Credit Card Utilization Calculator

How Credit Utilization Works

Your credit utilization is the percentage of your available credit you're using. Experts recommend keeping it below 30% to maintain a healthy credit score. Closing cards can increase your utilization rate even if you don't spend more, potentially lowering your credit score.

Your Credit Utilization

Your credit utilization rate is based on your total available credit and current debt.

Credit Impact

Your current utilization is healthy. Closing cards could increase your rate and potentially lower your score.

Key Recommendations

- Use cards at least once every 6 months to prevent closure

- Keep utilization below 30% for optimal credit scores

- Close cards with annual fees only after checking utilization impact

- Maintain your oldest card to preserve credit history length

Keeping a credit card open but not using it might feel like a harmless habit-after all, you’re not spending, you’re not carrying debt, and you’re not paying annual fees. But in the world of credit scoring, silence isn’t always golden. In fact, an unused credit card can quietly hurt your credit score more than you think.

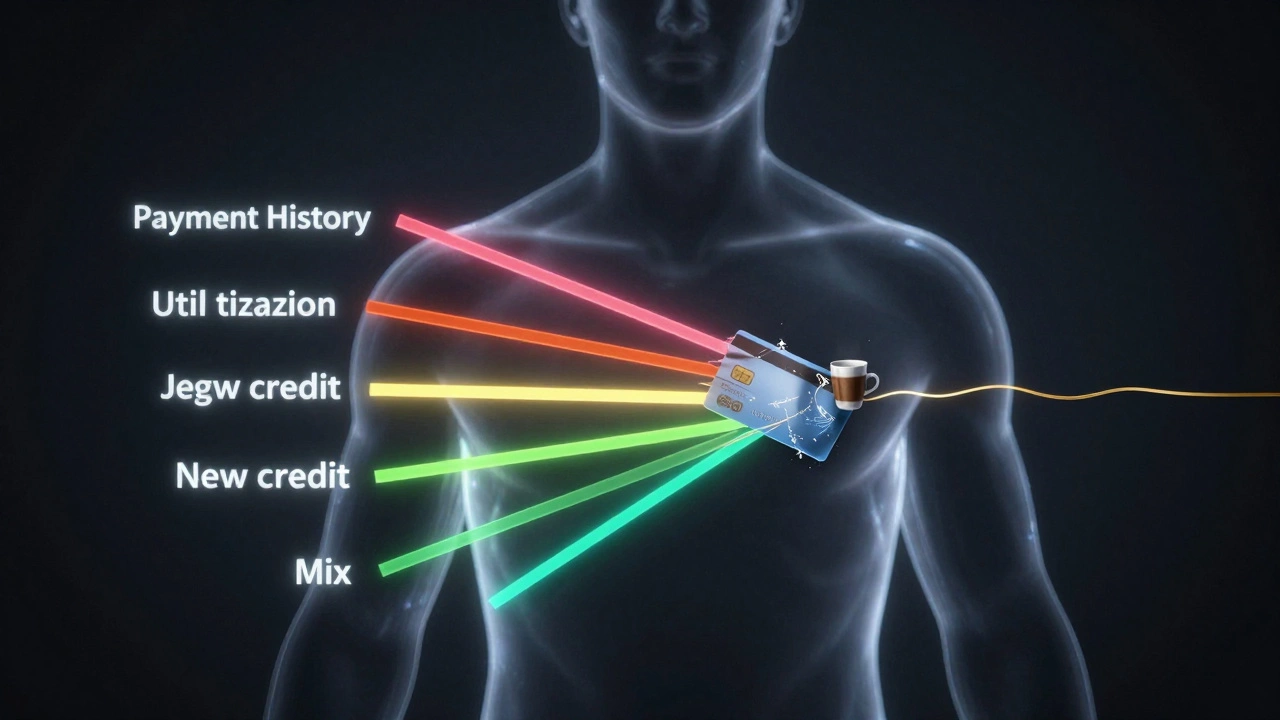

How Credit Scoring Works Behind the Scenes

Your credit score isn’t just about whether you pay on time. It’s built from five main pieces: payment history (35%), credit utilization (30%), length of credit history (15%), new credit (10%), and credit mix (10%). When you stop using a card, you’re not just going quiet-you’re removing a key part of that mix.Let’s say you’ve had a credit card for 12 years. That card helps your credit history look long and stable. Lenders love that. It tells them you’ve managed credit responsibly over time. But if you close that card, you’re cutting off part of your credit timeline. Even if you have other accounts, losing the oldest one can shorten your average account age and drop your score by 10 to 20 points.

And here’s the twist: unused cards still count toward your total available credit. That’s good-if you keep them open. But if you close them, your total credit limit drops. That can spike your credit utilization rate, which is the percentage of your available credit you’re using. If you have $10,000 in total credit across two cards and you’re using $2,000, your utilization is 20%. If you close one card with a $5,000 limit, now you’ve got $5,000 total and still $2,000 used. Your utilization jumps to 40%. That’s a red flag to lenders. Experts say keeping utilization under 30% is smart. Under 10% is even better.

