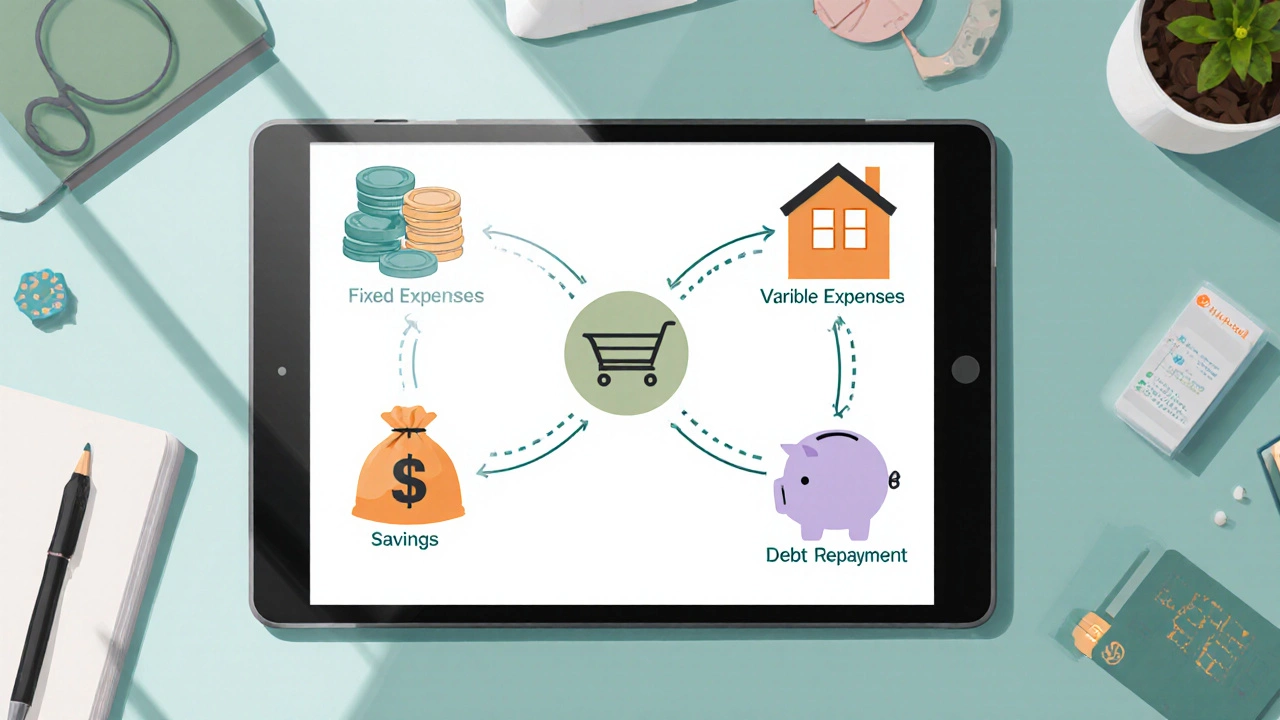

Budget Components: Build a Strong Financial Foundation

When you talk about budget components, the individual parts that make up a personal budget, such as income, fixed costs, variable costs, savings and debt payments. Also known as budget categories, they help you see where every pound goes and where you can improve. A solid emergency fund, cash set aside for unexpected expenses is one of those components, and it acts as a safety net that prevents you from dipping into credit when life throws a curveball. Another key piece is the debt repayment plan, a schedule that prioritises high‑interest obligations and tracks progress, which keeps interest costs from ballooning. Finally, a savings goal, the target amount you aim to set aside for future needs or dreams rounds out the picture, giving you a clear destination for any surplus cash. Together, these items form a framework that lets you manage money with confidence and avoid costly surprises.

How Each Component Shapes Your Money Flow

Budget components each have distinct attributes that influence the overall plan. Income defines the ceiling – it’s the amount you can allocate across all other categories. Fixed costs, like rent or mortgage, are predictable and repeat each month, so they’re easy to track but also non‑negotiable. Variable costs, such as groceries or entertainment, fluctuate, giving you room to adjust and free up cash for the emergency fund or debt repayment. The emergency fund typically aims for three to six months of essential expenses; hitting that target reduces reliance on credit cards and improves financial resilience. A debt repayment plan usually follows the 20% credit utilization rule, meaning you keep balances well below that threshold to protect your credit score while chipping away at high‑interest loans. Savings goals can be short‑term (a vacation) or long‑term (a house deposit), and they benefit from automatic transfers that turn saving into a habit. When you align these attributes—income ceiling, fixed anchor, variable flexibility, safety net, repayment cadence, and growth target—you create a budget that balances present needs with future security. This alignment is a classic example of a semantic triple: "Budget components include essential expenses, emergency fund, and debt repayment," and another triple: "Effective budgeting requires an emergency fund to protect against unexpected costs." The more you fine‑tune each piece, the smoother the cash flow becomes.

The articles below pull these ideas together, showing you real‑world ways to apply the 3 R’s of budgeting, set top priorities, and even handle specific situations like checking account balances or credit‑card utilization. Whether you’re looking for a simple basic budget setup, tips on negotiating lower loan rates, or guidance on using equity release wisely, you’ll find practical steps that fit each component of a solid budget. Dive in to see how each piece works in practice and start building a financial plan that actually moves the needle for you.

5 Essential Elements Every Budget Needs

Learn the five fundamental parts of any budget-income, fixed and variable expenses, savings, and debt repayment-and how to use them for real financial control.

Read More >>