's right for.

Read More >>Why Did My Home Insurance Rates Jump in 2024? All the Key Reasons Explained

Shocked by your 2024 homeowners insurance bill? Learn why rates spiked so much in Australia, who's to blame, and what you can actually do.

Read More >>Who Qualifies for USAA Home Insurance? Key Rules and Surprising Exceptions

Thinking of USAA for your home insurance? It's not for everyone. This article cuts through the confusion on who actually qualifies for a USAA policy, why the rules are so unique, and what tricks can help your family snag coverage. Get the details, learn about real-life exceptions, and see how membership could save you money and hassle.

Read More >>Understanding Homeowners Insurance: What's Often Not Covered?

Homeowners insurance is vital, but not every type of damage is covered. Learning about typical exclusions, such as flood and earthquake damage, can save future headaches. Being aware of what your policy doesn’t cover helps homeowners make informed decisions to fill those gaps with additional policies. This proactive approach can protect against common pitfalls and ensure comprehensive protection for valuable assets.

Read More >>Is Switching Insurance Companies Often Smart?

Exploring whether frequently changing home insurance providers is beneficial or risky, this article discusses the pros and cons of switching. Many homeowners grapple with loyalty versus potential savings. We dive into real reasons to consider a switch, like better rates or much-needed coverage, while also examining hidden pitfalls such as penalty fees or coverage gaps. Empowering readers with insights and tips helps them decide if staying or leaving their insurance company serves them best.

Read More >>Choosing the Most Reliable Home Insurance Company: Insights and Tips

Finding a trustworthy home insurance company is crucial for protecting your home and belongings. This article sheds light on how to identify reliable insurers by considering their financial strength, customer service, policy offerings, and claims handling process. Explore some well-regarded companies and understand key factors that influence consumer trust. By the end, you'll have practical tips to make an informed decision about your home insurance provider.

Read More >>Understanding the Surging Costs of Homeowners Insurance in 2025

In recent years, many homeowners have been shocked to find that their insurance premiums have doubled or even tripled. Several factors contribute to these rising costs, including increased natural disasters, inflation, and changes in underwriting practices. This article explores these factors in depth, provides strategies for managing insurance expenses, and advises homeowners on how to get the best coverage for their needs. Learn how to navigate the evolving landscape of home insurance without breaking the bank.

Read More >>