Student Loan Forgiveness Calculator

Calculate Your Forgiveness Timeline

If you’ve ever looked at your student loan balance and wondered when, or if, it will ever go away, you’re not alone. Many borrowers-especially those with high balances or lower incomes-have heard whispers about a 20-year rule for student loans. But what does it really mean? Is it a magic reset button? Or just a myth floating around online forums?

The short answer: yes, there is a 20-year rule-but it’s not universal, and it doesn’t apply to everyone. It’s part of income-driven repayment plans in the United States, and it’s one of the most misunderstood pieces of student loan policy out there.

How the 20-Year Rule Actually Works

The 20-year rule refers to the length of time you must make payments under certain income-driven repayment (IDR) plans before your remaining student loan balance is forgiven. It’s not automatic. You have to enroll in the right plan, make consistent payments, and meet specific eligibility requirements.

Here’s how it breaks down:

- If you’re on the Income-Based Repayment (IBR) plan and borrowed before July 1, 2014, forgiveness happens after 25 years.

- If you borrowed on or after July 1, 2014, and are on IBR, forgiveness kicks in after 20 years.

- For the Pay As You Earn (PAYE) and Revised Pay As You Earn (REPAYE) plans, forgiveness occurs after 20 years for undergraduate loans.

- For graduate loans under PAYE or REPAYE, forgiveness takes 25 years.

So when people say “20-year rule,” they’re usually talking about the newer versions of these plans-especially REPAYE, which is the most common today. But you have to be on one of these plans for the full 20 or 25 years. Missing payments, defaulting, or switching plans can reset the clock.

Who Qualifies for the 20-Year Rule?

Not everyone with student loans can use this. You must have federal student loans. Private loans? Forget it. They don’t offer forgiveness at all.

You also need to have your loans in a qualifying repayment plan. That means:

- Direct Loans (subsidized or unsubsidized)

- Direct Consolidation Loans

- Some Federal Family Education Loans (FFEL) if they’re consolidated into a Direct Loan

And here’s the catch: your income must be low enough to qualify for an income-driven plan. If your income rises above a certain threshold, your monthly payment may increase-and you might end up paying more than you originally borrowed.

Let’s say you borrowed $40,000 for undergrad. You’re on REPAYE. Your income is $35,000 a year. Your monthly payment might be $150. After 20 years, the government wipes out whatever’s left-even if it’s $25,000. Sounds great, right?

But here’s what no one tells you: that $25,000 forgiven amount? It’s taxable income. The IRS treats it like a bonus. You could owe $6,000 or more in taxes the year your loan is forgiven. That’s a big surprise for people who thought forgiveness meant “free money.”

What Happens After 20 Years?

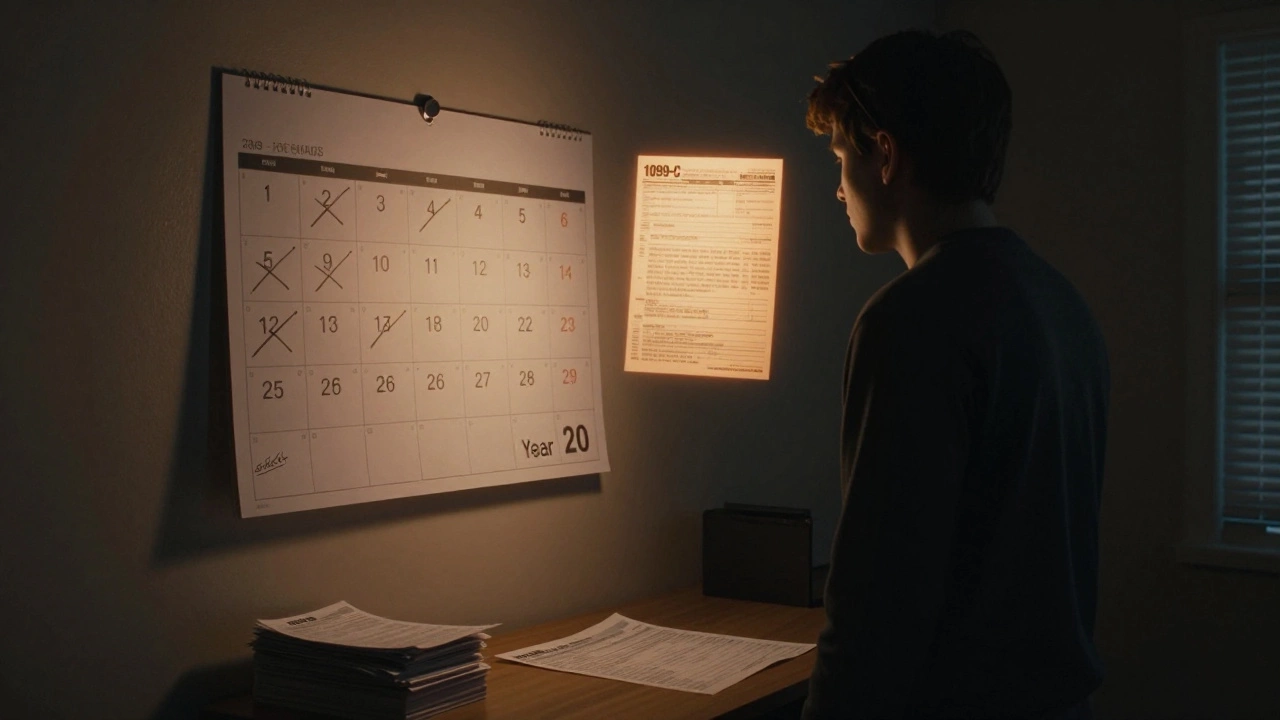

After 20 or 25 years of on-time payments, your loan balance is forgiven-but only if you’ve stayed in the plan the whole time. The Department of Education doesn’t automatically forgive your debt. You have to apply for forgiveness.

