Financial Planning Made Simple – Tips, Tools, and Resources

Feeling overwhelmed by bills, savings goals, and retirement dreams? You’re not alone. A solid financial plan doesn’t have to be a wall of spreadsheets – it’s just a clear map that tells you where you are, where you want to go, and how to get there without losing sleep.

Start With a Clear Budget

The first step is to know exactly how much money flows in and out each month. Grab a notebook, a spreadsheet, or an app you trust and write down every source of income. Then list every expense – from rent and utilities to that weekly coffee run. When you see the numbers side by side, you’ll spot the low‑hanging fruit: maybe a subscription you never use or a habit you can trim.

Once you have the basics, give each category a realistic target. A popular rule is the 50/30/20 split – 50% for needs, 30% for wants, and 20% for savings or debt repayment. It’s not a law, just a handy shortcut that works for many people. If your numbers don’t line up, adjust until they do. The goal is a budget you can stick to, not one that makes you dread every payday.

Plan for the Future

With a budget in place, it’s time to think long term. Ask yourself: when do I want to retire? How much money will I need to travel, support family, or cover unexpected health costs? Use simple calculators to estimate the total, then break it down into yearly, monthly, and weekly savings goals.

If you haven’t already, open a tax‑free ISA. Our latest guide, “Is an ISA a Good Investment? Benefits, Risks & How to Choose,” explains the differences between cash, stocks & shares, and lifetime ISAs, so you can pick the right one for your goals. For those juggling debt, the article “Debt Consolidation Loans From UK Banks: Options & What To Expect” walks you through how a consolidation loan could lower your interest and free up cash for investing.

Don’t forget retirement accounts beyond ISAs. A workplace pension, a personal pension plan, or even a self‑invested personal pension (SIPP) can boost your nest egg. Match any employer contributions – it’s free money you don’t want to leave on the table.

While you’re building wealth, protect it. The post “Does Credit Score Affect Home Insurance? The Truth Every Homeowner Should Know” shows why a good credit score can shave pounds off your insurance premiums. A higher score also opens the door to cheaper mortgages – see our “What Are the Real Costs of a $100,000 30‑Year Mortgage at 7 Percent Interest?” for a clear breakdown.

Finally, keep learning. Our tag page pulls together the hottest topics, from budgeting tricks in “Simple Basic Budget Setup: Your Guide to Smart Money Management” to investment strategies like the “70/30 Investment Strategy Explained.” Scan the list, pick a couple that match your current needs, and dive in.

Remember, financial planning isn’t a one‑time project. Review your budget every few months, adjust savings as life changes, and stay curious about new tools. Small, consistent actions add up, turning today’s worries into tomorrow’s confidence.

