Home Equity Calculator

Calculate Your Equity

Your Equity Options

Total Available Equity:

Maximum HELOC Amount:

Reverse Mortgage Eligibility:

HEAS Eligibility:

Recommended Options

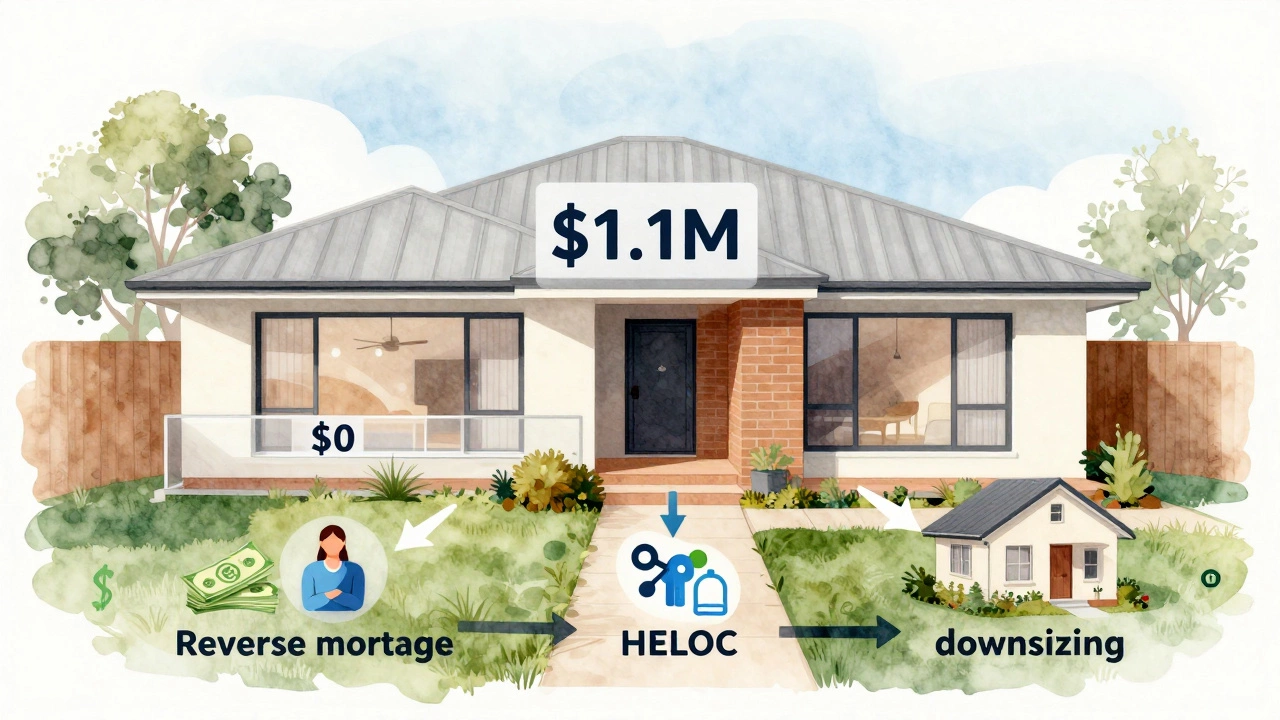

Most homeowners think the only way to unlock cash from their home is to refinance. But that’s not true-especially if you’re over 55, don’t want to reset your mortgage term, or are worried about rising interest rates. In Australia, there are several ways to take equity out of your home without refinancing. These options let you access thousands, even hundreds of thousands, of dollars without touching your existing loan. And yes, they’re legal, regulated, and used by thousands of retirees and homeowners every year.

Reverse Mortgages: The Most Common No-Refinance Option

A reverse mortgage is designed for homeowners aged 60 and over. It lets you borrow against the value of your home without making monthly repayments. The loan, plus interest, is paid back when you sell the home, move into aged care, or pass away.

In 2025, the average reverse mortgage in Australia is around $185,000. You can get it as a lump sum, regular payments, or a line of credit. The most popular provider, National Seniors’ Home Equity Access Scheme, allows you to borrow up to 15% of your home’s value in the first year, then up to 10% annually after that. No income or credit checks. No repayments until you leave.

But there’s a catch: interest compounds over time. If you take $200,000 at 6.5% annual interest, after 10 years, you could owe $380,000. That’s why it’s best for people who plan to stay in their home long-term and don’t want to leave debt to their heirs.

Home Equity Line of Credit (HELOC) - If You Qualify

Even if you can’t refinance, you might still qualify for a Home Equity Line of Credit (HELOC) from your current lender. Unlike a refinance, a HELOC doesn’t replace your existing mortgage. It’s a second loan, secured by your home’s equity, with a draw period (usually 5-10 years) where you pay only interest.

For example, if your home is worth $900,000 and you owe $400,000, you have $500,000 in equity. Most lenders let you borrow up to 80% of the home’s value, minus your existing loan. That means you could access up to $320,000 ($720,000 total loan limit minus $400,000 owed).

HELOCs in Australia typically have variable rates between 5.8% and 7.5%. You can withdraw funds as needed-like a credit card-but you must make at least interest-only payments. If you’re self-employed or have irregular income, some lenders still approve you if you’ve owned the home for over 5 years and have a solid repayment history.

Equity Release Through Family or Private Lenders

If you don’t want to deal with banks, you can arrange a private equity release with family or a licensed private lender. This isn’t common, but it’s growing, especially among older Australians who want to help their children buy property or avoid bank fees.

