Personal Finance in 2025: Loans, Budgets, and Smart Money Moves

When it comes to managing your money in 2025, personal finance, the practice of planning and managing your income, expenses, savings, and debt to achieve long-term financial goals. Also known as household finance, it’s not about getting rich overnight—it’s about making sure your money works for you, not against you. Whether you’re juggling a personal loan, a fixed-sum loan used to cover unexpected costs, consolidate debt, or fund major purchases, often with fixed monthly payments, trying to build an emergency fund, or wondering if you should remortgage your home, the basics haven’t changed: know your numbers, avoid hidden traps, and stay in control.

One of the biggest mistakes people make is treating credit like free money. A credit score, a three-digit number lenders use to predict how likely you are to repay debt on time can open doors to lower interest rates—or slam them shut. That $5,000 personal loan might look easy, but if your score is below 650, you could end up paying double in interest. And those 0% APR credit cards? They’re not gifts. They’re timed bombs if you don’t pay off the balance before the promo ends. The budget, a simple plan that tracks where your money goes each month to ensure you’re not spending more than you earn isn’t about restriction—it’s about freedom. The top three priorities? Pay for essentials, build a safety net, then tackle debt or save for goals. Skip any one of these, and you’re just delaying trouble.

Across the Atlantic, Australians are asking the same questions: Can I buy back my home after equity release? What’s the minimum credit score for a home equity loan? Are remortgage rates in 2025 actually better than last year? The answers aren’t one-size-fits-all. Your income, your home’s value, your credit history—all of it matters. And while Americans don’t have ISAs, they’ve built powerful alternatives like Roth IRAs and HSAs that let you save tax-free. The tools vary by country, but the goal is the same: keep more of your money, not less.

This collection from October 2025 cuts through the noise. You’ll find real examples of what payments look like on a $5,000 loan, why keeping too much cash in your checking account is a hidden cost, how balance transfers can hurt your credit score if done wrong, and why State Farm leads the U.S. insurance market—not because it’s the cheapest, but because it’s the most reliable. You’ll learn how to negotiate a lower car loan rate, spot a hardship loan scam, and understand the golden rule of credit without getting lost in jargon. These aren’t theory pieces. They’re field guides for people who want to make smarter choices with their money, right now.

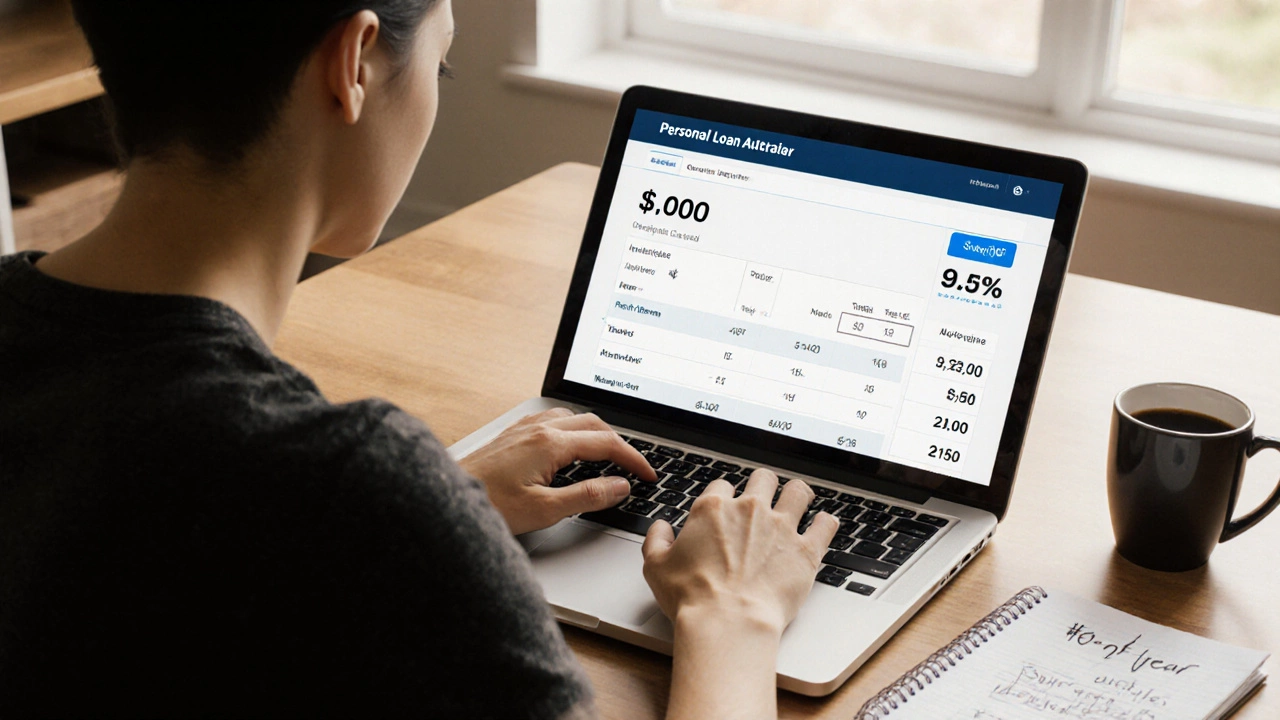

What Would Payments Be on a $5000 Personal Loan? Rates, Terms, and Real Examples

Find out exactly how much you'd pay monthly on a $5000 personal loan in Australia. See real rates, terms, and repayment examples from top lenders - plus tips to avoid costly mistakes.

