Personal Finance Tips You Can Use Right Now

Feeling overwhelmed by money talks? You’re not alone. Most people just need a clear plan that fits their life. Below you’ll find easy steps you can start today to get your finances in shape.

Build a Budget That Actually Works

The first rule of personal finance is to know where every pound goes. Grab a spreadsheet or a free budgeting app and list your income, then write down all regular expenses – rent, bills, groceries, transport. Anything that varies month to month (like eating out) goes in a separate column. Once you see the totals, look for the places you can trim. Cutting a weekly coffee habit or switching to a cheaper phone plan can free up dozens of pounds each month.

After you’ve trimmed, assign the extra cash to three buckets: emergency fund, debt repayment, and savings for goals. Aim for at least three months of living costs in your emergency fund – that’s the safety net everyone needs.

Boost Your Credit Score Without Extra Stress

Your credit score matters more than you think. It influences mortgage rates, car loan interest, and even some insurance premiums. The simplest way to improve it is to keep credit utilization under 30 %. That means if you have a £2,000 limit, try not to carry more than £600 in balance.

Pay your credit‑card bill on time every month – set up automatic payments if you can. If you have multiple cards, consider consolidating balances onto the one with the lowest interest. A quick check of your credit report each year helps you spot errors that could drag your score down.

When you’re ready to apply for new credit, remember the 20 % credit‑card rule: keep your total usage below one‑fifth of your total credit limit. This signals lenders that you’re responsible and can help you qualify for better rates.

Now that you have a budget and a healthier credit score, let’s talk about growing your savings.

High‑interest ISAs are a popular way to earn more on tax‑free savings. Look for the best ISA rates in the UK – some banks offer up to 5 % for the first year. If you’re comfortable with a little risk, a stocks‑and‑shares ISA can give higher returns over the long term. Just make sure you understand the fees and the investment horizon.

For short‑term goals, a regular savings account with a competitive interest rate works well. Compare offers from major UK banks – you might find a 7 % rate on a fixed‑term product, but check the terms carefully. Some accounts require a minimum deposit or lock your money for a year.

Lastly, tackle debt strategically. If you have high‑interest credit‑card debt, prioritize paying it off before you start investing heavily. A debt‑consolidation loan from a reputable UK bank can lower your interest rate and give you one easier monthly payment.

Remember, personal finance isn’t a one‑size‑fits‑all game. Adjust these tips to match your income, goals, and risk comfort. Start with a simple budget, keep your credit score in the green, and let your savings grow. Small, consistent actions add up fast, and before you know it, you’ll have the financial harmony you’ve been chasing.

