Remortgage Calculator

Calculate Your Potential Remortgage Savings

Compare your current mortgage with potential new loan options to see if remortgaging makes financial sense for you.

If you’ve heard talk about remortgaging but can’t picture what it actually looks like, you’re not alone. Many Australians hear the word in the news and wonder whether it could lower their monthly bill or free up cash for a renovation. This article walks through a clear, step‑by‑step case so you can see exactly how a remortgage works from start to finish.

What is a Remortgage?

When you hear the term Remortgage is the process of replacing your existing home loan with a new one, usually to secure a better interest rate or release extra equity, it simply means you are swapping one mortgage for another. The old loan is paid off at settlement, and a fresh loan takes its place, often with different terms.

Why People Choose to Remortgage

There are three common reasons:

- Lower interest rate - A drop in market rates can shave hundreds of dollars off your monthly payment.

- Access home equity - If your property has risen in value, you can borrow a portion of that gain for a kitchen remodel, debt consolidation, or investment.

- Change loan features - Switching from a variable‑rate loan to a fixed‑rate loan (or vice‑versa) can give you more certainty or flexibility.

Each motive affects the numbers you’ll see on the comparison table later, so keep your priority clear before you start hunting for offers.

A Real‑World Remortgage Example

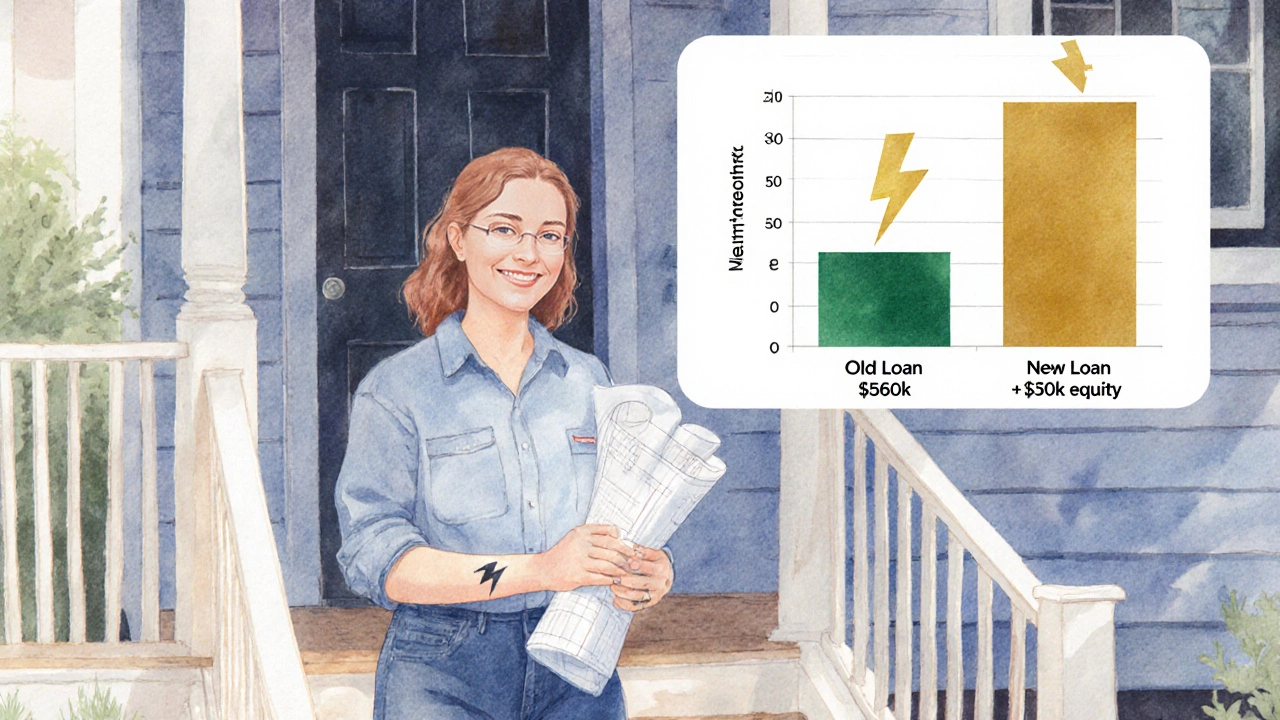

Meet Sarah, a 38‑year‑old electrician living in Sydney’s inner west. In 2018 she bought a three‑bedroom house for $800,000 with a 20% deposit. Her original loan was a 30‑year variable‑rate mortgage at 4.9% interest, meaning her monthly repayment was about $3,630 (principal and interest only).

