Pick the wrong place for equity release and you can pay tens of thousands more in compounding interest. Pick the right place and you’ll get flexible features, a safer contract, and a better rate for your age and health. Here’s the short answer: most homeowners get the best results by using a whole‑of‑market, FCA‑authorised specialist broker who’s also an Equity Release Council member. Going direct can work if you already know the exact product you want, but you’ll miss the wider market.

TL;DR / Key takeaways

- Best place for most people: a whole‑of‑market specialist broker (FCA‑authorised, Equity Release Council member) who compares multiple lenders and discloses fees clearly.

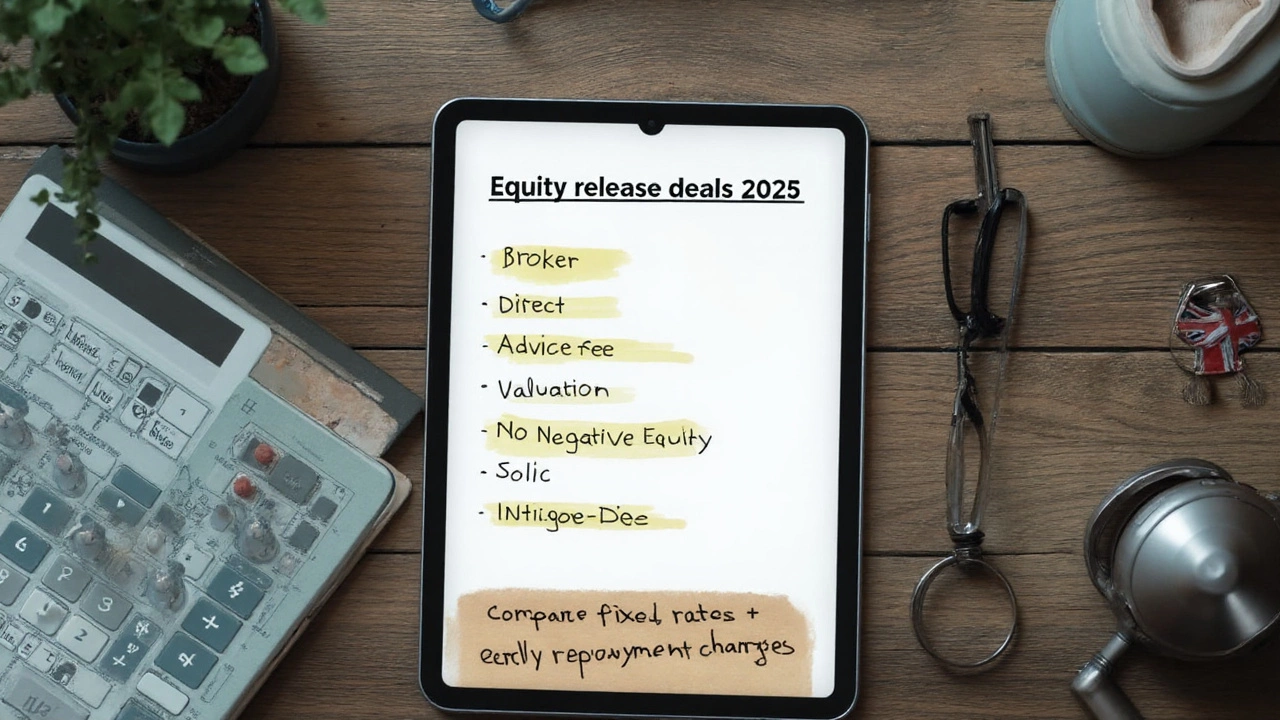

- What to compare: interest rate + early repayment charges + drawdown flexibility + downsizing protection + inheritance protections + lender panel size.

- Expect total set‑up costs in the hundreds to low thousands; insist on a written cost breakdown before any valuation.

- 2025 market: rates are lower than 2023 peaks, but still meaningful; health‑enhanced plans can increase the amount you can release or reduce the rate.

- Alternatives may beat equity release if you can afford repayments: Retirement Interest‑Only mortgages, downsizing, or using pension drawdown.

How to choose the best place for equity release (what to check first)

Start with two sanity checks. First: is equity release actually right for your situation? It’s designed for homeowners 55+ who want to unlock money from their home without making mandatory monthly repayments. If you can afford repayments comfortably, a Retirement Interest‑Only (RIO) mortgage or standard remortgage may cost less over time. Second: do you need a lump sum, or flexible access over time? That one question often decides which provider and product channel makes sense.

