Investment Strategies – Find the Best Approach for Your Money

When you start thinking about growing your cash, the first question is always “what strategy should I use?” There’s no one‑size‑fits‑all answer, but the right plan can turn a modest sum into something much bigger over time.

On this page you’ll see a mix of articles that break down the most popular ways to invest in the UK. Whether you’re looking at ISAs, a 70/30 split, or even a simple budgeting hack, each piece gives you concrete steps you can try right now.

Why a Strategy Matters

A clear strategy saves you from guessing and helps you stay on track when markets wobble. It tells you how much risk you’re comfortable with, which assets to pick, and when to adjust. Without a plan, you might chase high returns one day and pull back the next, leaving your money stuck in limbo.

For example, the 70/30 investment strategy focuses on 70% growth‑oriented assets (like stocks) and 30% stable assets (like bonds). This mix aims to capture upside while smoothing out volatility. It’s a good middle ground if you want growth but can’t handle huge swings.

Popular Strategies to Explore

ISA Investing: An Individual Savings Account lets you grow money tax‑free. Our guide on “Is an ISA a Good Investment?” walks you through cash, stocks & shares, and lifetime ISAs, so you can pick the right type for your goals.

70/30 Split: Learn how to allocate 70% to growth assets and 30% to defensive ones. The article “70/30 Investment Strategy Explained” shows risk levels, expected returns, and how to rebalance each year.

High‑Yield Savings: If you prefer safety, the “Savings Accounts With 7% Interest” post lists UK banks offering top rates and warns about hidden conditions.

Equity Release: For homeowners, equity release can free up cash without selling. Our “Best Place to Get Equity Release in the UK (2025)” guide compares brokers, lenders, and banks, highlighting fees and safeguards.

Debt Management: Before you invest, you might need to clear high‑interest debt. The “Debt Consolidation Loans From UK Banks” article explains when a bank loan makes sense and how to get the best terms.

Every strategy has pros and cons, so the key is matching it to where you are now and where you want to be. Ask yourself: How long can I leave money untouched? What level of loss could I handle? Do I need quick cash for a house or can I wait for long‑term growth?

Once you answer those, pick one or two strategies from the list above and start small. Even a £100 monthly contribution can add up, especially when you combine tax advantages like ISAs with a balanced asset mix.

Remember to revisit your plan at least once a year. Life changes, interest rates shift, and new investment products appear. A quick review keeps you from drifting off course and helps you capture new opportunities.

Ready to start? Pick the article that matches your current need, follow the step‑by‑step tips, and watch your money work harder for you. Investing doesn’t have to be complicated – a solid strategy and a bit of discipline go a long way.

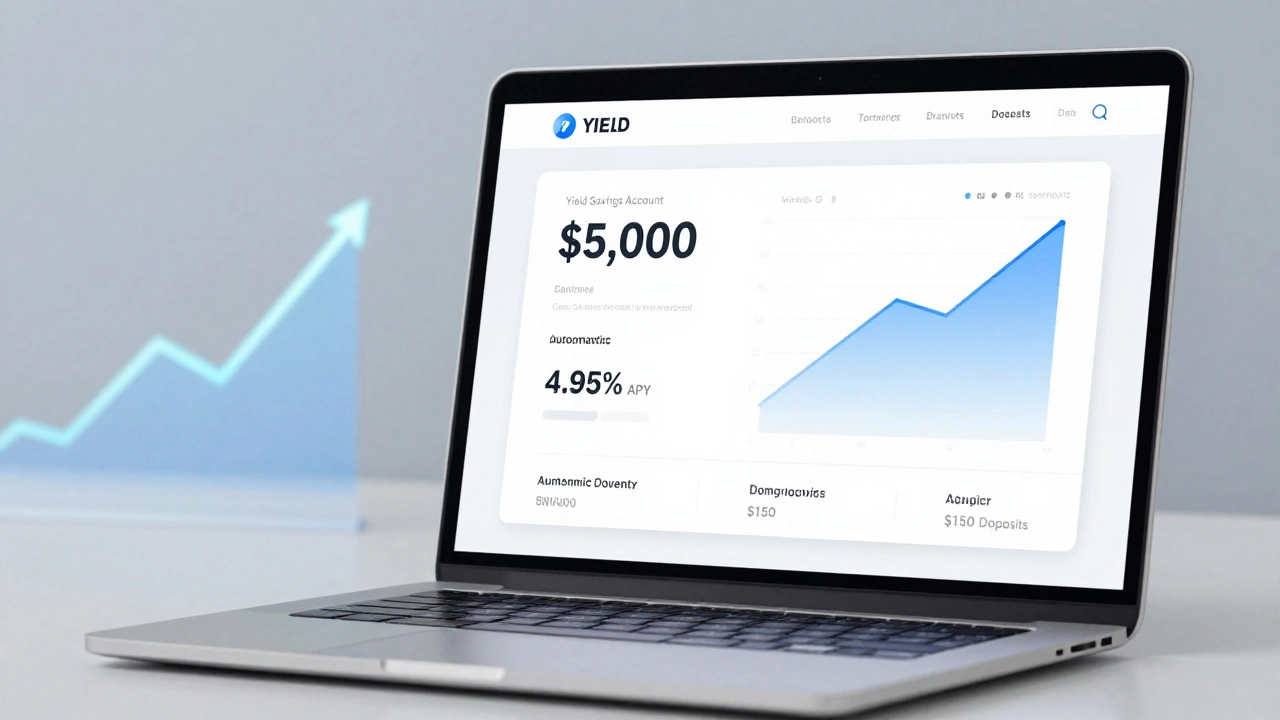

How to Double $5000 in Savings Accounts and Realistic Investment Paths

You can double $5,000 without taking big risks - just by using high-yield savings accounts and smart, consistent saving. No crypto, no gambling. Just compound interest and time.

Read More >>Achieving $1,000,000 in Retirement Savings: How Many Make It and How You Can Too

As of today, reaching the million-dollar mark in retirement savings is more attainable than ever due to strategic planning and prudent investing. This article delves into the real numbers of people with $1,000,000 in their retirement accounts, explores the possible paths to this goal, and offers practical tips to enhance your financial future. It highlights the common mistakes to avoid, key strategies for every life stage, and how to adjust in uncertain economic times. Packed with insights, this piece offers a roadmap for growing your nest egg responsibly.

Read More >>