Warren Buffett doesn’t tell people to chase hot stocks, crypto trends, or meme stocks. He doesn’t even recommend buying ETFs just because they’re popular. What he does say is simple, timeless, and often ignored - especially when markets are wild. If you want to know what he advises people to invest in, you need to stop looking for shortcuts and start thinking like a business owner.

He Invests in Businesses, Not Stocks

Buffett doesn’t see shares as pieces of paper that go up and down with the news cycle. He sees them as partial ownership in real companies. That’s why he says, "Be fearful when others are greedy and greedy when others are fearful." His focus isn’t on predicting the market - it’s on understanding the business behind the ticker symbol.

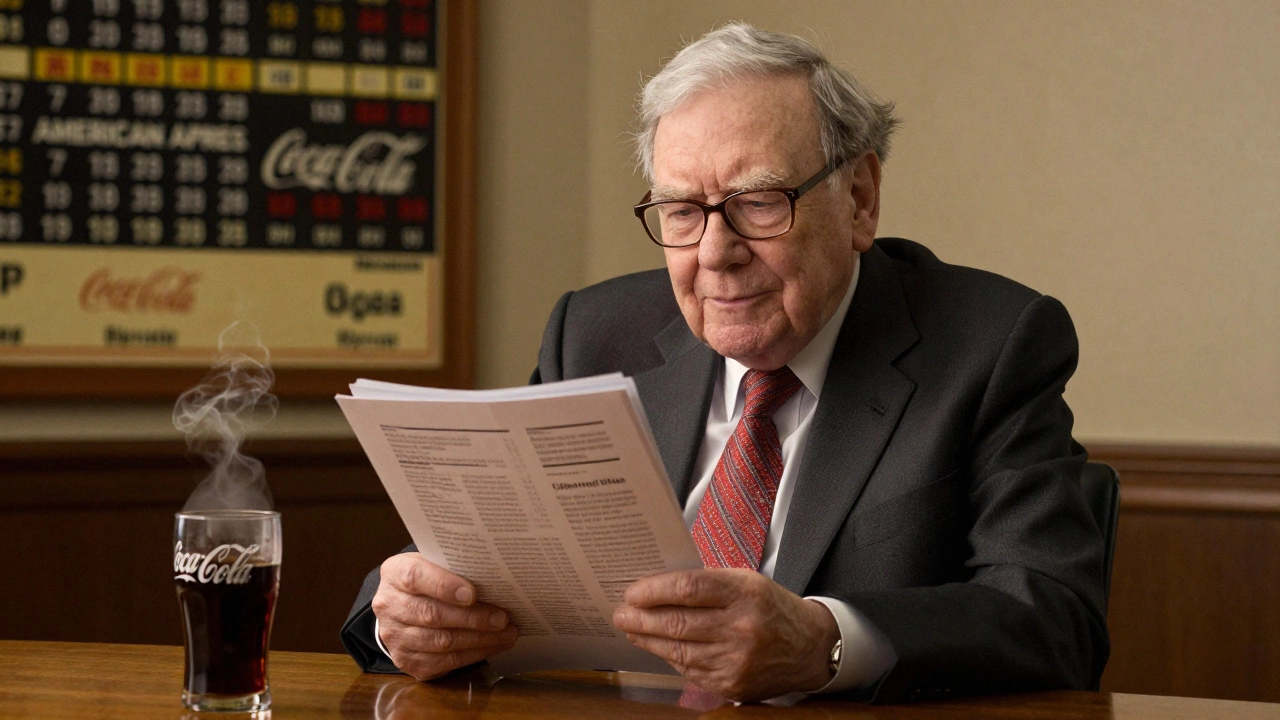

Take Coca-Cola. He bought it in 1988 when its stock was flat for years. Why? Because people around the world drank it every day. The brand was strong, the pricing power was real, and the cost to keep selling it stayed low. He didn’t care if the S&P 500 was up or down that week. He cared that Coca-Cola had a moat - a lasting advantage competitors couldn’t easily copy.

Same with American Express. In the 1960s, the company faced a scandal that crushed its stock. Most investors ran. Buffett saw a payment network with loyal customers and high switching costs. He bought more. Today, Amex is still a core holding in Berkshire Hathaway’s portfolio.

His Top Three Investment Categories

Buffett doesn’t give a list of five stocks to buy tomorrow. But over decades, his actions reveal clear patterns. Here are the three types of businesses he consistently invests in:

- Consumer monopolies with pricing power - Companies that sell everyday products people keep buying no matter what. Think Coca-Cola, See’s Candies, or Gillette. These brands don’t need to slash prices to stay relevant. Customers pay because they trust them.

- Financial institutions with strong balance sheets - Buffett loves banks and insurance companies - but only if they’re disciplined. He avoids risky lenders. Instead, he picks ones like Bank of America, where he invested after the 2008 crisis because he knew their fundamentals were solid. Insurance companies like Geico are golden because they collect premiums upfront and pay claims later - giving Buffett free cash to invest.

- Infrastructure and utilities with regulated returns - Berkshire owns railroads (BNSF), energy grids (MidAmerican Energy), and pipelines. These aren’t flashy. But they make money year after year. Demand doesn’t disappear. Regulation keeps profits steady. That’s the kind of predictable cash flow Buffett wants.

Notice what’s missing? No tech startups. No AI hype. No crypto. Buffett doesn’t avoid tech - he owns Apple. But he bought Apple because it acts like a consumer brand with a loyal user base, not because it’s a "tech stock." He sees iPhone users as customers who upgrade every few years and buy accessories. That’s a business model he understands.