Fast‑forward to October2025: the property’s market value has risen to $950,000. Sarah’s loan balance has fallen to $560,000 after five years of repayments. She’s hearing that rates have dropped to around 3.2% for a 5‑year fixed product, and she’d also like $30,000 to finish her backyard deck.

Below is a remortgage example that shows how Sarah can achieve both goals in one transaction.

- Determine the loan‑to‑value (LTV) ratio. LTV = loan amount ÷ property value. Sarah’s current LTV is 560,000 ÷ 950,000 ≈ 58.9%, well below the typical 80% ceiling, so she can comfortably borrow more.

- Decide how much extra equity to release. She wants $30,000, so the new loan amount will be 560,000 + 30,000 = $590,000.

- Shop for a new loan. She receives three quotes:

- Bank A: 5‑year fixed at 3.2%, $590,000, $2,595 monthly.

- Bank B: 5‑year variable at 3.1%, $590,000, $2,560 monthly.

- Credit Union C: 5‑year fixed at 3.15%, $590,000, $2,580 monthly.

- Calculate total cost. Over the first five years, Bank A would cost $2,595 × 60 = $155,700, Bank B $153,600, and Credit Union C $154,800. The difference is modest, so Sarah picks Bank B for the lower monthly payment and the flexibility to refinance again if rates fall further.

- Arrange settlement. Her current lender agrees to discharge the $560,000 loan on the settlement date. The new lender provides the $590,000 loan, pays off the old balance, and releases the additional $30,000 to Sarah’s nominated account.

- Post‑settlement. Sarah’s new monthly repayment is $2,560, a $1,070 reduction from her old $3,630 payment. She also has $30,000 in cash to complete the deck, which adds value to her home.

The whole process took about six weeks from the first quote to settlement, and the fees (valuation, legal, and application) added up to roughly $2,200 - a cost that will be recouped within the first two years of lower repayments.

Key Terms You’ll Hear

- Mortgage - The original loan taken to buy the property.

- Remortgage - The replacement loan that pays off the existing mortgage.

- Loan‑to‑Value (LTV) Ratio - The proportion of the loan amount to the property’s market value.

- Fixed‑rate - An interest rate that stays the same for a set period, such as 5 years.

- Variable‑rate - An interest rate that can change with market movements.

- Equity - The difference between the property’s market value and the outstanding loan balance.

- Settlement - The day the old loan is cleared and the new loan takes effect.

- Valuation - An assessment of the property’s current market price, required by the new lender.

- Credit Score - A numeric representation of your borrowing reliability; higher scores generally secure better rates.