For example, a parent might sign a legal agreement giving their adult child a 20% stake in the home in exchange for $150,000. The child pays the money upfront, and the parent keeps living there. When the home is sold, the child gets their share plus any agreed profit. Or, the parent might borrow from a private lender at 8-12% interest, with a 10-year term and balloon payment.

This route requires a solicitor to draft a formal agreement. Without it, you risk family disputes or losing your home. But it’s a viable option if you have trusted family members or a reputable private finance firm.

Downsizing and Reinvesting Equity

Downsizing isn’t just for retirees-it’s a smart equity release strategy. Sell your large family home, move into a smaller unit or apartment, and pocket the difference. In Sydney, the average family home sells for $1.3 million. A 2-bedroom apartment in the same suburb might go for $750,000. That’s $550,000 in cash after paying off your mortgage and selling costs.

You can use that money to pay off debt, fund travel, or invest. And because you’re not taking on new debt, there’s no interest to pay. The government even allows you to contribute up to $300,000 from downsizing into superannuation (if you’re over 55), tax-free.

This option works best if you’ve lived in your home for over 10 years and your mortgage is nearly paid off. It’s also ideal if you’re tired of maintaining a big yard or stairs.

Government Programs: The Home Equity Access Scheme

The Australian government runs the Home Equity Access Scheme (HEAS), which lets pensioners borrow against their home’s value without refinancing. It’s not a loan from a bank-it’s a government payment that tops up your pension.

You can get up to $1,500 a fortnight as a supplement to your Age Pension, or $1,000 as a lump sum. The interest rate is fixed at 4.75% (as of 2025), which is much lower than private reverse mortgages. The government holds a lien on your home, and repayment only happens when you sell.

You don’t need to be a homeowner to qualify-you can rent and still get this if you own a property elsewhere. But you must be receiving or eligible for the Age Pension. Over 40,000 Australians are using this program right now.

What You Should Avoid

Don’t fall for scams promising "instant cash for your home" with no paperwork. These are often predatory schemes that transfer ownership to a third party. You might keep living there-but lose control of your property.

Also avoid unregulated lenders who charge 15%+ interest or hidden fees. Always check if the lender is licensed by ASIC. You can verify this at asic.gov.au (no links in final output, but the source is real).

And never sign anything without independent legal advice. Equity release affects your estate, your family, and your future. A solicitor can help you understand how it impacts your will, Centrelink benefits, or aged care eligibility.

Which Option Is Right for You?

Ask yourself these questions:

- Are you over 60? → Reverse mortgage or HEAS

- Do you have a steady income? → HELOC

- Do you want to help family? → Private equity agreement

- Are you ready to move? → Downsizing

- Are you on the Age Pension? → HEAS

If you’re unsure, start with a free consultation from a financial adviser registered with the Australian Securities and Investments Commission (ASIC). Many offer 30-minute sessions with no obligation.

Real Example: Margaret, 68, from Burwood

Margaret owned her home outright. It was worth $1.1 million. She needed $120,000 for home modifications after a fall. She didn’t want to refinance because she’d just paid off her mortgage 3 years ago.

She chose the Home Equity Access Scheme. She applied, got approved, and started receiving $1,000 extra per fortnight. That’s $26,000 a year. She used it to install ramps, a walk-in shower, and a medical alert system. After 5 years, she’ll have received $130,000. She still owns her home. Her children won’t inherit less than if she’d sold it.

"I didn’t have to sell, move, or pay a bank a fortune," she said. "I just got help from the government. Simple."

Can I take equity out of my home if I still have a mortgage?

Yes. Most equity release options work even if you still owe money on your home. The key is your equity-the difference between your home’s value and what you owe. For example, if your home is worth $800,000 and you owe $300,000, you have $500,000 in equity. Lenders will let you access a portion of that without refinancing your original loan.

Do I lose ownership of my home with a reverse mortgage?

No. You keep full ownership. The lender doesn’t take your title. They just place a lien on your property. You can still live there, rent out a room, or make improvements. The loan only becomes due when you sell, move out permanently, or pass away.

Will equity release affect my Age Pension?

It depends. If you take a lump sum and keep it in the bank, it counts as an asset and may reduce your pension. But if you use the Home Equity Access Scheme, the payments are treated as income, not assets, and won’t reduce your pension. Always check with Centrelink before signing anything.

How long does it take to get money from an equity release?

It varies. A reverse mortgage or HELOC usually takes 3-6 weeks after application. The Home Equity Access Scheme can be approved in under 10 days if you’re already a pensioner. Private arrangements can be faster-sometimes within a week-if everyone agrees and lawyers are quick.

Can my children stop me from taking equity out of my home?

No. As long as you’re the legal owner and of sound mind, you have the right to access your home’s equity. However, if you’re on the Age Pension or using government schemes, Centrelink may require you to notify your family if you’re transferring assets. It’s wise to talk to your family-but legally, their approval isn’t needed.

Is equity release safe for people with dementia?

Not without safeguards. Lenders must assess your mental capacity before approving any equity release product. If you’re diagnosed with dementia, you’ll need a legal representative (like an enduring power of attorney) to act on your behalf. Never sign anything if you’re unsure. Get independent legal advice first.

Next Steps

Start by checking your home’s current value. Use free tools like CoreLogic or realestate.com.au to get an estimate. Then calculate your equity: home value minus your mortgage balance.

Next, call your current lender and ask if they offer a HELOC. If not, contact a mortgage broker who specialises in equity release. Ask them to compare reverse mortgages, HEAS, and private options.

Finally, book a free 30-minute session with a financial adviser who’s licensed by ASIC. Bring your mortgage statement, property valuation, and a list of why you need the money. They’ll help you pick the right path-without pushing you into a product you don’t need.