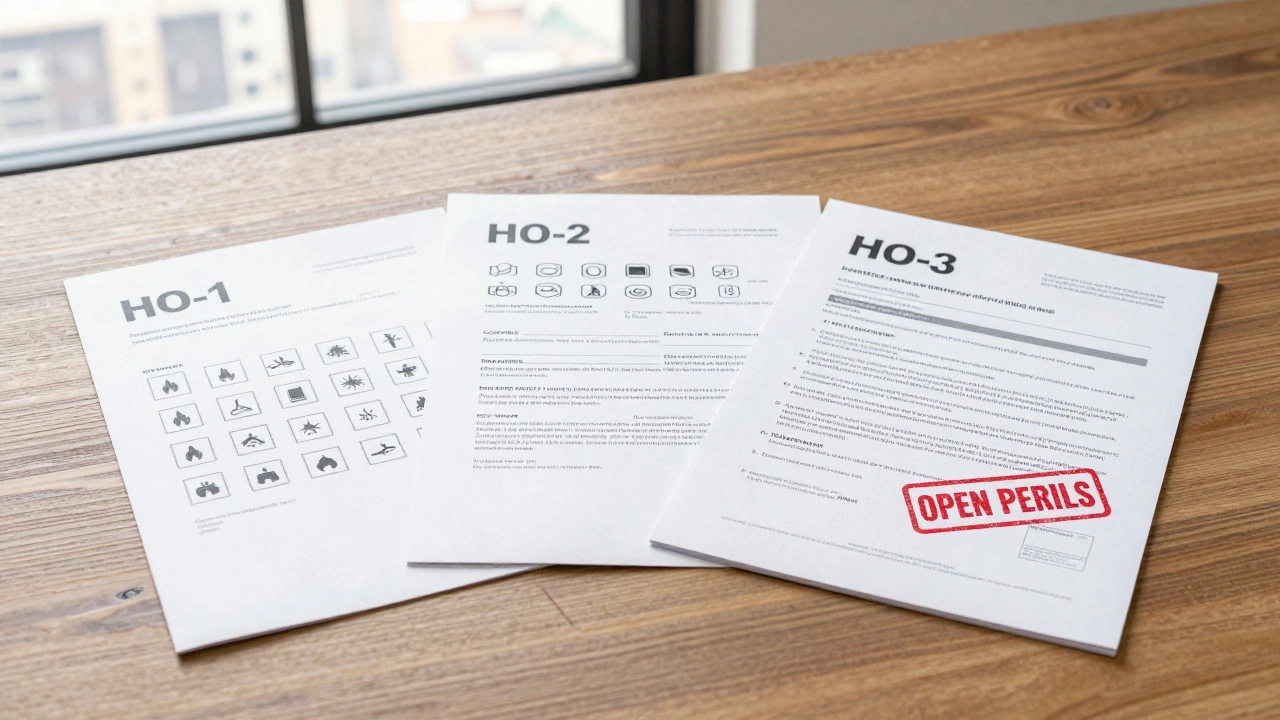

When you buy a home, insurance isn’t just a suggestion-it’s often required by your lender. But not all homeowners insurance is the same. The three main types of policies you’ll encounter are HO-1, HO-2, and HO-3. Most people end up with HO-3, but knowing the differences can save you money and avoid nasty surprises when something goes wrong.

HO-1: Basic Form (Named Perils Only)

HO-1 is the most basic homeowners insurance policy available. It only covers damage from 10 specific causes, called named perils. These include fire, lightning, windstorms, hail, explosions, riots, aircraft damage, vehicles crashing into your home, smoke damage, and volcanic eruptions.

It doesn’t cover things like theft, water damage from burst pipes, or falling objects unless they’re on that list. If your roof gets damaged by a tree branch during a storm, HO-1 won’t pay unless the branch fell because of wind or hail-two of the covered perils. If the tree was rotten and fell on its own? No coverage.