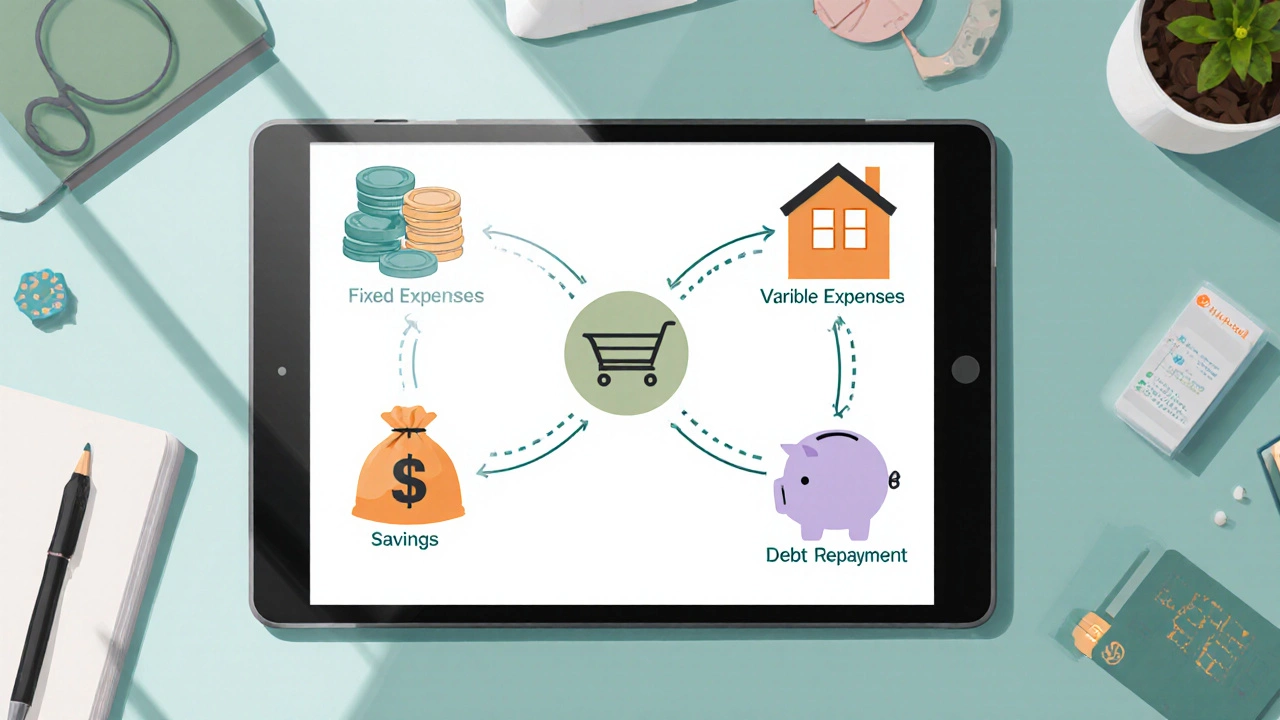

5 Essential Elements Every Budget Needs

Learn the five fundamental parts of any budget-income, fixed and variable expenses, savings, and debt repayment-and how to use them for real financial control.

Read More >>3 R's of a Good Budget: Simple Tips for Smarter Money Management

Learn the 3 R's of a good budget-Reality, Reserve, Review-and how to apply them for smarter money management and a solid emergency fund.

Read More >>Best Budgeting Strategies for Financial Success in 2025

Struggling with managing your money? Discover the best budgeting strategies, learn tips for real-life success, and see how your choices impact your financial future.

Read More >>How Much Cash Should You Keep in a Savings Account?

This article digs into how much money you should actually keep parked in your savings account. We break down why having the right amount matters, how to decide your target balance, and what to do if you have too much or too little set aside. Expect practical advice, expert-backed tips, and things people usually overlook when managing their emergency savings. Whether you're just getting started or rethinking your goals, you'll get clear steps to take. We also highlight some common mistakes and easy fixes.

Read More >>How Much Will I Have If I Save $100 a Month for 30 Years?

Ever wondered what stashing away $100 each month for 30 years could do for you? This article breaks down the numbers, shows you how interest really works, and uncovers some sneaky ways your money can grow faster. There's math, but it's simple—promise! You'll also get smart tips to make your savings plan actually stick, plus a peek at what that pile of cash could do for your life.

Read More >>How Much Do You Repay on Equity Release? Navigating Your Financial Choices

Equity release is a popular way for homeowners to access cash tied up in their property. But, what does repayment look like? This article digs into the ins and outs of equity release repayment, including how much you might expect to pay back, the repayment options available, and how different factors affect these costs. Whether you're considering a lifetime mortgage or a home reversion plan, understanding your repayment obligations can help you make informed financial decisions.

Read More >>Debt Consolidation: Uncovering the Downsides

Debt consolidation might seem like an easy fix, but it's essential to understand its pitfalls. While it can simplify payments, it doesn't reduce the overall debt and could extend it. Hidden fees and potential impacts on credit scores are real concerns. Not all plans truly cater to individual needs, and there is a risk of falling back into debt if spending habits aren't addressed.

Read More >>Do Student Loans Affect Buying a House?

Student loans can make buying a house tricky, affecting your ability to qualify for a mortgage and influencing your financial planning decisions. Understanding how student debt impacts your credit score, debt-to-income ratio, and savings potential is crucial for homebuyers. Effective management of loans and strategic financial planning can help navigate these challenges. Learn how student loans play a role in home-buying decisions and discover practical tips for managing this aspect of your financial life.

Read More >>Achieving $1,000,000 in Retirement Savings: How Many Make It and How You Can Too

As of today, reaching the million-dollar mark in retirement savings is more attainable than ever due to strategic planning and prudent investing. This article delves into the real numbers of people with $1,000,000 in their retirement accounts, explores the possible paths to this goal, and offers practical tips to enhance your financial future. It highlights the common mistakes to avoid, key strategies for every life stage, and how to adjust in uncertain economic times. Packed with insights, this piece offers a roadmap for growing your nest egg responsibly.

Read More >>How Much of Your Income Should Be Allocated to Student Loans?

Managing student loans can be challenging, and it's important to know how much of your income should be dedicated to them. This article explores various strategies for allocating income toward student loan payments, helping you balance debt repayment with other financial goals. We'll discuss different repayment plans, budgeting tips, and the psychological aspects of debt management. By understanding these elements, you'll be better equipped to make informed financial decisions. Our goal is to empower you to handle student loans with confidence.

Read More >>Optimal Savings: What Amount is Right for You?

Knowing how much to save can be challenging. From gauging your lifestyle to setting clear financial goals, understanding optimal savings is crucial. This article explores how much money is recommended in savings, tailoring advice to different situations. We'll also share tips that help you effectively manage and grow your savings.

Read More >>