Read More >>Does the US Have ISA Accounts? Here’s What Americans Actually Use Instead

The US doesn't have ISA accounts, but Americans have powerful tax-advantaged alternatives like Roth IRAs, HSAs, and 401(k)s. Learn how to save tax-free in the US without an ISA.

Read More >>Why 0% APR Credit Cards Can Hurt Your Wallet

Zero‑interest credit cards sound great, but hidden fees, post‑promo rates, and credit‑score impacts can turn them into costly traps. Learn why and when they’re actually useful.

Read More >>Understanding the Golden Rule of Credit and How It Impacts Your Card Choices

Learn the golden rule of credit-pay in full, on time, and keep utilization low-to boost your score, avoid interest, and choose the right cards.

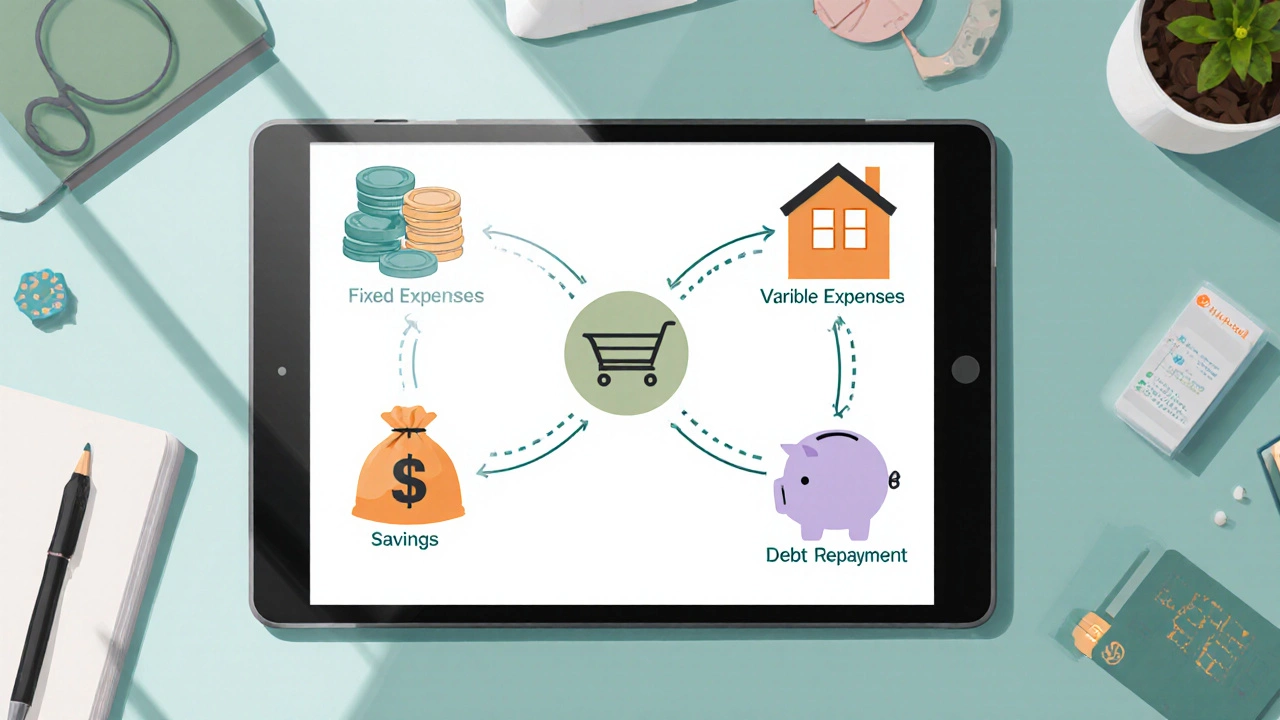

Read More >>5 Essential Elements Every Budget Needs

Learn the five fundamental parts of any budget-income, fixed and variable expenses, savings, and debt repayment-and how to use them for real financial control.

Read More >>Upstart Personal Loans: Reliability Review 2025

Explore Upstart's reliability, approval rates, APRs, funding speed, and how it compares to LendingClub and Prosper for personal loans in 2025.

Read More >>Ideal Checking Account Balance: When Too Much Money Becomes a Problem

Learn how much cash you should keep in a checking account, why excess balances waste money, and the best ways to move surplus funds for higher returns.

Read More >>Pension vs 401(k): Which Retirement Plan Wins?

Explore the core differences between pensions and 401(k) plans, covering guarantees, taxes, risk, and real‑world examples to help you pick the right retirement strategy.

Read More >>Buying Back Your Home After Equity Release: Complete Guide & Costs

A practical guide on whether you can buy back your home after an equity release, covering steps, costs, pros/cons, and FAQs.

Read More >>3 R's of a Good Budget: Simple Tips for Smarter Money Management

Learn the 3 R's of a good budget-Reality, Reserve, Review-and how to apply them for smarter money management and a solid emergency fund.

Read More >>Major Disadvantage of a Home Equity Loan - What You Need to Know

Discover the main downside of a home equity loan, how it raises foreclosure risk, and smarter ways to access cash in Australia.

Read More >>How to Negotiate a Lower Car Loan Interest Rate - Proven Tips

Learn how to negotiate a lower car loan interest rate with practical steps, comparison tables, and proven tactics to save thousands on your auto financing.

Read More >>