Budget Breakdown Calculator

Key Guidelines from the Article

- • 10% minimum for savings/emergency fund (article recommendation)

- • Prioritize high-interest debt repayment (avalanche method)

- • Use 50/30/20 rule as reference (50% needs, 30% wants, 20% savings/debt)

When you hear the word Budget is a plan that outlines expected income and planned spending over a set period, usually a month, you might think it’s just a spreadsheet. In reality it’s a roadmap that keeps your money working for you instead of slipping away unnoticed.

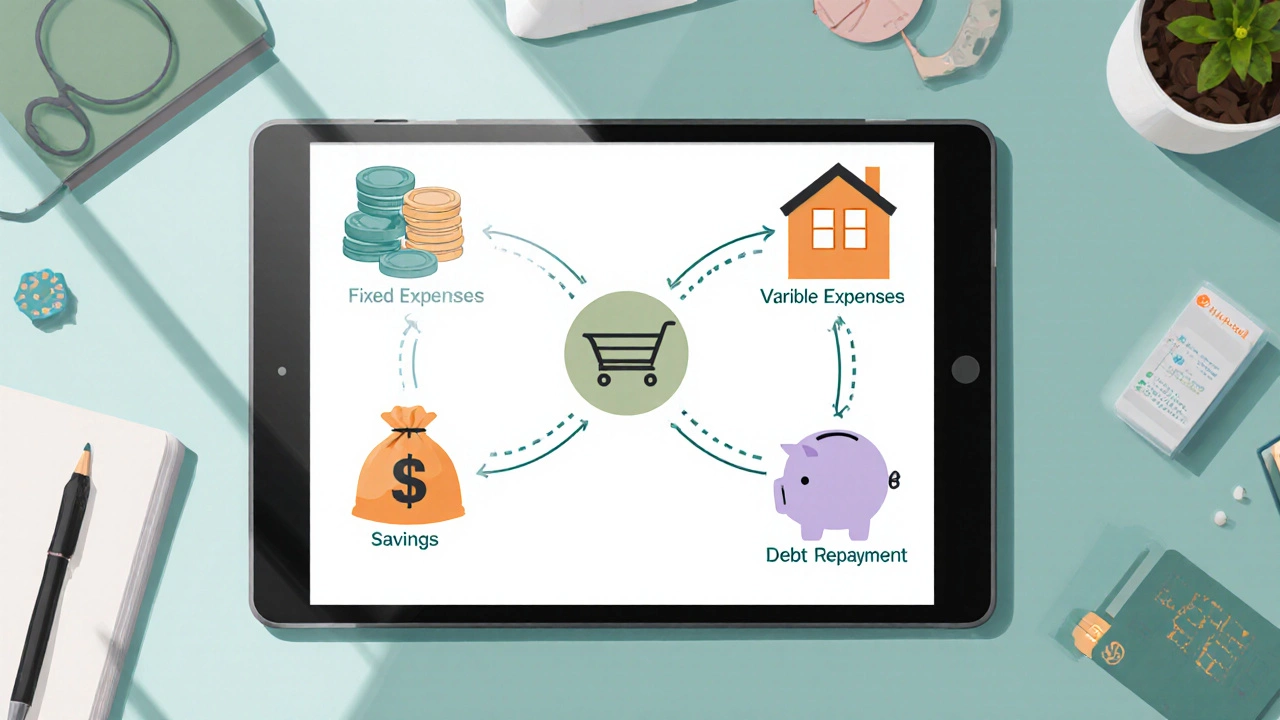

Why the 5‑element framework matters

Most people start budgeting with vague goals like "spend less" or "save more". Those ideas feel right but they lack the concrete pieces you need to track progress daily. Breaking a budget down into five clear elements gives you a checklist you can tick off each payday. It also lets you spot leaks before they become problems.

1. Income - the money you bring in

First up is Income all cash, wages, side‑gig earnings, and any regular cash inflow you expect during the budgeting period. Knowing exactly how much lands in your bank account sets the ceiling for everything else. Include salary after tax, freelance invoices, government benefits, and even occasional rental income. If you have a variable commission, use the average of the last six months to avoid over‑estimating.

2. Fixed Expenses - the bills that don’t move

Next are Fixed Expenses regular costs that stay the same each month, like rent, mortgage, utilities, insurance, and subscription services. These are the non‑negotiable line items that take up a big chunk of your paycheck. Write them down before you look at anything else; they define the baseline you must cover before you can think about discretionary spending.

