Investment Advice You Can Use Today – Simple Tips for Smart UK Investors

If you’re tired of confusing jargon and want clear steps to grow your money, you’ve landed in the right place. We’ll break down the big ideas into bite‑size actions you can start right now, whether you’re saving for retirement or looking for the next growth opportunity.

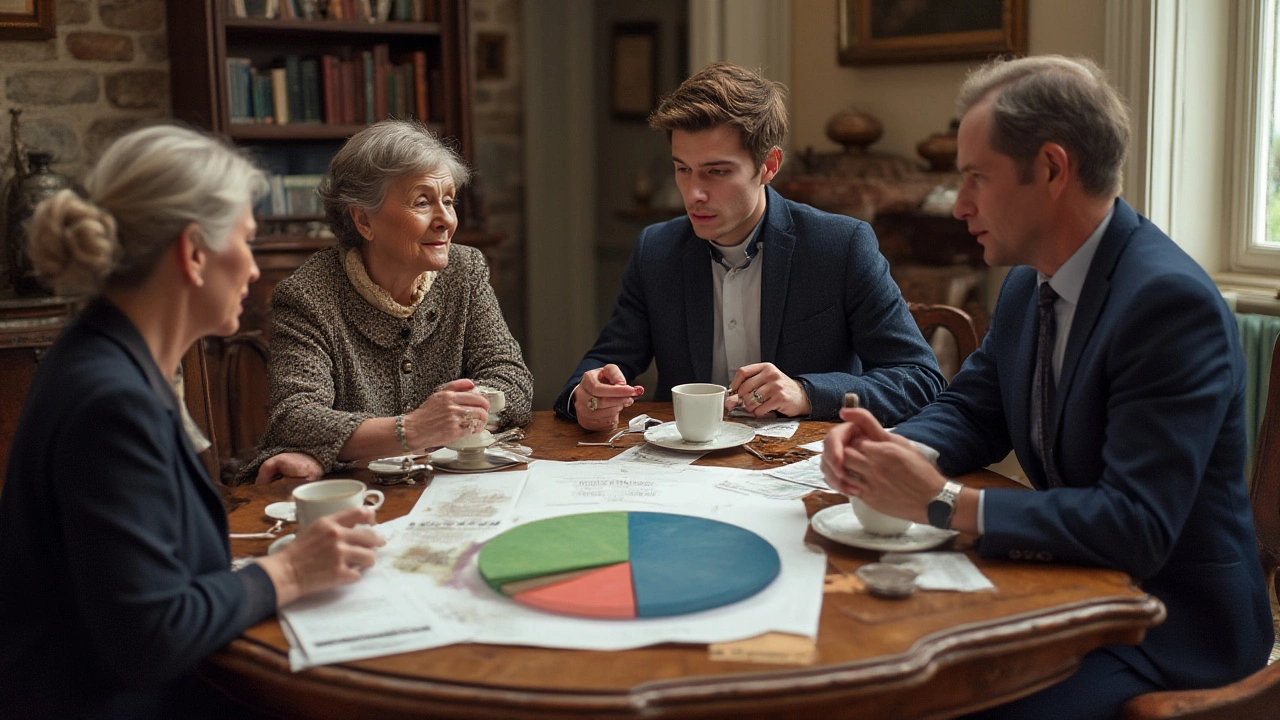

Cover the Basics: How to Build a Smart Portfolio

The first thing most people overlook is asset allocation – basically, how you split your cash between stocks, bonds, and other assets. A popular rule of thumb is the 70/30 strategy: 70% in growth‑focused assets like equities and 30% in more stable investments such as bonds. This mix aims to give you upside potential while cushioning market dips. Adjust the split based on your age, risk tolerance, and financial goals, and you’ll have a solid foundation.

Risk isn’t something to avoid; it’s something to manage. Ask yourself: how much could I afford to lose before it hurts my life plan? That answer guides whether you tilt more toward high‑growth stocks or safer options like government bonds and dividend‑paying companies. Keep a portion in cash or short‑term savings for emergencies – it prevents you from selling investments at a loss when unexpected bills pop up.

What’s Hot in 2025 and Beyond

Looking ahead, several sectors are catching investors’ eyes. Sustainable and clean‑energy stocks are gaining traction as governments push green policies. Real estate, especially in growth towns, still offers steady rental yields and capital appreciation. Don’t forget technology – AI‑driven firms and cloud services are expected to keep expanding. Mixing a few of these themes into your portfolio can add growth without over‑concentrating on any single area.

Remember, no single investment beats the market every year. The goal is a diversified mix that aligns with your timeline. If you’ve got a long horizon, you can afford more equity exposure. If retirement is near, shift toward bonds and cash to lock in what you’ve earned.

