Home Equity Loan Affordability Calculator

Calculate Your Home Equity Loan Affordability

Results and Foreclosure Risk Assessment

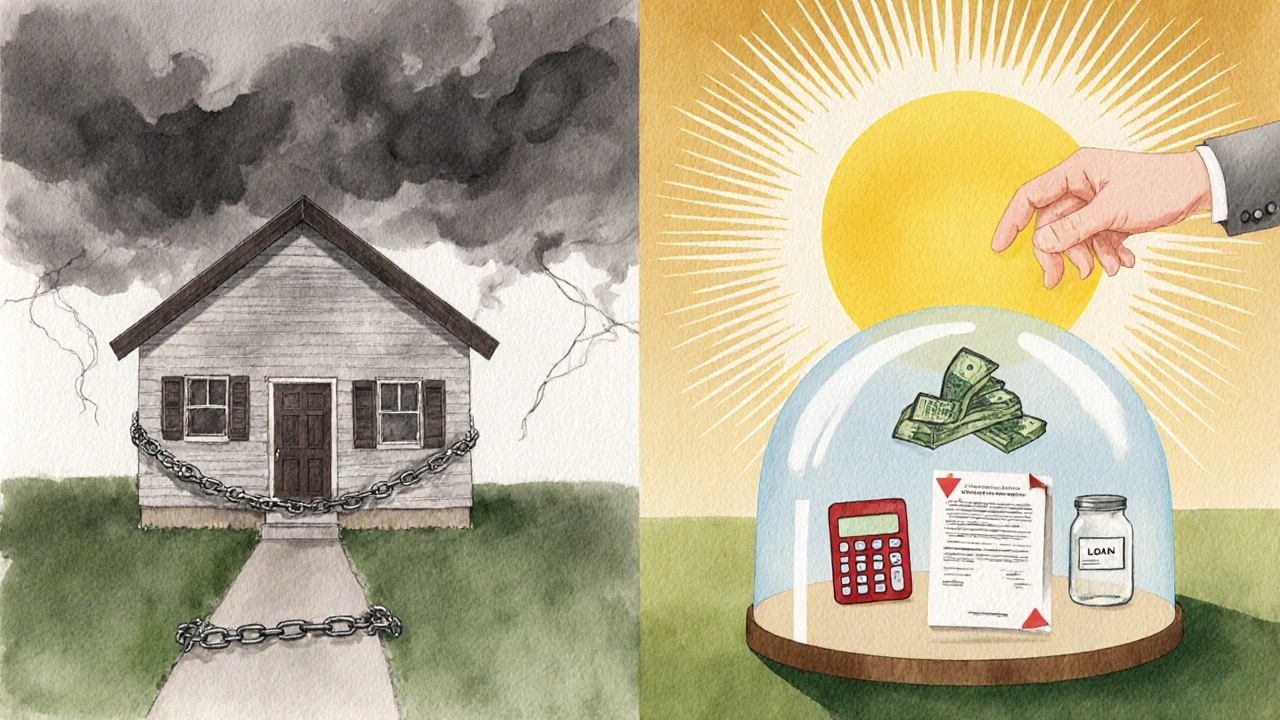

Thinking about tapping the equity in your house? A Home Equity Loan is a popular way to borrow against the value you’ve built up, but there’s one big drawback that can catch borrowers off guard.

Key Takeaways

- The primary disadvantage is the heightened risk of default and possible foreclosure.

- Because the loan is secured by your property, any missed payment directly endangers your home.

- Australia’s strict LTV limits and credit‑score requirements mean not everyone qualifies.

- Alternatives like a HELOC, personal loan, or mortgage refinance can reduce that risk.

- Understanding the full cost - interest, fees, and repayment schedule - is essential before signing.

What Exactly Is a Home Equity Loan?

A Home Equity Loan is a lump‑sum, fixed‑interest loan that uses the equity in your house as collateral. You receive the money all at once, and you repay it over a set term, typically 5‑15 years, with constant monthly payments. In Australia, lenders usually allow you to borrow up to 80% of your property’s appraised value, minus any existing mortgage balance.

The Major Disadvantage: Debt Overload and Foreclosure Risk

While the cash boost can feel tempting, the home equity loan disadvantage lies in the fact that you’re adding a second mortgage onto your property. If you already have a primary mortgage, the new loan creates two separate repayment obligations. Missing payments on either one can trigger a default, and because the loan is secured, the lender can move to foreclose.