Why Closing a Card Can Backfire

People often think closing an unused card is a clean break. But it’s not. Credit bureaus don’t just track active accounts-they track your entire history. Even if you stop using a card, it stays on your report for up to 10 years after closing. But during that time, you’re missing out on its benefits.Here’s a real example: Sarah had three cards. One, opened in 2015, had a $10,000 limit and she hadn’t used it in five years. She closed it thinking she was simplifying her finances. Six months later, she applied for a home loan and got denied. Her credit score had dropped 37 points. Why? Closing that card raised her utilization from 18% to 42% and cut her average account age from 9.2 years to 5.8 years. That’s not a small change-it’s enough to cost you thousands in interest over a mortgage.

Another risk: some issuers automatically close cards that stay inactive for 12 to 24 months. If you forget about a card and don’t use it, the bank might shut it down for you. Now you’ve lost the account without control. You can’t predict when that’ll happen, and you can’t plan for the score drop.

What You Should Do Instead

You don’t need to use your card every month. But you do need to use it occasionally to keep it alive. Here’s how:- Set up a small recurring payment-like a $5 Netflix subscription or a $10 Spotify bill-to charge to the card.

- Pay it off in full each month. No interest. No debt. Just activity.

- Do this every 3 to 6 months. Even once a quarter is enough.

That’s it. You’re not spending more. You’re just keeping the account active. Banks see usage. Credit bureaus see history. And your score stays healthy.

Also, check if your card has an annual fee. If it does, and you’re not getting value from it-travel perks, cashback, insurance-then it might be worth closing. But only after you’ve considered the impact on your utilization and credit age. If you have other cards with higher limits, the damage might be minimal. If it’s your only card with a long history, hold onto it.

When It’s Okay to Close a Card

There are times when closing an unused card makes sense:- You’re being charged an annual fee and won’t use the benefits.

- You’re tempted to spend it and can’t trust yourself.

- You have multiple cards with similar limits and one is much older than the rest.

For example, if you have five cards, and the oldest one is from 2010, but you also have another from 2008 that you use regularly, closing the 2010 card won’t hurt your average age much. But if the 2010 card is your only card with a $15,000 limit and you’ve got $8,000 in debt on other cards, closing it could push your utilization over 50%. That’s dangerous territory.

Before closing any card, run a quick math check:

- Add up all your credit limits across all cards.

- Add up how much you currently owe.

- Divide the total debt by the total limit. That’s your utilization rate.

- Now subtract the limit of the card you’re thinking of closing.

- Recalculate your utilization. If it jumps above 30%, don’t close it.

That’s the rule of thumb most financial advisors in Australia use. And it’s backed by data from the Reserve Bank of Australia and credit reporting agencies like Equifax and Experian.

What Happens If Your Card Gets Closed by the Bank?

Sometimes, banks shut down inactive cards without warning. If that happens to you, your score might dip temporarily. But you can recover. Here’s what to do:- Call your issuer. Ask if they’ll reopen the account. Sometimes they will, especially if you’ve been a good customer.

- Request a credit limit increase on another card to offset the lost limit.

- Apply for a new card only if you need it-and make sure it doesn’t trigger a hard inquiry right before you plan to apply for a loan.

Don’t panic. One closed card won’t ruin your credit forever. But it can delay big purchases like a car or home. Give yourself time to rebuild.

Bottom Line: Keep It Open, Use It Lightly

An unused credit card isn’t a liability-it’s an asset. It’s a long history, a high limit, and a buffer against high utilization. The trick isn’t to use it heavily. It’s to use it enough to stay alive.Set a calendar reminder. Charge a coffee every six months. Pay it off. That’s all it takes. Your credit score will thank you when you need it most.

Will keeping a credit card open hurt my credit score if I never use it?

No, keeping a credit card open and unused won’t hurt your score by itself. In fact, it usually helps by increasing your total available credit and lengthening your credit history. The problem comes when the issuer closes the account due to inactivity, or when you close it yourself-both can raise your credit utilization rate and shorten your credit history, which lowers your score.

How often should I use an unused credit card to keep it active?

Use it at least once every six months. Charge a small amount-like a $5 subscription-and pay it off in full. This shows the issuer you’re still active, and it keeps the account open. Some banks may close accounts after 12 to 24 months of inactivity, so being proactive prevents surprise closures.

Should I close a credit card with an annual fee if I don’t use it?

Only if the fee outweighs the benefit to your credit score. If closing it would raise your credit utilization above 30% or cut your average account age significantly, it’s better to keep it open-even if you pay the fee. You can call the issuer and ask to downgrade to a no-fee version instead of closing it outright.

Can closing a credit card affect my ability to get a loan?

Yes. Closing a card can lower your credit score by increasing your credit utilization rate and shortening your credit history. Lenders look at these factors closely when approving loans for homes, cars, or personal finance. A drop of 20+ points could mean higher interest rates or even a denial. Always check your utilization rate before closing any account.

Do all credit card issuers close inactive accounts?

Not all, but many do. Major Australian banks like Commonwealth Bank, Westpac, and NAB have policies that allow them to close accounts after 12 to 24 months of no activity. It’s not guaranteed, but it’s common enough that you shouldn’t rely on your card staying open forever without use. Always assume it could be closed-and plan accordingly.