Below are some quick reads from our latest articles that dive deeper into each of these topics. Pick the ones that match your current questions and start applying the advice today.

- 70/30 Investment Strategy Explained: Balance, Risks, and Real Returns – Learn why many investors favor this split and how to tailor it to your situation.

- Safest Investment with Highest Return: Your Best Options Explained – Discover the trade‑offs between safety and growth, and which options give the best realistic returns.

- Best Investment Options for 2025: What You Should Consider – A rundown of promising sectors, from sustainable stocks to real‑estate opportunities.

- What Stock Will Rise the Most in 2024? – Insight into market trends that could point to high‑performing stocks this year.

- Smart Strategies for Investing $100k at Age 70 – Practical steps for seniors looking to make their retirement savings work harder.

- Who Offers the Best Stock Tips: Insider Insights and Expert Analysis – Guidance on where to find reliable stock advice and how to vet it.

- Achieving $1,000,000 in Retirement Savings: How Many Make It and How You Can Too – Real‑world numbers and a roadmap to hit the million‑pound mark.

Start with a quick audit of what you own today. Write down each holding, its value, and why you bought it. If you can’t name a clear reason, consider swapping it for something that fits your plan better. This simple habit alone can clean up a messy portfolio and boost confidence.

Finally, set a habit of reviewing your investments at least twice a year. Markets shift, your life changes, and your goals evolve – staying on top means you can adjust before small issues become big problems. With the basics covered and the right resources at hand, you’re ready to make smarter, calmer investment decisions.

What Is the Rule Never Lose Money Buffett? The Simple Truth Behind Warren Buffett's #1 Investment Principle

Warren Buffett's rule to never lose money isn't about avoiding risk-it's about avoiding stupid mistakes. Learn how to apply his simple, powerful strategy to protect your investments and build wealth over time.

Read More >>What Does Warren Buffett Say to Invest In? His Top Choices Explained

Warren Buffett advises investing in businesses with strong brands, steady cash flow, and low debt - not stocks based on hype. Learn his top picks and why he avoids crypto and day trading.

Read More >>70/30 Investment Strategy Explained: Balance, Risks, and Real Returns

Confused about the 70/30 investment strategy? Find out what it really means, how it works, and why so many investors use this mix for balancing growth and stability.

Read More >>Safest Investment with Highest Return: Your Best Options Explained

People are always looking for investments that combine safety and high returns, but the answer is rarely black and white. This article digs into what 'safe' and 'high return' really mean, why it's tricky to get both, and what smart investors do instead. We'll walk through the safest investments around, the compromises you have to consider, and which options might work for regular folks like you. By the end, you'll have clear tips to help you pick an investment strategy that's both practical and realistic.

Read More >>Best Investment Options for 2025: What You Should Consider

Wondering where to invest your money in 2025? With the evolving financial landscape, it's crucial to make informed decisions. This article dives into the promising sectors, from sustainable stocks to real estate opportunities, offering practical tips and insights. Equip yourself with knowledge to make savvy investment choices this year.

Read More >>What Stock Will Rise the Most in 2024?

Looking to invest wisely in 2024? Discover which stock might achieve notable growth, exploring the underlying factors in a shifting market. Uncover expert tips and real-world insights to make informed decisions. Whether you're a seasoned investor or a beginner, learn how to navigate potential opportunities in the stock market this year. Equip yourself with the right tools and knowledge to boost your investment portfolio.

Read More >>Smart Strategies for Investing $100k at Age 70

Investing at seventy calls for careful planning and thoughtful decisions. This article explores sensible strategies for using $100,000 to bolster retirement savings, ensuring both security and potential growth. It covers diversified portfolios, bonds, real estate, and other prudent options that align with lifestyle needs and risk tolerance. With simple language, it invites the reader to confidently navigate investment landscapes during the golden years.

Read More >>Who Offers the Best Stock Tips: Insider Insights and Expert Analysis

Navigating the world of stocks can be daunting, but finding the right advice can make a significant difference. This article explores who is best suited to provide stock advice, including financial advisors, financial publications, online platforms, and social media influencers. It also discusses attributes that make advice reliable and how to blend different sources for a well-rounded investment strategy. Investment success isn't about who you listen to but learning to synthesize information and apply it wisely to your objectives.

Read More >>Achieving $1,000,000 in Retirement Savings: How Many Make It and How You Can Too

As of today, reaching the million-dollar mark in retirement savings is more attainable than ever due to strategic planning and prudent investing. This article delves into the real numbers of people with $1,000,000 in their retirement accounts, explores the possible paths to this goal, and offers practical tips to enhance your financial future. It highlights the common mistakes to avoid, key strategies for every life stage, and how to adjust in uncertain economic times. Packed with insights, this piece offers a roadmap for growing your nest egg responsibly.

Read More >>