He Avoids What Most People Chase

Buffett has been clear: he doesn’t invest in what he doesn’t understand. That’s why he skipped the dot-com boom. He didn’t say it was a bubble - he just said he didn’t know how to value those companies. When Bitcoin surged in 2021, he called it a "rat poison squared." Why? Because it doesn’t produce anything. No earnings. No dividends. No cash flow. Just speculation.

Same with meme stocks. When GameStop or AMC spiked on Reddit hype, Buffett didn’t even blink. He knows those stocks aren’t tied to real business performance. They’re gambling. And he’s never been a gambler.

He also avoids companies with massive debt, shrinking markets, or leadership that changes strategy every year. He once said, "I look for companies with durable competitive advantages and honest, capable management." If either is missing, he walks away.

What About Index Funds? Does He Recommend Them?

Yes - but only for most people.

Buffett has repeatedly told average investors: "I recommend the S&P 500 index fund. It’s the best way to invest if you don’t have time to analyze companies." He even bet $1 million in 2008 that a low-cost S&P 500 fund would beat any hedge fund over ten years. He won - by a wide margin.

Here’s the catch: He says this for people who don’t want to spend hours reading financial statements. If you’re willing to learn, he wants you to dig deeper. If you’re not, the index fund is your best shot at matching the market’s long-term returns - without the stress.

So if you’re asking, "Should I buy an index fund?" - yes, if you’re not going to study companies. But if you’re curious, he’d say: start with one business. Learn how it makes money. Read its annual report. Then try another. Slowly, you’ll build the skill to pick winners.

How to Start Like Buffett

You don’t need millions to think like Warren Buffett. You need curiosity and patience.

- Start with what you know. What companies do you use every day? Do you buy their products? Do you trust them? That’s your starting point.

- Read the annual report. Look for the "Letter to Shareholders" at the front. Buffett writes his own. He explains problems honestly. If a CEO hides mistakes, walk away.

- Check the balance sheet. Look for low debt and high cash. Companies that borrow too much can collapse when rates rise.

- Look for consistent profits. Has the company made money every year for the last 10 years? If not, why?

- Wait for the right price. Even the best company is a bad buy if you pay too much. Buffett waits for panic. He buys when others are scared.

He doesn’t time the market. He times his patience.

What’s the One Thing He Always Says?

Buffett’s most repeated advice? "It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price."

That’s the core of his entire strategy. A great business - one with strong branding, loyal customers, and steady cash flow - will grow over time. Even if you buy it at a normal price, it will reward you. A cheap company with weak fundamentals? It might stay cheap forever.

He’s not trying to find the next Apple before it explodes. He’s trying to find the next Coca-Cola - a business that quietly compounds value for decades.

Real Example: Apple in Berkshire’s Portfolio

Buffett didn’t buy Apple because it’s a tech company. He bought it because it’s a consumer brand with an ecosystem people don’t leave. Once you own an iPhone, you’re likely to buy AirPods, an Apple Watch, iCloud, and apps. That’s recurring revenue. That’s a moat.

Apple also holds over $100 billion in cash. That’s not debt - it’s a war chest. Buffett loves companies with cash they can use to buy back shares. When Apple buys back its own stock, it raises the value of every share left - just like Buffett does with Berkshire.

Apple is now Berkshire’s largest holding. Not because it’s trendy. Because it fits Buffett’s model: predictable, cash-generating, customer-loyal.

Final Thought: Don’t Copy His Picks - Copy His Thinking

Buffett doesn’t want you to buy Coca-Cola just because he owns it. He wants you to learn how to find your own Coca-Colas.

Look at your own life. What brands do you keep buying? What companies do you trust? That’s your research list. Start there. Read their reports. Ask why they’re still around. If you can answer that, you’re already ahead of 90% of investors.

He’s not a magician. He’s a student of business. And if you take the time to understand how companies work - not just their stock prices - you’ll do better than most people who follow headlines.

What stocks does Warren Buffett own right now?

As of 2025, Warren Buffett’s Berkshire Hathaway holds major positions in Apple, Bank of America, American Express, Coca-Cola, and Chevron. These aren’t random picks - they’re businesses with strong brands, steady cash flow, and low debt. Apple is the largest holding, making up over 50% of the portfolio’s value. But Buffett didn’t buy Apple because it’s tech - he bought it because it acts like a consumer brand with loyal customers.

Does Warren Buffett invest in cryptocurrency?

No. Buffett has called Bitcoin "rat poison squared" and says it has no intrinsic value. He doesn’t invest in anything that doesn’t generate earnings, dividends, or cash flow. Cryptocurrencies don’t produce anything - they rely on someone else paying more for them later. That’s speculation, not investing.

Should I buy index funds instead of individual stocks?

Buffett says yes - if you don’t have the time or interest to study companies. He’s bet millions that a low-cost S&P 500 index fund will outperform most hedge funds over 10 years. But if you’re willing to learn how businesses work, he encourages you to pick individual stocks. Start small. Read annual reports. Focus on companies you understand.

What does Warren Buffett think about day trading?

He thinks it’s a losing game. Day trading is betting on short-term price moves, not business value. Buffett says most people who try it lose money - especially after fees and taxes. He owns businesses for decades, not minutes. His success comes from patience, not speed.

Is Warren Buffett’s strategy still relevant today?

Absolutely. Even with AI, crypto, and high interest rates, his core principles haven’t changed: buy businesses you understand, look for durable advantages, avoid debt, and never pay too much. Apple, Coca-Cola, and Bank of America still fit his criteria. The world changes, but human behavior - trust, loyalty, habit - doesn’t. That’s what he bets on.