Homeowners Insurance: Quick Tips to Save Money and Stay Protected

If you own a house, you probably know that insurance is a must, but you might not know how to make it work for you. The right policy protects your home, your belongings, and your peace of mind – and it doesn’t have to drain your wallet.

First, understand what a standard homeowners policy covers. It usually includes the building itself, personal items, liability if someone gets hurt on your property, and extra living expenses if you have to move out after a claim. Knowing exactly what you’re paying for helps you spot unnecessary add‑ons and focus on the coverage you truly need.

How Your Credit Score Impacts Your Premium

Many people are surprised to learn that insurers look at credit scores when setting rates. A higher score signals lower risk, so companies often offer cheaper premiums to borrowers with good credit. If your score is in the low 600s, you could be paying 10‑20% more than someone with a score above 750.

Improving your credit doesn’t require a major overhaul. Start by checking your credit report for errors and disputing any mistakes. Pay down revolving balances – aim for a utilization under 30% – and make sure you never miss a payment. Even small changes, like moving a credit card balance from 40% to 20% of its limit, can shave a few pounds off your insurance bill.

Choosing the Right Deductible

The deductible is the amount you agree to pay out of pocket before the insurer steps in. A common choice is a $2,500 deductible, but the best number depends on your budget and risk tolerance. If you can comfortably cover $2,500 after a claim, you’ll usually see a lower premium compared to a $500 deductible.

Think of the deductible as a trade‑off. Higher deductibles lower monthly costs, but they mean a bigger hit if a loss occurs. Run the numbers: compare the annual savings from a higher deductible with the potential out‑of‑pocket expense. If the savings are less than the extra cash you’d need to pay after a claim, a lower deductible might make more sense.

Another tip: ask your insurer about “deductible discounts.” Some providers shave a few percent off the rate for every $500 increase in the deductible. It’s a simple way to customize the policy to fit your cash flow.

Beyond credit scores and deductibles, look for discount opportunities you might have missed. Bundling home and auto insurance, installing security systems, or being claim‑free for several years can all unlock lower rates. Ask your agent for a “review of discounts” each time you renew – the conversation often reveals savings you didn’t know were available.

Finally, review your policy every year. Life changes – a renovation, a new pool, or a change in the value of your belongings – can affect coverage needs. Updating the policy prevents over‑insuring (wasting money) or under‑insuring (leaving you exposed).

Take these steps now: pull your credit report, decide on a deductible you can afford, and call your insurer to ask about discounts. A few minutes of effort today can translate into a lower premium tomorrow, while still keeping your home safe and sound.

Which homeowners insurance company has the highest customer satisfaction?

Amica Mutual leads in customer satisfaction for homeowners insurance in 2025, offering faster claims, better communication, and personalized service. Learn why mutual insurers outperform big names and how to choose the right provider for your needs.

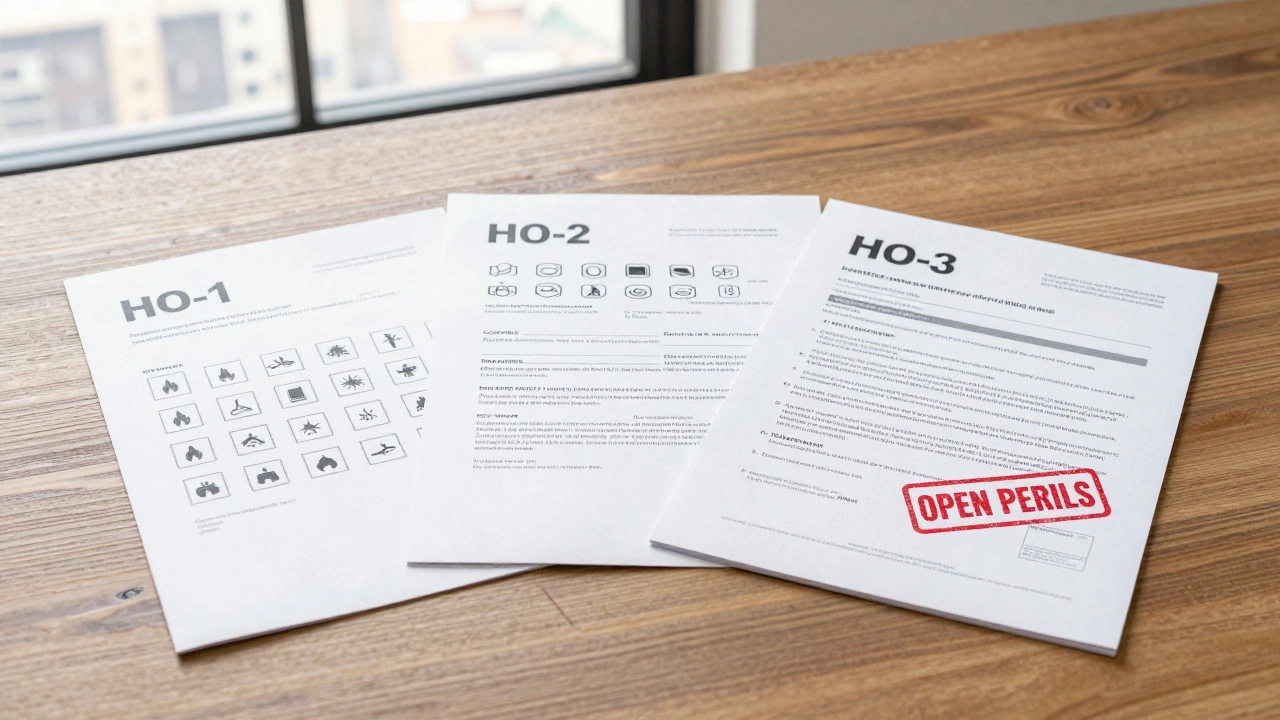

Read More >>What Are the Three Main Types of Homeowners Insurance?

Learn about the three main types of homeowners insurance-HO-1, HO-2, and HO-3-and understand which one offers real protection for your home and belongings. Know what’s covered, what’s not, and how to avoid costly gaps.

Read More >>Why Did My Home Insurance Rates Jump in 2024? All the Key Reasons Explained

Shocked by your 2024 homeowners insurance bill? Learn why rates spiked so much in Australia, who's to blame, and what you can actually do.

Read More >>Understanding the Surging Costs of Homeowners Insurance in 2025

In recent years, many homeowners have been shocked to find that their insurance premiums have doubled or even tripled. Several factors contribute to these rising costs, including increased natural disasters, inflation, and changes in underwriting practices. This article explores these factors in depth, provides strategies for managing insurance expenses, and advises homeowners on how to get the best coverage for their needs. Learn how to navigate the evolving landscape of home insurance without breaking the bank.

Read More >>Understanding the 80% Rule in Homeowners Insurance: Key Insights and Tips

The 80% rule in homeowners insurance is a critical principle that impacts your policy coverage and potential claims. It requires homeowners to insure their property for at least 80% of its replacement cost to avoid penalties during claims. This article dives into the specifics of the rule, offering insights and tips to ensure adequate home protection, while avoiding common pitfalls during the insurance process. Discover how understanding and applying the 80% rule can safeguard your home and financial peace of mind.

Read More >>Common Gaps in Homeowners Insurance Coverage

Homeowners insurance is essential for protecting your most valuable asset, but certain aspects of your home might not be covered by standard policies. Understanding these exclusions helps you prepare for unexpected expenses and fill coverage gaps. Typically, issues like flooding and mold damage are not included, often catching homeowners by surprise. With insightful tips and practical guidance, this article sheds light on what is usually not covered, enabling you to safeguard against unforeseen circumstances effectively.

Read More >>