This policy is rarely sold today. Most insurers don’t even offer it unless you’re in a very low-risk area or own an older home that’s hard to insure. Even then, it’s not recommended. The protection is too thin. You’re paying for a policy that leaves you exposed to most real-world risks.

HO-2: Broad Form (More Named Perils)

HO-2 expands the list of covered perils from 10 to about 16-18. In addition to the HO-1 list, it typically adds coverage for damage from falling objects, weight of ice or snow, accidental water discharge (like a burst pipe), freezing of plumbing, and electrical surge damage.

It’s better than HO-1, but still has limits. For example, if your basement floods because of heavy rain seeping through the foundation, HO-2 won’t cover it. Floods are excluded. Same with sewer backups or groundwater. If your TV gets fried by a lightning strike, you’re covered. If your laptop dies because of a power surge from the grid? Maybe covered. But if your dog chews through the wiring? Not covered.

HO-2 is still available in some areas, especially for older homes or rental properties where the owner doesn’t want to pay for full coverage. But it’s becoming rare. Most lenders won’t approve it for financed homes because the protection isn’t enough.

HO-3: Special Form (The Most Common)

HO-3 is the standard homeowners insurance policy in Australia and most of the world. It’s called a special form because it works differently: instead of listing what’s covered, it lists what’s excluded. Everything else is covered.

This means if your house is damaged by fire, wind, hail, theft, vandalism, or even a falling tree-unless it’s specifically excluded-it’s covered. The big exclusions are floods, earthquakes, nuclear events, intentional damage, and wear and tear.

HO-3 covers two main things: your dwelling (the structure of your home) and your personal property (your stuff). For your home, it’s open perils coverage-meaning any sudden, accidental damage is included. For your belongings, it’s usually named perils unless you upgrade to replacement cost coverage.

Most people choose HO-3 because it gives the best balance of protection and cost. It’s what lenders require. It’s what insurers recommend. And if you’ve ever filed a claim for a broken window after a storm or stolen jewelry, it’s likely your HO-3 policy paid out.

What’s Actually Covered Under HO-3?

HO-3 doesn’t just cover your house. It includes four key parts:

- Dwelling coverage - Pays to repair or rebuild your home if it’s damaged by a covered event. This includes attached structures like garages or decks.

- Other structures - Covers detached buildings like sheds, fences, or guest houses. Usually 10% of your dwelling coverage.

- Personal property - Covers your belongings: furniture, clothes, electronics, appliances. Most policies pay actual cash value (depreciated value), but you can upgrade to replacement cost.

- Liability protection - If someone gets hurt on your property or you accidentally damage someone else’s stuff, this covers legal fees and medical bills. Typically $100,000 to $500,000.

For example: If a guest slips on your icy driveway and breaks their hip, liability coverage pays their hospital bills and any legal costs. If a fire destroys your living room, dwelling coverage rebuilds it. If your laptop is stolen during a burglary, personal property coverage replaces it-up to your limit.

Many people don’t realize how important liability coverage is. A single lawsuit can wipe out your savings. That’s why experts recommend at least $300,000 in liability coverage, and many go for $500,000 or more.

What’s Not Covered? Common Gaps

Even HO-3 has big gaps. Here are the most common exclusions:

- Floods - Rainwater entering through a broken roof? Covered. Water rising from a river or storm surge? Not covered. You need separate flood insurance.

- Earthquakes - Ground shaking, landslides, or soil liquefaction? Excluded. Requires a separate endorsement.

- Wear and tear - A roof that’s 25 years old and leaks? Not covered. Insurance doesn’t fix aging.

- Mold - Only covered if it results from a sudden covered event, like a burst pipe. Slow leaks? Excluded.

- Home-based businesses - If you run a bakery from your kitchen and a customer gets sick, your homeowners policy won’t cover it. You need commercial coverage.

These gaps matter. In Sydney, heavy rain and storms are common. If you live near a river or in a flood zone, you’re at risk. You can add flood coverage as an endorsement. Same with earthquakes in high-risk areas. Don’t assume your HO-3 policy is enough.