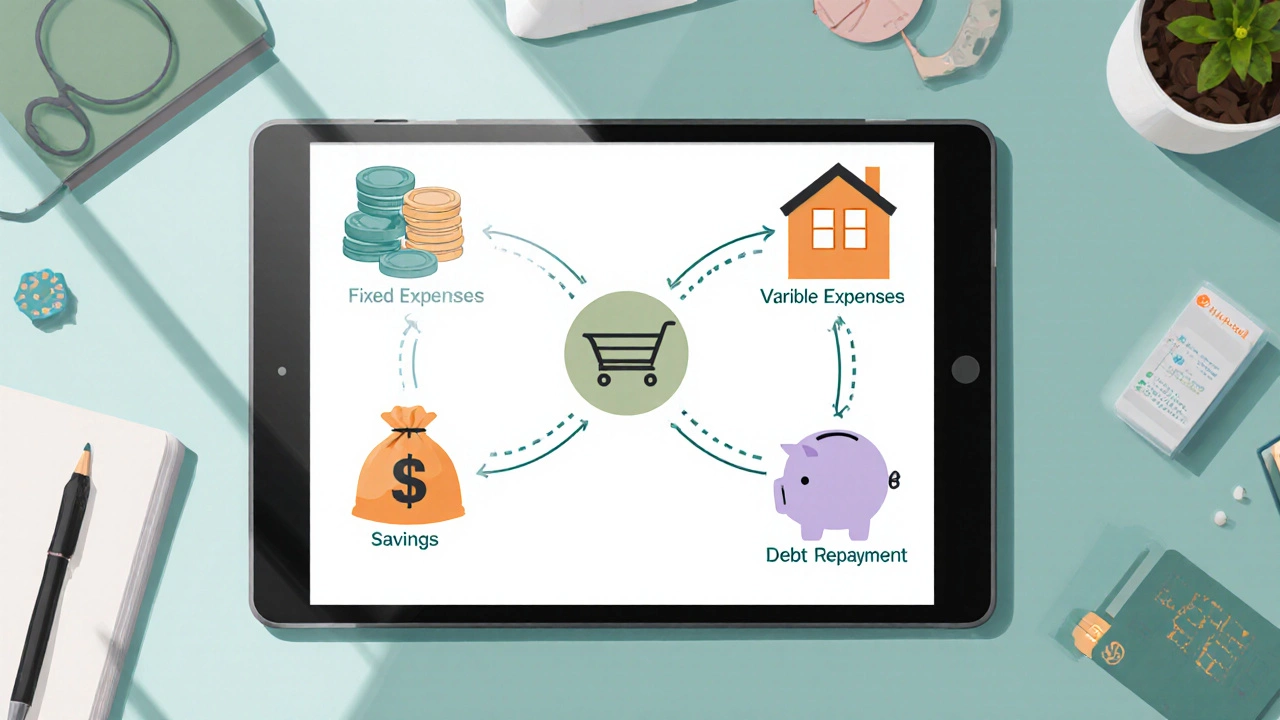

5 Essential Elements Every Budget Needs

Learn the five fundamental parts of any budget-income, fixed and variable expenses, savings, and debt repayment-and how to use them for real financial control.

Read More >>3 R's of a Good Budget: Simple Tips for Smarter Money Management

Learn the 3 R's of a good budget-Reality, Reserve, Review-and how to apply them for smarter money management and a solid emergency fund.

Read More >>How to Budget $4000 a Month Without Stress: Smart Tips for Financial Success

Learn how to budget $4000 a month with real-life tips, examples, and smart strategies. Stretch your cash, save, and enjoy life—all while staying stress-free.

Read More >>Best Budgeting Strategies for Financial Success in 2025

Struggling with managing your money? Discover the best budgeting strategies, learn tips for real-life success, and see how your choices impact your financial future.

Read More >>75-15-10 Rule: Simple Budgeting That Actually Works

The 75-15-10 rule is a practical way to split your income for smarter budgeting. It suggests putting 75% to needs, 15% to wants, and 10% to savings or debt payments. This article breaks down how the rule works, where it comes from, and who it might help the most. You'll also find tips for making the numbers work in real life and common mistakes to avoid. If other budgeting methods have left you confused, this approach could be the refresher you need.

Read More >>Simplest Budgeting Method: 50/30/20 Rule Explained

Tired of feeling overwhelmed by complex budgeting tools? The 50/30/20 rule offers a straightforward way to manage your money without spreadsheets or apps. We'll break down how this budgeting method works, show you why it sticks for so many people, and help you spot common pitfalls. Get ready for practical steps and smart tips to make budgeting actually work in your life. Less math, more freedom.

Read More >>Budgeting Tips: What Is the Best Advice for Budgeting?

Budgeting can feel like a chore, but with the right advice, it becomes a powerful tool to manage your money. This article breaks down practical strategies anyone can use to start budgeting, stick to it, and actually enjoy the process. Get concrete tips on tracking your expenses, setting realistic goals, and using the best tools for the job. Whether you're new to budgeting or need help with discipline, this guide keeps it straightforward and actionable. A little prep can make a big difference in your wallet.

Read More >>4 Steps to Better Budgeting

Budgeting can seem daunting, but breaking it down into simple steps makes it manageable. Discover four straightforward steps to improve your budgeting skills, making it easier to track spending, save money, and achieve financial goals. From understanding your spending habits to setting realistic financial targets, this guide provides practical tips to help you take control of your finances. Learn how to make budgeting a stress-free part of your life.

Read More >>How Many Americans Have $200k in Savings and Essential Budgeting Tips

Discover how many Americans hold $200k in savings and explore effective budgeting tips to boost your financial security. This detailed examination provides insights into the saving habits of people and suggests practical ways to enhance your savings plan. Learn why having a substantial savings account is crucial and how you can achieve this milestone regardless of your current financial status.

Read More >>