Budget Priorities Calculator

Cover your basic living costs (rent, utilities, groceries, transport).

Build a safety net for 3-6 months of expenses.

Pay off debt or save for goals (retirement, house down payment).

Your Financial Plan

Enter your income and adjust percentages to see how your money is allocated.

Tips for Adjusting Your Budget

- If your essentials exceed 50% of income, consider reducing non-essentials.

- Start with a smaller emergency fund if needed—build it over time.

- Focus on high-interest debt first for maximum savings.

- Review your budget monthly and adjust as your income or expenses change.

When you sit down with a spreadsheet or an app, the biggest question isn’t "how much can I spend?" but "what should I focus on first?" Pinpointing the three core priorities in any budget gives you a clear roadmap, cuts stress, and speeds up progress toward the things that truly matter.

Key Takeaways

- Identify your essential living expenses and allocate enough to cover them.

- Build an emergency fund that can handle 3‑6 months of costs.

- Decide between debt repayment and goal‑oriented savings, then assign a realistic percentage.

- Use a simple 50/30/20‑style split as a starting point, then adjust based on personal circumstances.

- Review and tweak your priorities every month to stay on track.

What a Budget Actually Is

Budget is a planned allocation of income toward expenses, savings, and debt over a set period. It serves as a financial blueprint, helping you see where every dollar goes before it disappears.

Every budget starts with two numbers: Income (the cash you bring in) and Expenses (the cash you spend). The difference between them is the pool you can direct toward savings, debt reduction, or discretionary fun.

Priority #1 - Cover Your Essential Living Expenses

The first priority is non‑negotiable: you must fund the basics that keep the lights on and food on the table. Think rent or mortgage, utilities, groceries, transportation, and essential insurance. These are often labeled Fixed Expenses because they stay relatively constant month to month.

How to nail this down:

- List every mandatory cost and note the exact amount.

- Sum them up and compare the total to your net Income. If fixed expenses eat more than 50% of income, you’ll need to trim discretionary spending or find ways to boost earnings.

- Set up automatic payments for rent, utilities, and insurance to avoid missed due dates and late fees.

Once covered, you have a solid foundation on which the next priorities can safely build.

Priority #2 - Build an Emergency Fund

Life throws curveballs-job loss, car repair, medical bill. An Emergency Fund acts as a financial safety net, preventing you from relying on high‑interest credit cards or loans when the unexpected hits.

Target size: three to six months of essential living expenses (the amount you calculated in Priority #1). If you’re self‑employed or have an unstable income, aim for the higher end.

Steps to grow the fund fast:

- Open a separate high‑interest savings account solely for emergencies.

- Allocate a fixed percentage of each paycheck-5% to 15% depending on current savings level.

- Direct any windfalls (tax refunds, bonuses) straight into the fund.

When the balance hits the target, you can pause contributions and redirect that money toward the third priority.

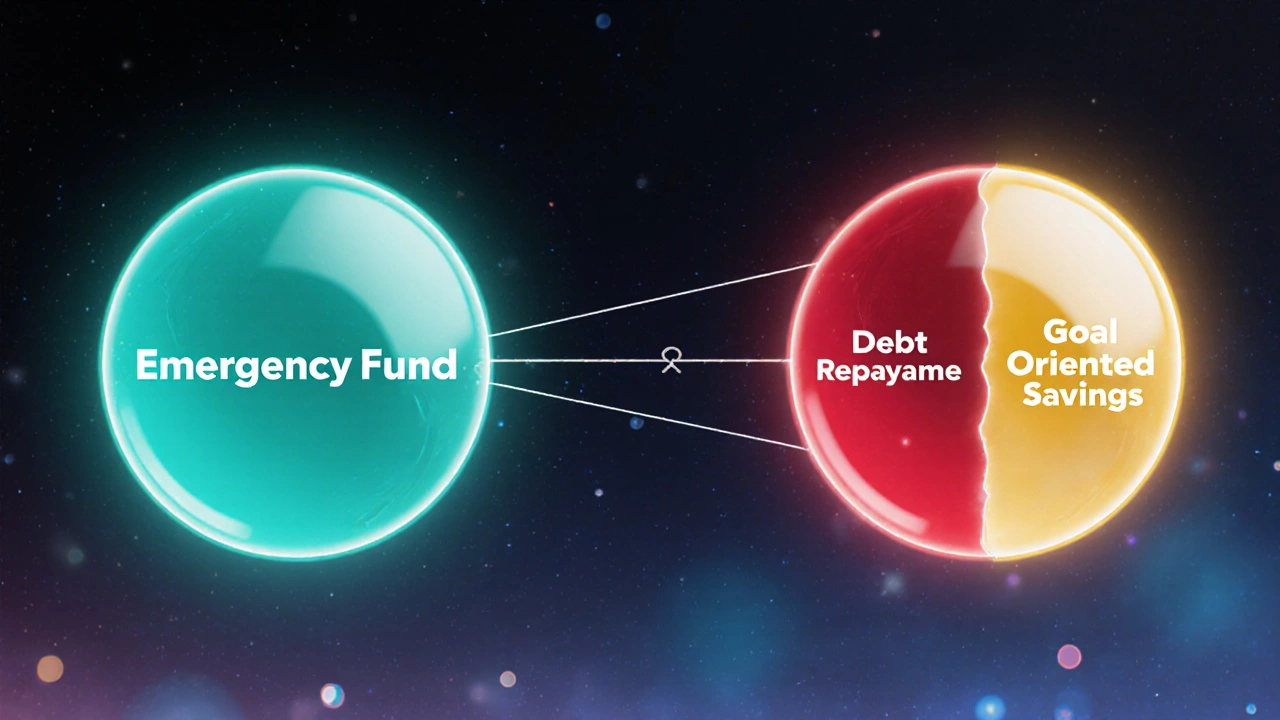

Priority #3 - Debt Repayment vs. Goal‑Oriented Savings

After you’ve secured your essentials and emergency cushion, the next decision is whether to focus on paying down debt or saving for specific goals (a down‑payment, education, retirement). Both are important, but the optimal mix depends on interest rates, debt type, and personal timelines.