Original Mortgage vs. Remortgage - Quick Comparison

| Feature | Original Mortgage (2018) | Remortgage (2025) |

|---|---|---|

| Loan amount | $560,000 | $590,000 (includes $30k equity release) |

| Interest rate | 4.9% variable | 3.1% variable (Bank B) |

| Monthly repayment | $3,630 | $2,560 |

| LTV ratio | 70% (approx.) | 62% (after equity release) |

| Loan term remaining | 25 years | 25 years (reset to new term) |

| Fees | None (original) | $2,200 (valuation, legal, application) |

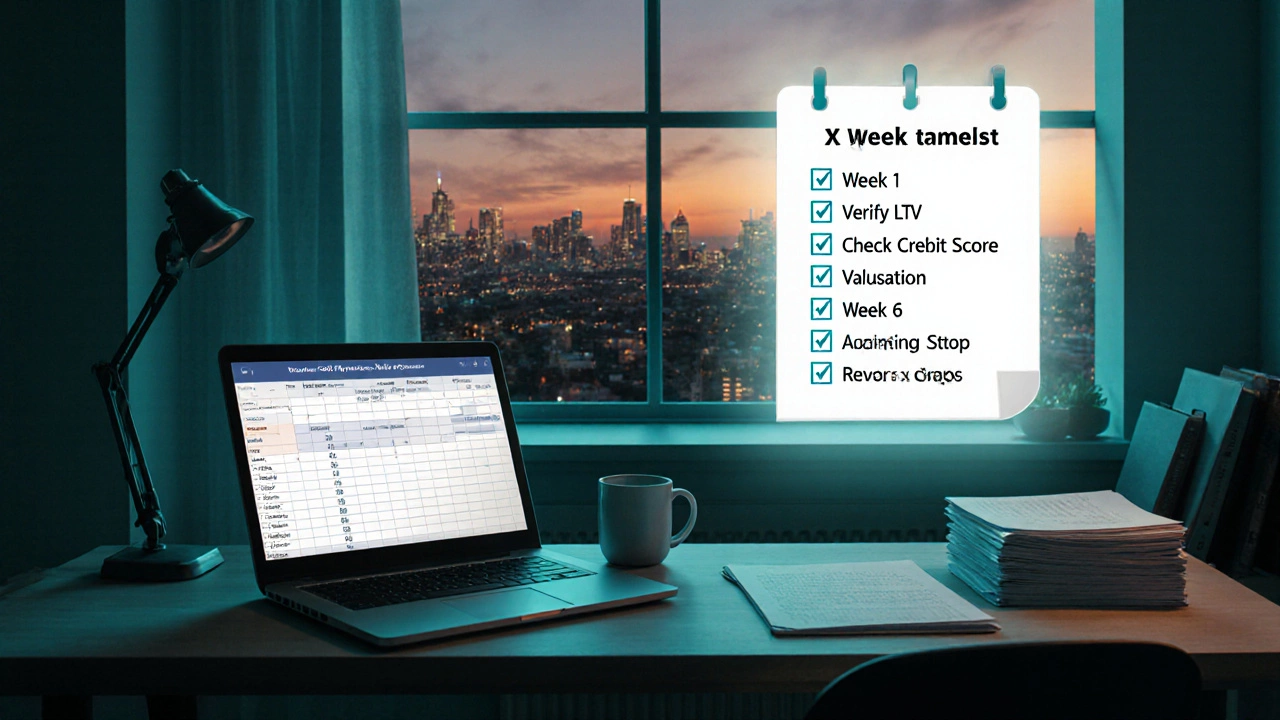

Checklist Before You Apply for a Remortgage

- Verify your current LTV is below 80%.

- Check your credit score; aim for 700+ for the best rates.

- Gather recent payslips, tax returns, and a copy of your existing loan statement.

- Order a professional property valuation (some lenders cover this).

- Compare at least three offers - look at rate, fees, and features.

- Calculate the break‑even point: total fees ÷ monthly savings.

- Consider the length of the fixed period and any early‑repayment penalties.

Common Pitfalls and How to Avoid Them

Ignoring total cost. A lower interest rate can be offset by high application fees. Always use an online calculator to include fees in your comparison.

Choosing the wrong loan type. Fixed rates give certainty but can be higher than variable rates when markets are falling. If you plan to move or refinance within a few years, a variable product might save you more.

Forgetting the impact on equity. Borrowing extra cash reduces the equity cushion, which could affect future borrowing power or resale value. Keep your LTV comfortably under 80%.

Missing the settlement timeline. Your current lender needs notice to discharge the loan, and the new lender must arrange valuation. Start the process early to avoid missing a rate lock.

Next Steps After a Successful Remortgage

- Set up automatic payments to avoid missed due dates.

- Update your budgeting spreadsheet with the new repayment amount.

- Monitor interest rate news if you have a variable loan - you may refinance again.

- Consider using any leftover cash (if fees were lower than expected) to pay down higher‑interest debt.

- Keep all settlement documents for tax and future reference.

Frequently Asked Questions

Can I remortgage if my property value has fallen?

Yes, but you’ll face a higher loan‑to‑value ratio. Lenders usually cap LTV at 80% for a standard loan, so if the value drops you may need a larger deposit or a specialist lender willing to accept higher risk.

What fees are typical in a remortgage?

Common fees include a valuation ($300‑$600), legal/conveyancing ($800‑$1,200), application or loan‑establishment fees ($0‑$500), and possibly an early‑repayment charge on the existing loan (often 1‑2% of the remaining balance).

How long does the remortgage process usually take?

From first quote to settlement, most borrowers spend 4‑8 weeks. The timeline can stretch if the valuation takes longer or if there are complications with the existing lender.

Is it better to fix the rate or stay variable?

It depends on your risk tolerance and market outlook. Fixed rates protect you from rises but can be slightly higher. Variable rates can be cheaper when rates fall, but you’ll need to budget for possible increases.

Can I use a remortgage to consolidate debt?

Yes. By borrowing extra equity and paying off credit‑card balances or personal loans, you can turn high‑interest debt into a lower‑interest mortgage debt. Just ensure the new loan’s monthly payment fits your budget.