Budgeting Basics: Your Guide to Smarter Money Management

When you start Budgeting Basics, the practice of planning how your income covers expenses, saves, and reaches goals. Also known as personal budgeting, it helps you keep control over money. A solid Budget, a detailed monthly plan for income and spending works hand‑in‑hand with an Emergency Fund, a cash reserve for unexpected costs and follows clear Budget Priorities, the order in which you allocate money to essentials, savings, and debt. This trio forms the backbone of any effective financial plan.

Key Concepts in Budgeting Basics

The budget isn’t just a spreadsheet; it’s a living framework that adapts as life changes. One popular method is the 3 R’s – Reality, Reserve, Review – which teaches you to be honest about spending, set aside a reserve for short‑term goals, and regularly review progress. Another approach, highlighted in our collection, is the Top 3 Budget Priorities model that forces you to earmark money for essential expenses, an emergency fund, and then debt or goal savings. Both models show that budgeting basics require consistency, not complexity.

Tools matter, too. Simple apps, spreadsheets, or even a pen‑and‑paper ledger can track every pound that comes in and goes out. This tracking feeds directly into the “Reality” part of the 3 R’s, letting you spot leaks like an over‑funded checking account – a topic covered in our article about optimal checking balances. When you see excess cash sitting idle, you can redirect it to higher‑return vehicles such as a high‑yield savings account or an ISA, boosting overall financial health.

Building an emergency fund is a non‑negotiable step. Most experts recommend saving three to six months of living expenses, but the exact number depends on job stability, family size, and personal risk tolerance. Our guide on emergency fund basics explains why this reserve is the safety net that protects your credit score, prevents costly debt, and gives you confidence to pursue bigger goals like buying a home or investing.

Once the core of budgeting basics is set – a functional budget, a funded emergency reserve, and clear priorities – you can start fine‑tuning. Adjustments might include reallocating a portion of discretionary spend to a retirement ISA, or swapping a high‑interest credit card balance for a lower‑rate personal loan. Readers will find advice on how the 20% credit card rule, balance‑transfer strategies, and debt‑consolidation loans intersect with budgeting fundamentals.

Another practical angle is cash flow timing. Aligning paydays with bill due dates reduces the chance of overdrafts and helps you stick to your plan. Our pieces on checking account balances and cash management illustrate how aligning inflows and outflows can free up money for investments, like the 70/30 strategy or a diversified portfolio, without breaking the budget.

Finally, budgeting basics aren’t a one‑off event. Regular review – quarterly or after any major life change – ensures the plan stays relevant. The “Review” step of the 3 R’s encourages you to compare actual spending against targets, update your emergency fund target if needed, and re‑prioritize goals. This habit loops back into the first step, creating a sustainable cycle of financial improvement.

Below you’ll find a curated set of articles that dive deeper into each of these areas. From simple budget setups to advanced debt‑consolidation tactics, the collection equips you with actionable steps to put budgeting basics into practice right now.

5 Essential Elements Every Budget Needs

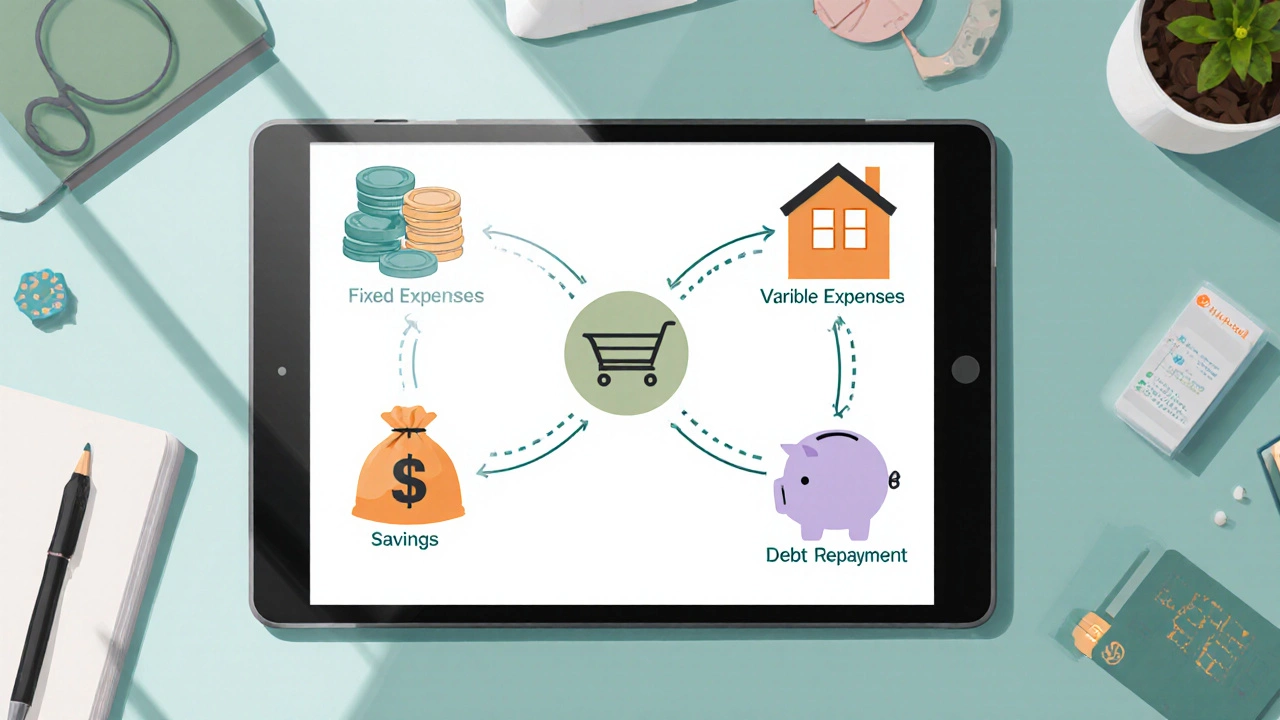

Learn the five fundamental parts of any budget-income, fixed and variable expenses, savings, and debt repayment-and how to use them for real financial control.

Read More >>