Debt Repayment wins when you carry high‑interest balances-credit cards (often 15‑25% APR) or payday loans. Paying off these debts saves you more money than most investment returns.

Goal‑Oriented Savings shines for low‑interest or zero‑interest debt (student loans at 3‑5% APR, mortgages). Directing money to a high‑yield savings account or a tax‑advantaged investment can outpace the cost of this debt.

Use this rule of thumb:

- If any debt’s interest rate exceeds the expected return on your investments, allocate extra cash to that debt first.

- Otherwise, split the surplus-say 50% to extra debt payments, 50% to savings for a defined goal.

Whichever route you pick, keep the effort consistent. Small, regular contributions add up quickly.

Putting It All Together: A Simple Allocation Framework

Many budgeting experts start with the 50/30/20 rule, then fine‑tune it. Here’s a quick way to map the three priorities onto percentages:

| Priority | Typical % of Net Income | What It Covers |

|---|---|---|

| Essential Living Expenses | 50‑55% | Housing, utilities, food, transport, essential insurance |

| Emergency Fund | 10‑15% (until target reached) | 3‑6 months of essential expenses in a liquid account |

| Debt Repayment / Goal Savings | 30‑40% | Extra debt payments, retirement contributions, down‑payment savings, education funds |

Adjust the slices as your situation evolves. For instance, once the emergency fund is fully funded, shift that 10‑15% into the third slice to accelerate debt payoff or goal savings.

Step‑by‑Step Guide to Set Your Three Priorities

- Gather your latest pay stubs and identify total net Income.

- List every fixed and variable expense for the past month. Categorize as "essential" or "non‑essential".

- Calculate the sum of essential expenses. This becomes your baseline for Priority #1.

- If the baseline exceeds 50% of income, look for low‑cost ways to trim (cheaper grocery brands, renegotiating subscriptions).

- Set a realistic emergency fund goal (multiply essential expenses by 3‑6). Open a dedicated savings account if you don’t have one.

- Determine how much you can safely divert each pay period toward the emergency fund. Automate the transfer.

- List all debts with interest rates and balances. Rank them from highest to lowest APR.

- Apply the debt‑vs‑savings rule: high‑APR debt gets extra payment; low‑APR debt can share surplus with goal‑oriented savings.

- Choose concrete short‑term goals (e.g., $5,000 down‑payment) and long‑term goals (e.g., retirement). Assign a target date and required monthly contribution.

- Review the allocation percentages. Use a budgeting app or spreadsheet to track actual spending versus plan.

- At month‑end, compare outcomes. If you overspent in non‑essential categories, pull that amount back into Priority #3 for the next month.

Repeating this loop every month creates a habit loop that gradually shifts money where it matters most.

Common Pitfalls and How to Avoid Them

- Under‑estimating essential costs. People often forget irregular bills (annual insurance premiums). Keep a “buffer” line item of at least 5% of income.

- Skipping the emergency fund. It’s tempting to jump straight to debt payoff, but without a safety net you’ll likely revert to credit cards when emergencies arise.

- Focusing solely on one debt. The “snowball” method (pay smallest first) feels rewarding, but the “avalanche” method (pay highest APR first) saves more money in the long run.

- Not adjusting for life changes. A raise, a new child, or a move can shift the balance. Re‑run the priority calculation whenever a major event occurs.

- Ignoring psychological factors. Budgeting isn’t just numbers; it’s behavior. Give yourself a modest “fun” budget (the 30% slice) to prevent burnout.

Quick Checklist for Your Three‑Priority Budget

- ✅ Essential expenses identified and covered.

- ✅ Emergency fund goal set and contributions automated.

- ✅ Debt list with interest rates ready.

- ✅ Savings goals defined with timelines.

- ✅ Monthly allocation percentages entered into a tracking tool.

- ✅ Review scheduled for the last day of each month.

Frequently Asked Questions

How much of my income should go to essential expenses?

A good rule of thumb is 50‑55% of net income. If you’re consistently above that, look for ways to lower rent, switch to cheaper utilities, or reduce transportation costs.

What if I can’t afford a 3‑month emergency fund right now?

Start with one month’s worth, then add whatever you can each paycheck. Even a modest buffer reduces reliance on high‑interest credit.

Should I pay off student loans before saving for a house?

Compare the loan’s interest rate to the expected return on a home‑purchase savings vehicle. If the loan is under 5% APR and you can earn more through a high‑yield account or investments, split your surplus between both goals.

Can I use the 50/30/20 rule with irregular income?

Yes, but base your percentages on an average monthly income over the past six months. Keep a buffer in your checking account to smooth out low‑income months.

How often should I revisit my budget priorities?

At least once a month, and whenever a major life event occurs-new job, move, marriage, or a significant debt payoff.