Imagine you lose your job and can’t cover the combined monthly outgoings. Your bank may first seize the home equity loan, leaving you with the primary mortgage still due. In worst‑case scenarios, the property is sold to recoup the debt, and you lose the place you called home.

Why the Risk Matters in the Australian Context

Australian lenders calculate the Loan‑to‑Value Ratio (LTV) to determine how much they’ll let you borrow. The typical LTV cap for a home equity loan sits at 80%, meaning you can’t exceed 80% of the property’s market value. If your home is valued at AU$800,000 and you owe AU$400,000 on an existing mortgage, the maximum you could pull from a home equity loan is AU$240,000 (80% of $800,000 = $640,000; $640,000 - $400,000 = $240,000).

But the LTV rule is just a safety net. Lenders also scrutinise your Credit Score. A lower score can bump the interest rate, stretching your repayment schedule and making defaults more likely.

In addition, the Australian Prudential Regulation Authority (APRA) imposes strict capital adequacy standards on banks, which can lead to higher fees or tighter borrowing criteria during economic downturns. That means the loan that seemed affordable when you signed the agreement could become a financial strain later.

How It Differs From a HELOC and a Traditional Mortgage

Many borrowers compare a home equity loan to a Home Equity Line of Credit (HELOC) or a regular Mortgage. The table below highlights the key differences, especially around the major disadvantage.

| Feature | Home Equity Loan | HELOC | Mortgage |

|---|---|---|---|

| Funding method | Lump‑sum | Revolving line of credit | Lump‑sum (primary loan) |

| Interest type | Fixed (usually) | Variable | Fixed or variable |

| Repayment schedule | Fixed monthly payments | Interest‑only or principal+interest | Fixed term payments |

| Primary risk | Added debt on same property → higher default chance | Variable rates can spike payments | Long‑term debt but usually single mortgage |

| LTV limit (AU$) | Up to 80% combined | Up to 80% combined | Typically up to 90% for first‑home buyers |

| Typical use cases | Renovations, debt consolidation, education | Ongoing expenses, flexible cash flow | Home purchase, major refinancing |

Strategies to Mitigate the Disadvantage

- Run the numbers first: Use a loan calculator to see how the extra payment fits into your budget.

- Keep an emergency fund: Ideally three to six months of combined mortgage and home equity payments.

- Choose a shorter term: Faster payoff reduces total interest and the window for potential default.

- Lock in a low fixed rate: Avoid variable‑rate surprises that can blow up your monthly outgo.

- Consider insurance: Some lenders offer payment protection insurance that covers missed installments due to illness or job loss.

Alternative Ways to Access Cash Without the Same Risk

If the foreclosure threat feels too heavy, explore these options before signing a home equity loan:

- Personal Loan: Unsecured, lower loan amounts, but no risk to your property.

- Mortgage Refinancing: Replace your existing mortgage with a larger one, often at a lower rate.

- Equity Release (for seniors): A product designed for retirees that may not require monthly repayments.

- Small‑business or government grants: If the money is for home‑based work, specific grants might cover part of the cost.

Frequently Asked Questions

Can I get a home equity loan if I already have a mortgage?

Yes. Lenders will look at your combined loan‑to‑value ratio. As long as the total borrowing stays under the allowed LTV (usually 80%), you can add a second loan.

What happens if I miss a payment on my home equity loan?

Missing payments can lead to default, and because the loan is secured by your house, the lender may initiate foreclosure proceedings to recover the debt.

Is the interest rate on a home equity loan usually lower than a personal loan?

Typically yes. Since the loan is secured by property, banks can offer rates lower than unsecured personal loans, but the trade‑off is the added risk to your home.

Can I refinance my home equity loan later?

Refinancing is possible, but you’ll need to meet current lending criteria and may incur new fees. It can be a way to lower rates if market conditions improve.

Are there any tax benefits to a home equity loan in Australia?

Unlike some countries, Australia does not allow tax deductions for interest on residential home equity loans unless the funds are used for investment purposes and meet strict criteria.

Bottom line: a home equity loan can unlock cash at a good rate, but the biggest downside is the extra debt burden that puts your house on the line. Weigh the risk, run the numbers, and consider safer alternatives before you sign.