Interest Rates – What They Mean for Your Wallet Right Now

Interest rates are the price of borrowing money and the reward for saving it. When the Bank of England shifts the base rate, every loan, mortgage and savings account feels the ripple. That’s why keeping an eye on rates can save you a few pounds a month or shave years off a mortgage.

In the past year the base rate has nudged up, pushing many UK banks to offer higher savings deals. You’ll see offers flashing 7% or even 8% on specific accounts, but they often come with strings attached – limited deposits, fixed terms, or eligibility rules. Understanding those details lets you chase the best return without getting caught off guard.

Where to Find the Best High‑Interest Deals

Our recent post “Savings Accounts With 7% Interest: Which UK Banks Offer The Best Rates?” breaks down the handful of banks actually offering double‑digit returns. Most of them are fixed‑term products, like a 12‑month cash ISA or a certificate of deposit (CD). If you can lock away £5,000 for a year, the boost can be noticeable. Another hot topic is the “Best ISA Interest Rates in 2025”. ISAs let you earn tax‑free interest, so pairing a high‑rate cash ISA with a regular savings account can maximise your after‑tax earnings. Keep an eye on the annual ISA allowance – it’s £20,000 for the 2024/25 tax year – and spread it across the highest‑yielding accounts you qualify for. If you prefer flexibility, look for “high‑yield savings” that allow easy access but still pay close to market rates. Some challenger banks offer introductory rates of 5‑6% for the first three months, then drop to a lower standard rate. Use those intro periods to stash any cash you don’t need immediately, then move the money when the rate falls.

How Interest Rates Affect Loans and Mortgages

Higher rates don’t just help savers; they also raise the cost of borrowing. Our guide on “What Are the Real Costs of a $100,000 30‑Year Mortgage at 7 Percent Interest?” shows how a few extra points can add thousands to total repayments. The same principle applies to credit cards, car loans and personal loans.

If you already have a mortgage, consider remortgaging. The “Remortgaging Benefits Explained” article outlines how switching to a lower‑rate deal can cut monthly outgoings and free up cash for savings or investments. Even a 0.5% drop can save you over £150 a month on a £150,000 loan. For credit cards, watch the “20% Credit Card Rule”. Keeping your balance under 20% of the limit helps you avoid interest spikes and protects your credit score, which in turn influences the rates lenders offer you.

One simple trick: if you spot a high‑rate savings account, use it as a “piggy bank” for the cash you’d otherwise leave on a low‑interest current account. Transfer the money each month, let it earn, then move it back when the promotional period ends.

Bottom line – interest rates move the financial needle daily. By staying informed, swapping to higher‑rate accounts, and timing your loan moves, you can turn rate changes into a clear advantage. Check our tag page regularly for fresh posts on the latest rates, smart saving tactics, and loan‑rate breakdowns. Your money works harder when you do.

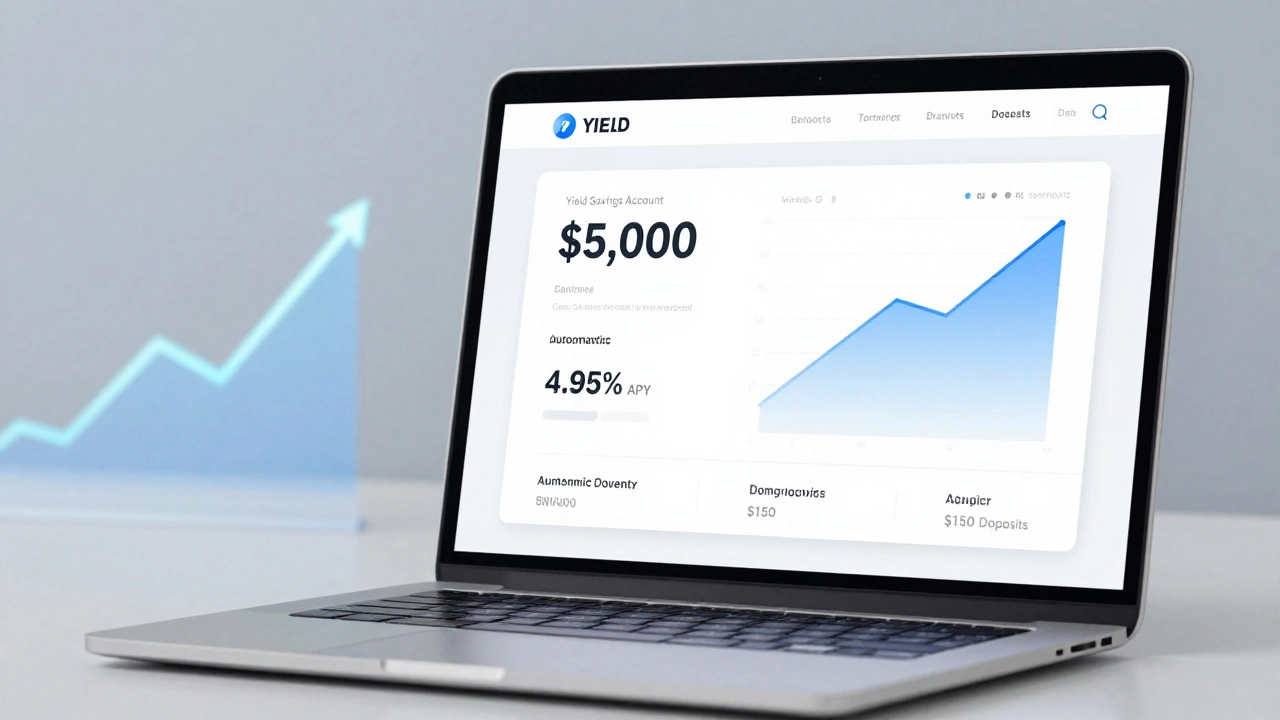

How to Double $5000 in Savings Accounts and Realistic Investment Paths

You can double $5,000 without taking big risks - just by using high-yield savings accounts and smart, consistent saving. No crypto, no gambling. Just compound interest and time.

Read More >>What Are the Negative Effects of Debt Consolidation?

Debt consolidation can seem like a quick fix, but it often hides hidden costs, longer repayment terms, and risks to your credit score and assets. Learn the real downsides and when it actually helps.

Read More >>Understanding the Golden Rule of Credit and How It Impacts Your Card Choices

Learn the golden rule of credit-pay in full, on time, and keep utilization low-to boost your score, avoid interest, and choose the right cards.

Read More >>Is Now the Right Time to Invest in a CD?

Wondering whether a CD is worth your money right now? This article breaks down the pros and cons of investing in a CD today. Learn about current interest rates, potential benefits, and common pitfalls so you can make an informed decision. Discover tips for choosing the right CD and what to consider before locking in your savings. Get clear, practical advice to help you decide if a CD fits into your financial strategy.

Read More >>Discovering the Lowest Car Interest Rates: A 2025 Guide

Choosing a bank with the lowest car interest rates can save you a significant amount of money over time. This article provides a practical guide to finding which bank offers the most competitive car loan rates in 2025. Explore tips and factors to consider, such as loan term and credit score, for making an informed decision. Learn how to stay updated with the latest rates and make the best financial choices for your car purchase.

Read More >>