US Tax-Advantaged Account Calculator

How Much Tax-Free Space Do You Have?

Calculate your total tax-free investment potential using US accounts that match the UK ISA's benefits.

Your Tax-Free Investment Space

Your total tax-free investment space for 2025

(vs. UK ISA's £20,000 limit)

If you’re used to the UK’s ISA-where you can save or invest up to £20,000 a year tax-free-you might wonder: what’s the US version of an ISA? The short answer? There isn’t one single account that matches it exactly. But the US has a handful of accounts that together do what the ISA does: let you grow money without paying taxes on gains, dividends, or interest. The closest match? The Roth IRA. But it’s not a perfect copy. Here’s how they stack up-and which US accounts actually give you the same freedom as an ISA.

What Makes an ISA Special?

The UK’s ISA (Individual Savings Account) is simple: you put money in, it grows tax-free, and you can take it out anytime without paying tax on the returns. No capital gains tax. No income tax on dividends. No tax when you withdraw. You can hold cash, stocks, bonds, or even peer-to-peer loans inside it. And you can switch between types-cash ISA, stocks and shares ISA, innovative finance ISA-without losing your allowance. The whole thing is built around flexibility and tax freedom.

The US doesn’t have a single account with that exact mix. Instead, it has a patchwork of accounts, each with their own rules, limits, and restrictions. You need to combine them to get close to ISA-like freedom.

The Closest Match: Roth IRA

The Roth IRA is the most similar to an ISA. You contribute after-tax money-so you’ve already paid income tax on it. Then your investments grow tax-free. And when you withdraw in retirement, you pay nothing. No taxes on gains, dividends, or interest. That’s the same as an ISA.

For 2025, you can contribute up to $7,000 a year to a Roth IRA ($8,000 if you’re 50 or older). That’s less than the UK’s £20,000 allowance, but the tax treatment is nearly identical. Plus, you can withdraw your original contributions (not the gains) anytime without penalty or tax. That’s a big deal-it gives you some flexibility, like an ISA.

But here’s the catch: you can’t use a Roth IRA to hold cash savings the way you can with a cash ISA. And there are income limits. If you earn over $161,000 as a single filer (or $240,000 as a couple) in 2025, you can’t contribute at all. That’s a major difference. An ISA has no income caps.

What About 401(k)s? They’re Not the Same

Many Americans assume their 401(k) is the US version of an ISA. It’s not. A traditional 401(k) lets you contribute pre-tax money, which lowers your taxable income now. But you pay income tax when you withdraw in retirement. That’s the opposite of an ISA and a Roth IRA. It’s tax-deferred, not tax-free.

A Roth 401(k) is closer. You pay tax upfront, then withdrawals are tax-free. But it’s tied to your employer. You can’t open one on your own. And the contribution limit is much higher-$23,500 in 2025 (or $31,000 if you’re 50+). That’s more than an ISA, but you’re stuck with your employer’s plan choices. You can’t pick your own investments like you can with a stocks and shares ISA.