Now, about “where.” In 2025, you have five real channels: specialist brokers, direct‑to‑lender, your existing bank/building society, online comparison/lead sites, and non‑specialist advisers who occasionally place an equity release case. Each route has trade‑offs. The broker route tends to win because lifetime mortgage pricing and features vary a lot between lenders and change frequently. A broker who covers the whole market can line up the best mix for your age, property type, loan size, and plans (moving later, gifting now, clearing a mortgage, etc.).

Here’s a simple rule of thumb: unless you already have a specific product and lender in mind and you’re certain it has the right features, get three whole‑of‑market broker illustrations before you commit. You’re testing the rate, the early repayment charges, and the flexibility.

What makes a broker "the best place"?

- Authorisation & safeguards: They’re authorised by the Financial Conduct Authority (FCA). They’re a member firm of the Equity Release Council (ERC). ERC standards include a no‑negative‑equity guarantee and the right to remain in your home for life or until you move into long‑term care.

- Whole‑of‑market access: They can access a wide panel across household names and specialist providers-think Aviva, Legal & General, Canada Life, Just, more2life, Standard Life Home Finance, Pure Retirement, LV=, and others. Ask which lenders they do NOT use and why.

- Transparent fees: Advice fees range from £0 to around £1,995. Some charge a flat fee; others rely on commission from the lender. Get it in writing, up front.

- Evidence‑backed recommendations: They’ll show Key Facts Illustrations (KFIs) from multiple lenders, not just one. They explain early repayment charges clearly and highlight features that matter for you (downsizing protection, inheritance guarantees, partial repayments, drawdown facility).

- Service and process: Free initial call, soft fact‑find, and a willingness to say “don’t do this yet” if it’s not in your best interest. Timescale guidance (typical completion 6-12 weeks), and help co‑ordinating the independent solicitor step.

What about going direct to a lender? It can be fine if you already know the product you want and the lender you trust, or if your case is very straightforward and you’ve compared like‑for‑like features. The risk is tunnel vision: you won’t see if another lender would offer a lower rate, more generous drawdown, gentler early repayment charges, or better protection if you move later.

Key decision criteria to weigh before you pick a place:

- Interest rate structure: Is it fixed for life? Most lifetime mortgages are. Rates vary by age, loan‑to‑value (LTV), property, and health. A lower rate compounds more gently; a 0.5% difference is meaningful over 10-20 years.

- Early repayment charges (ERCs): Some plans have fixed ERCs that end after a set period (e.g., 8-10 years). Others use a gilt‑linked scale that can be unpredictable. If you might repay early, look for fixed ERCs or a clear cap.

- Partial repayments: Many ERC‑member plans let you repay up to 10% per year without penalty. This is a big lever to control compounding if your income allows.

- Drawdown flexibility: If you don’t need all the money now, a drawdown plan lets you take smaller chunks later at the then‑prevailing rate, and you only accrue interest on what you’ve drawn.

- Downsizing and porting: If you might move, downsizing protection can let you repay without penalty when moving to a lower‑value home. Porting lets you take the plan with you if the new property fits criteria.

- Inheritance protections: You can ring‑fence a percentage of the home’s value to leave to heirs, but it reduces the amount you can release.

- Eligibility & property quirks: Lease length, construction type, flats over commercial units, and listed buildings can limit lender choice. A broker who’s seen your property type before is gold.

Costs to expect (ask for a written breakdown before valuation):

- Advice fee: £0-£1,995 (varies by firm).

- Lender fees: £0-£995 arrangement; many lenders offer free valuations in 2025, but not always.

- Legal: typically £700-£1,200 for your independent solicitor, plus disbursements.

- Telegraphic transfer/admin: £20-£50.

Worked example to show why the "place" matters: Say you release £100,000 at 6.5% fixed. If you make no repayments, the balance roughly doubles in around 11 years and could exceed £200,000 by year 12. If a broker finds you 5.9% with 10% voluntary repayments allowed, paying £200 per month trims thousands off long‑term interest and keeps more equity intact. The difference between two brokered products-or broker vs direct-adds up over time.

Market context for 2025: Lifetime mortgage rates fell from 2023 highs but still sit above pre‑2022 levels. Lenders have brought back features like flexible repayments and enhanced terms for certain health conditions. Providers continue to meet FCA rules, and ERC standards remain the industry baseline for consumer protections.