How to Choose the Right Policy

Here’s how to pick:

- Check your mortgage requirements - Most lenders require HO-3. If you’re renting out your property, you’ll need landlord insurance instead.

- Know your home’s rebuild cost - Don’t just insure your market value. Insure the cost to rebuild. A $800,000 house might cost $500,000 to rebuild. Underinsuring means you pay out-of-pocket.

- Upgrade personal property coverage - Opt for replacement cost instead of actual cash value. If your 5-year-old TV is stolen, replacement cost gives you a new one. Actual cash value gives you $200.

- Add endorsements - If you live near the coast, add flood. If you have expensive jewelry or art, get scheduled personal property coverage.

- Review liability limits - $300,000 is the minimum. If you have assets or kids who play sports, consider $500,000 or $1 million.

Most people don’t shop around for home insurance. They just renew with the same company. But premiums can vary by 40% between providers for the same coverage. Get quotes from at least three insurers every two years.

What Happens If You Don’t Have Enough Coverage?

Let’s say your home is worth $600,000, but you only insured it for $400,000. A fire destroys your house. The insurer pays out $400,000-but it costs $600,000 to rebuild. You’re out $200,000. That’s not a small gap. That’s a financial disaster.

Or worse: you don’t have liability coverage. A child falls off your trampoline and needs surgery. The medical bill is $50,000. Your policy doesn’t cover it. The family sues you. You lose your savings, your car, even your future wages. That’s why liability isn’t optional.

Homeowners insurance isn’t about being perfect. It’s about being protected against the big, unexpected things. HO-3 gives you that. HO-1 and HO-2 don’t.

Final Thoughts

HO-1 is outdated. HO-2 is a middle ground you probably don’t need. HO-3 is the standard for a reason. It covers what matters: your home, your stuff, and your legal responsibility.

Don’t just accept the default policy your insurer offers. Ask questions. Know your limits. Make sure your coverage matches your risks. In Australia, where weather events are getting more intense, having the right policy isn’t just smart-it’s essential.

If you’re unsure, talk to an independent insurance broker. They can compare policies across multiple companies and help you add endorsements without overpaying. Don’t wait until after the storm to realize your policy doesn’t cover the damage.

What is the most common type of homeowners insurance?

The most common type is HO-3, also called a special form policy. It covers your home and belongings against all risks except those specifically excluded, like floods or earthquakes. Most lenders require HO-3, and it’s the standard choice for homeowners because it offers the best balance of protection and affordability.

Does homeowners insurance cover water damage?

It depends on how the water got in. If a pipe bursts suddenly, HO-3 covers it. If your basement floods from heavy rain or rising groundwater, it doesn’t. Sewer backups are also excluded unless you add a specific endorsement. The key is whether the damage was sudden and accidental. Slow leaks or poor maintenance are never covered.

Is HO-2 better than HO-1?

Yes, HO-2 covers more perils than HO-1-adding things like water damage from burst pipes, falling objects, and electrical surges. But both are named peril policies, meaning they only cover what’s listed. HO-3 is far superior because it covers everything unless it’s excluded. HO-2 is rarely offered today and not recommended for most homeowners.

Do I need flood insurance if I have HO-3?

Yes. HO-3 policies never cover flood damage, even if the flood is caused by a storm. Flood insurance is a separate policy, usually through the National Flood Insurance Program or a private insurer. If you live near a river, coast, or in a low-lying area, you’re at risk-even if you’ve never flooded before. Climate change is making this risk more common.

What’s the difference between actual cash value and replacement cost?

Actual cash value pays you what your item is worth today after depreciation. If your 10-year-old sofa was stolen, you might get $300. Replacement cost pays to replace it with a new one of similar quality-say, $1,200. Most HO-3 policies start with actual cash value, but you can upgrade to replacement cost for personal property. It costs a bit more, but it’s worth it.