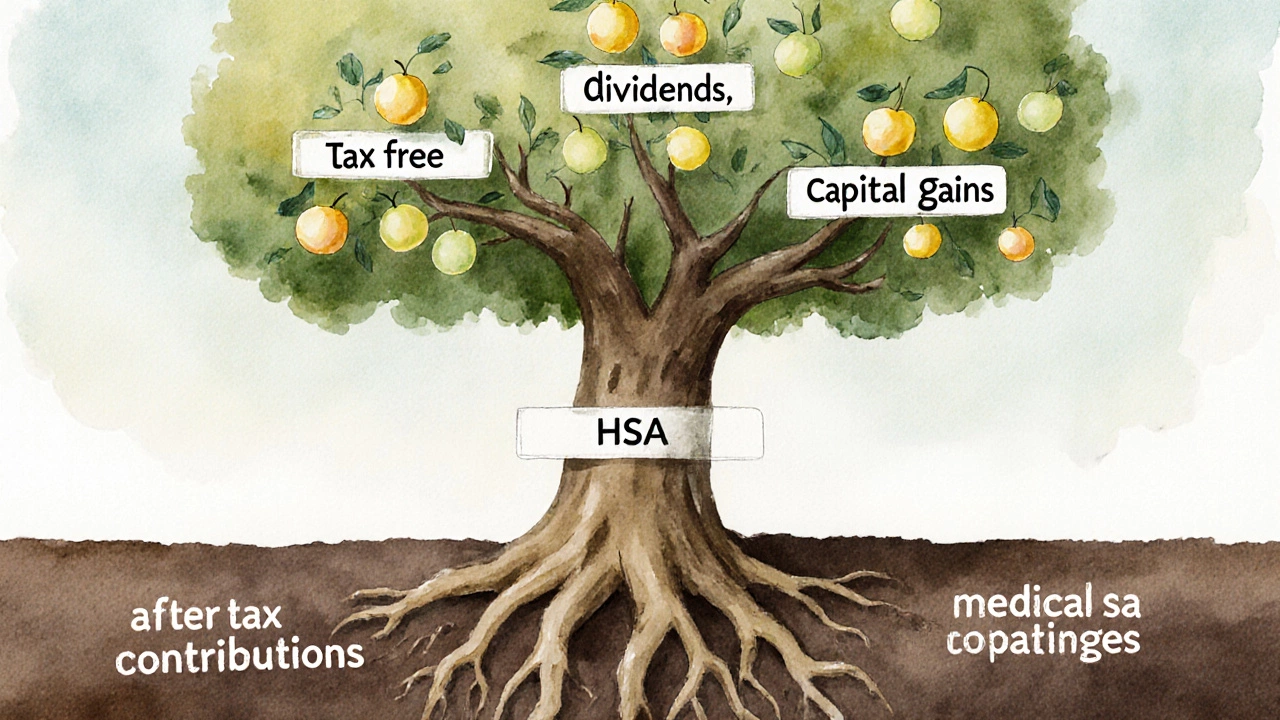

Health Savings Accounts (HSAs): The Hidden Gem

If you have a high-deductible health plan, you can open an HSA. It’s a triple tax advantage: you get a tax deduction when you contribute, your money grows tax-free, and withdrawals for qualified medical expenses are tax-free. That’s even better than an ISA.

For 2025, you can contribute up to $4,800 if you’re single, or $9,150 if you have a family plan. You can invest the money in stocks or funds inside the HSA. And unlike an IRA, there’s no age limit for withdrawals-if you use it for medical costs, you never pay tax.

But here’s the problem: you can only use it for healthcare. You can’t use it to buy a car, pay rent, or fund a vacation. So while it’s tax-advantaged like an ISA, it’s not flexible. It’s a specialized tool, not a general savings account.

Brokerage Accounts: The Default, But Taxed

Most Americans who want to invest outside of retirement accounts use a regular brokerage account. You can buy stocks, ETFs, bonds, mutual funds-anything. But every dividend, every capital gain, every interest payment is taxable. Short-term gains (held less than a year) are taxed as ordinary income. Long-term gains (held over a year) get lower rates, but you still pay.

That’s the big difference from an ISA. In the UK, you get a £1,000 annual capital gains tax-free allowance (and £500 for dividends). In the US, you pay taxes on every gain unless it’s inside a Roth IRA or HSA. There’s no blanket tax-free investment account for non-retirement savings.

Can You Combine Accounts to Mimic an ISA?

Yes-and that’s how most Americans get close to ISA-like freedom.

Here’s a real-world example: A 32-year-old software engineer in San Francisco earns $120,000 a year. She maxes out her Roth IRA ($7,000). She also contributes $10,000 to her Roth 401(k). That’s $17,000 in tax-free growth space. She opens an HSA and contributes $4,800. Now she’s got $21,800 in tax-free accounts. She uses a regular brokerage account for extra investing, knowing she’ll pay taxes on gains there.

She doesn’t have one account like an ISA, but she has three that cover the same ground. And she can access her Roth IRA contributions anytime without penalty. That’s the closest you can get.

What About 529 Plans and Other Accounts?

529 plans are for education. You get state tax breaks and federal tax-free growth if used for qualified education costs. But if you use it for anything else, you pay taxes and a 10% penalty. That’s not flexible.

Traditional IRAs? Tax-deferred, not tax-free. SEP IRAs? For self-employed people. Coverdell ESAs? Mostly obsolete. None of these match the ISA’s simplicity.

The Bottom Line: No Direct Equivalent, But Workarounds Exist

The US doesn’t have a direct version of the ISA. No single account gives you the same combination of high contribution limits, no income caps, full investment freedom, and tax-free growth and withdrawals.

But you can build a system that gets you 90% of the way there:

- Max out your Roth IRA every year.

- If your employer offers a Roth 401(k), contribute as much as you can.

- If you’re eligible, open an HSA and use it as a long-term investment account.

- For anything beyond that, use a taxable brokerage account and plan for taxes.

It’s more complex than a UK ISA, but it works. And if you start early, the tax-free compounding across these accounts can outpace even the best ISA.

What If You’re a US Citizen Living in the UK?

If you’re American and living in the UK, things get messy. The IRS doesn’t recognize ISAs as tax-advantaged. Even if you’re not paying UK tax on your ISA, the IRS still treats it as a regular investment account. You have to report gains every year and pay US taxes on them. Many Americans in the UK avoid ISAs for this reason and stick to US-based accounts.

Conversely, if you’re a UK citizen living in the US, your ISA won’t get any special tax treatment. The IRS sees it as a regular brokerage account. You’ll pay US taxes on dividends and capital gains, even if you didn’t pay UK tax.

There’s no tax treaty that protects ISAs from US taxation. So cross-border savers need to be extra careful.

Final Thoughts

The US doesn’t have a single account that mirrors the ISA. But it has a toolkit that, when used together, gives you more control over your tax bill than most people realize. The key is understanding which accounts do what-and stacking them smartly.

If you want tax-free growth, start with the Roth IRA. Add a Roth 401(k) if you can. Use an HSA if you qualify. And don’t let the lack of a perfect match stop you from building wealth. The US system isn’t as simple as the ISA-but with the right moves, it can be just as powerful.