Who to use: brokers vs lenders vs banks (and how to compare them)

Here’s a plain‑English comparison to help you decide where to start your application.

| Channel | Pros | Cons | Best for | Not for |

|---|---|---|---|---|

| Whole‑of‑market specialist broker (FCA + ERC member) | Compares many lenders; gets features right; explains ERCs; often free initial advice; can place tricky properties/health. | May charge a fee; quality varies-need to check panel size and transparency. | Most homeowners who want the best value/fit and clear guidance. | People who have a fixed preferred lender and won’t consider alternatives. |

| Direct to provider (e.g., big household names) | Simple process; fewer parties; sometimes special offer rates. | No market comparison; features may be less flexible than the best alternatives. | If you’ve already compared and know this exact product fits. | Anyone unsure about ERCs, moving plans, or drawdown needs. |

| Your existing bank/building society | Familiar brand; helpful if they already hold your mortgage; easy ID checks. | Often limited to their own product line; may not offer the most flexible terms. | Loyal customers who value simplicity and don’t mind paying a bit more for it. | Rate‑sensitive borrowers or those needing niche features. |

| Online comparison/lead sites | Quick illustrations; broad overview of rates/features. | Not advice; often a lead generator; quality depends on who they pass you to. | Getting a feel for ballpark numbers before proper advice. | Final decisions-always follow up with regulated advice. |

| Non‑specialist financial adviser | Knows your wider finances; good for holistic planning. | May not hold the specialist equity release qualification or market coverage. | If they collaborate with a specialist broker and keep your plan aligned. | Complex cases if they don’t work with a specialist. |

What the best brokers do differently:

- They show at least three KFIs from different lenders, with a simple comparison of rate, ERCs, drawdown options, and protections.

- They ask about future moves, gifting plans, and benefits-because these change the right product choice.

- They talk you through fixed vs gilt‑linked ERCs and recommend based on your horizon, not their commission.

- They explain health‑enhanced plans (if you have certain conditions or lifestyle factors) that can improve your terms.

- They coordinate the solicitor step and warn you early if your property type could be a problem.

Brands you’ll often see in UK lifetime mortgage quotes: Aviva, Legal & General, Canada Life, Just, more2life, Standard Life Home Finance, Pure Retirement, and LV=. Many providers follow Equity Release Council standards and are FCA‑regulated. Ask your adviser which panel they use and why your shortlist came from those lenders. If you only see one name and one KFI, push for alternatives or find a different adviser.

Fees and fair pricing checks:

- Ask for a one‑page fee summary covering advice fee, lender arrangement fee, legal costs, valuation, and any admin charges.

- Clarify when the advice fee becomes payable (on completion is typical; advice should be without obligation).

- Get confirmation that your advice is independent and based on a whole‑of‑market search, not a restricted panel-unless there’s a good reason.

Quick LTV guide by age (ballpark, varies by lender and rates):

- Age 55-60: roughly 15-30% of property value.

- Age 65-70: roughly 25-40%.

- Age 75-80+: roughly 35-55%.

If you’re offered less than you expected, it’s often due to age, property type, or current rate environment-not a "bad" adviser. A broader market search or health‑enhanced plan can change the number.

Scenarios, trade‑offs, safer paths, FAQs, and your next steps

Everyone asks, “What’s the catch?” Here are the real trade‑offs and how to manage them.

Common scenarios and the smartest route

- Clearing an interest‑only mortgage that’s maturing: Lifetime mortgage can be a fix if repayments are unaffordable. Ask for partial repayment features so you can chip away at interest when you can.

- Home improvements or accessibility changes: Consider a drawdown plan; take what you need in stages and avoid paying interest on money sitting in your account.

- Gifting to children (e.g., deposit help): Check means‑tested benefits impact and potential inheritance tax planning. Ask your adviser to coordinate with a solicitor or planner.

- Boosting retirement income: Drawdown plus optional repayments can balance flexibility and control of compounding.

- Divorce/life change: Ensure legal advice covers occupation rights, title changes, and future portability if one person moves.

Pitfalls to avoid

- Signing up to a plan with harsh or unpredictable ERCs when you’re likely to move or repay within 10 years.

- Taking a lump sum you don’t need now; drawdown is usually more cost‑effective.

- Choosing a provider that won’t lend on your property type; get this checked before paying valuation fees.