3. Variable Expenses - the costs you can shape

Then come Variable Expenses spending that fluctuates month to month, such as groceries, dining out, transport, and entertainment. Because they’re flexible, they’re the first place to cut back when you need extra cash. Track them for a couple of months, group similar items together, and set realistic caps based on past patterns.

4. Savings & Emergency Fund - the safety net

Every solid budget reserves money for Savings planned accumulation of funds for future goals or emergencies. A common rule is to aim for three to six months of living expenses in an easily accessible account. Think of it as a buffer that prevents you from falling into debt when a surprise bill pops up.

5. Debt Repayment & Financial Goals - the forward‑looking pieces

Finally, allocate cash to Debt Repayment paydowns on credit cards, student loans, personal loans, or any other liability and to specific Financial Goals targets such as a home down‑payment, travel fund, or retirement savings. Treat these like any other bill: give them a due date and a fixed amount each month. Paying down high‑interest debt first frees up more money for future goals.

How the five pieces fit together

Picture your budget as a pie. Budget elements are the slices that add up to 100 %. Income forms the whole pie. Fixed and variable expenses carve out the largest sections. Savings and debt repayment fill the remaining wedges. When the pieces line up, the pie balances; when one slice grows too big, the others shrink.

Quick Takeaways

- Identify every source of income before you list any spending.

- Separate fixed costs (rent, utilities) from variable costs (groceries, fun).

- Reserve at least 10 % of your net income for savings or an emergency fund.

- Give debt repayment a dedicated slot each month to avoid interest buildup.

- Link every dollar to a specific financial goal for motivation.

Comparing popular budgeting methods

| Method | Main Focus | Pros | Cons |

|---|---|---|---|

| Zero‑Based Budgeting | Assign every dollar a job until income minus expenses equals zero | Maximum control, forces discipline | Time‑intensive, needs regular updates |

| 50/30/20 Rule | Allocate 50 % to needs, 30 % to wants, 20 % to savings/debt | Simple, good for beginners | Less precise for irregular incomes |

| Envelope System | Use physical or digital envelopes for each expense category | Visual spending limits, reduces overspending | Can be cumbersome with many categories |

Step‑by‑step guide to set up your 5‑element budget

- Gather all income statements for the upcoming month.

- List every fixed expense with exact amounts and due dates.

- Track variable spending for two weeks; group items into categories.

- Decide on a realistic savings target - at least 5 % of net income to start.

- Identify any debts; calculate minimum payments and extra amounts you can afford.

- Write down specific financial goals and the monthly contribution needed for each.

- Plug the numbers into a spreadsheet, budgeting app, or paper sheet using the five headings.

- Review the total: income should cover fixed + variable + savings + debt. If you’re over, trim variable costs or boost income.

- Adjust the next month’s plan based on what you actually spent.

Common pitfalls and how to avoid them

Under‑estimating variable costs is the number one mistake. To keep it real, use receipts and bank statements from the past three months rather than a guess.

Another trap is forgetting the emergency fund. Treat it like a non‑negotiable bill; automate a small transfer to a high‑interest savings account each payday.

Many people also ignore debt interest. List debts by interest rate and attack the highest one first (the avalanche method). That frees up money faster than a random “pay whatever you can” approach.

Tools that make the five‑element budget easy

While a paper notebook works, several free apps sync with your bank and categorize expenses automatically. Examples include:

- Mint - visual breakdown of income, expenses, and savings.

- YNAB (You Need A Budget) - built around the zero‑based principle.

- Google Sheets - customizable templates for the five‑element structure.

Pick the tool that matches your comfort level; the core idea stays the same.

Tracking progress and staying motivated

Set a weekly check‑in. Open your budget, compare actual spend against each of the five elements, and note any drift. Celebrate small wins - like hitting a new savings milestone - to keep the habit alive.

How often should I update my budget?

A quick review each week is enough to catch overspending early. Do a deeper monthly audit when you receive your next paycheck.

What if my income varies month to month?

Base your budget on the average of the last six months, then adjust the variable expense slice up or down depending on the actual income you get that month.

Can I combine different budgeting methods?

Absolutely. Some people use the 50/30/20 split for the big picture, then apply the envelope system to the “wants” portion for tighter control.

How much should I save for an emergency fund?

Aim for three to six months of essential expenses. If you have an unstable job, lean toward the higher end.

What’s the best way to pay off credit‑card debt?

Use the avalanche method: focus extra payments on the card with the highest interest rate while making minimum payments on the others.

With the five core elements in place, budgeting shifts from a chore to a clear, repeatable system. It gives you the confidence to make big life choices - whether that’s buying a house, traveling the world, or simply sleeping better at night because you know the money is under control.