You’ll get a notice from your loan servicer around the 19-year mark. That’s your cue to start preparing. You’ll need to:

- Confirm your income for the last year (they’ll ask for tax returns or pay stubs)

- Submit a forgiveness application

- Wait for approval

- Get a 1099-C form for taxes

Many people miss this step. They assume forgiveness is automatic. It’s not. If you don’t apply, your loan doesn’t disappear. You’ll still owe it.

Is the 20-Year Rule a Good Deal?

For some borrowers, yes. For others, it’s a trap.

If you’re in a low-paying field-like teaching, social work, or nonprofit work-and your income stays low, the 20-year rule can be a lifeline. You’ll pay less each month than you would on a standard 10-year plan, and your debt will vanish before you hit retirement.

But if you’re in a high-income profession-say, law, medicine, or tech-the math doesn’t work. Your monthly payments under REPAYE might be close to what you’d pay on a standard plan. And after 20 years, you’ll owe taxes on tens of thousands in forgiven debt. You might have paid more in total than if you’d just paid it off in 10 years.

There’s also the psychological toll. Carrying student debt for two decades can feel crushing. You can’t buy a house. You can’t save for retirement. You’re stuck in a system that rewards patience but punishes ambition.

What About Public Service Loan Forgiveness?

There’s another path: Public Service Loan Forgiveness (PSLF). It’s not the 20-year rule-but it’s often confused with it.

PSLF forgives your loan balance after 10 years (120 qualifying payments) if you work full-time for a government agency or nonprofit. No taxes on the forgiven amount. And it applies to all federal loans, even older ones.

But PSLF has its own problems. You have to be on the right repayment plan. You have to submit paperwork every year. And the approval rate? Only about 35% of applicants get approved. Many get rejected because their employer didn’t qualify, or they missed a payment.

So if you’re eligible for PSLF, it’s usually better than waiting 20 years. But if you’re not working in public service? Then the 20-year rule is your best shot.

What’s Changing in 2026?

As of early 2026, the Biden administration has extended the pause on student loan repayments multiple times. But as of January 2026, payments have resumed. However, there’s a new twist: the Department of Education is reviewing all borrowers who were previously denied forgiveness under PSLF or IDR plans.

They’re applying a one-time adjustment to count past payments that didn’t used to count-like forbearance, deferment, or payments made under the wrong plan. If you’ve been making payments since 2008, you might now be closer to forgiveness than you think.

That’s why it’s critical to check your loan servicer’s website. Log in. Look at your payment count. If you’ve made 150 payments and thought you were halfway to 20 years, you might actually be at 18 years now.

What Should You Do Now?

Don’t wait. Even if you’re not close to 20 years yet, take action today:

- Confirm which repayment plan you’re on. If it’s Standard, switch to REPAYE or PAYE.

- Update your income every year. Even if it goes up, you need to report it. Otherwise, you risk losing credit for payments.

- Keep records of every payment. Save pay stubs, bank statements, and letters from your servicer.

- Check if you qualify for PSLF. Even if you’re not sure, apply. The review window is open.

- Start saving for taxes. If forgiveness is coming, set aside 15-20% of your expected forgiven amount each year.

The 20-year rule isn’t a gift. It’s a trade-off: lower monthly payments today, for a tax bill tomorrow. But if you understand it, you can use it to your advantage. It’s not about waiting for magic. It’s about planning smart.

Does the 20-year rule apply to private student loans?

No. The 20-year rule only applies to federal student loans in income-driven repayment plans. Private lenders like Sallie Mae, Discover, or SoFi do not offer loan forgiveness after any number of years. If you have private loans, your only options are refinancing, making extra payments, or negotiating hardship deferments.

Will my loan be forgiven if I die?

Yes. If you have federal student loans and you pass away, your loans will be discharged. Your family won’t be responsible for repaying them. The same applies if a parent who took out a PLUS loan dies. You’ll need to submit a death certificate to your loan servicer to start the discharge process.

Can I switch repayment plans after I’ve started?

Yes. You can switch between income-driven plans at any time. But be careful: if you switch from REPAYE to IBR, your payment count might reset depending on the rules. Always ask your loan servicer how switching will affect your forgiveness timeline. Don’t assume it’s automatic.

What happens if I miss a payment?

Missing one payment doesn’t immediately disqualify you. But if you go 30 days late, it counts as a delinquency. If you go 270 days without paying, your loan goes into default-and you lose eligibility for income-driven plans and forgiveness. You’ll need to rehabilitate the loan first, which takes nine on-time payments. Start paying immediately if you fall behind.

Is the 20-year rule going away?

There’s no current legislation to eliminate the 20-year forgiveness window. However, future administrations could change the rules. If you’re counting on this, don’t wait. Start making payments now, document everything, and plan for the tax bill. Policy changes are unpredictable-but your paperwork isn’t.