- Ignoring benefits: equity release can affect entitlement to means‑tested benefits. Get this checked in writing.

Safeguards and who enforces them

In the UK, lifetime mortgages and home reversion plans are regulated by the FCA. The Equity Release Council sets extra standards most reputable providers follow, including the no‑negative‑equity guarantee and the right to live in your home for life or until long‑term care. You must also get independent legal advice before you complete, which is there to protect you. For impartial guidance, MoneyHelper publishes consumer information on equity release and alternatives.

Alternatives worth a look before you commit

- Retirement Interest‑Only (RIO) mortgage: You pay the interest monthly, which prevents compounding. Best if you can commit to payments for the long term.

- Standard remortgage or part‑and‑part: If income is strong enough, this can be cheaper than a lifetime mortgage.

- Downsizing: Less interest cost, but moving costs and emotional trade‑offs. Still worth pricing up.

- Local authority grants/benefits: For accessibility or energy‑efficiency improvements, check if you can get help first.

- Pension drawdown/cash: Consider tax and sustainability of withdrawals with a regulated planner.

- Home reversion: You sell a share of your home at a discount for a tax‑free lump sum and live there rent‑free. Less common, but good in specific cases; advice is essential.

FAQ (quick, practical answers)

- What’s the minimum age? Usually 55 for lifetime mortgages; higher for some plans.

- Do I need a good credit score? It helps, but it’s not like a standard mortgage. Major issues (e.g., recent bankruptcy) need specialist placement.

- How long does it take? Roughly 6-12 weeks from advice to funds, depending on valuation, legal work, and property type.

- Can I make repayments? Many ERC‑standard plans allow up to 10% per year penalty‑free. Some allow monthly interest payments, fully optional.

- What about moving? Look for porting and downsizing protection. Tell your adviser if a move is likely within 5-10 years.

- Is the money tax‑free? Yes, the release itself is tax‑free in the UK. Tax can apply if you invest or gift it-get advice.

- Will it affect benefits? It can reduce or remove means‑tested benefits. Ask for a benefits impact check before proceeding.

- Can I switch later? Many lenders allow product switches; refinancing is possible, but fees and ERCs can apply. A broker can model break‑even points.

Next steps (a simple action plan)

- Clarify your goal and horizon: Lump sum or drawdown? Likely move in under 10 years? Any plan to repay early?

- Gather basics: Property value estimate, mortgage balance (if any), lease length, any unusual construction details, your ages, and health notes.

- Shortlist three specialist brokers: Check FCA authorisation and Equity Release Council membership. Ask about their lender panel size and typical fees.

- Ask nine pointed questions: 1) How many lenders will you quote? 2) What’s your advice fee, and when is it due? 3) Fixed vs gilt‑linked ERC options? 4) Drawdown availability? 5) Annual penalty‑free repayment allowance? 6) Downsizing protection? 7) Porting criteria? 8) Any health‑enhanced terms? 9) Total costs in writing?

- Compare at least three KFIs side by side: Don’t just look at the rate-scan ERCs, features, and flexibility.

- Speak with your independent solicitor early: They’ll spot title or lease issues before you spend on valuation.

- Sleep on it: A 24-48 hour pause stops costly impulse decisions. If anyone rushes you, walk away.

Troubleshooting common roadblocks

- Valuation comes in low: Ask your broker to challenge with comparables or get quotes from lenders who are more generous on your property type.

- Property is unusual (thatched, listed, park home, flat over shop): You need a broker with niche lender relationships; do not pay valuation until they check criteria.

- You need funds fast: Tell your adviser up front. Some lenders complete faster; a smaller initial advance can be quicker, with drawdown later.

- Health issues: A full health questionnaire can improve terms. Be open; this is where a specialist broker earns their keep.

- Worried about leaving an inheritance: Ask for inheritance protection and model voluntary repayments. A lower initial lump sum plus drawdown can preserve more equity.

Credibility check: Lifetime mortgages and home reversion plans are regulated by the Financial Conduct Authority. The Equity Release Council sets additional consumer protections used widely across the industry. MoneyHelper provides impartial guidance for consumers. If an adviser or provider can’t speak to these standards, find one who can.

Bottom line: the “best place” isn’t a single brand or website-it’s the route that gives you a full market view, clear safeguards, and a product tailored to your life, not just your house. In 2025, that usually means a whole‑of‑market specialist broker working to FCA rules and Equity Release Council standards, with an independent solicitor by your side.