Budgeting Made Simple: Real Tips You Can Use Today

Feeling overwhelmed by bills, expenses, and that never‑ending to‑do list? You’re not alone. Budgeting doesn’t have to be a math class – it’s just a way to make your money work for you. Below you’ll find straight‑forward advice that you can start using right now, plus a quick look at some of our most popular guides.

Start With a Core Budget That Fits Your Life

First step: write down every source of income and every regular expense. It sounds basic, but a simple spreadsheet or even a pen‑and‑paper list can reveal hidden leaks. Our "Simple Basic Budget Setup" article walks you through a proven structure that real people use to get their finances under control.

Once you see the numbers, decide how much you want to allocate to needs, wants, and savings. The 50/30/20 rule is a favorite because it’s easy to remember – 50% for essentials, 30% for lifestyle, 20% for debt or savings. If you need a quicker cheat sheet, check out the "Simplest Budgeting Method: 50/30/20 Rule Explained" guide.

Try a Fresh Split Like the 75‑15‑10 Rule

If the 50/30/20 feels too loose, the 75‑15‑10 rule offers a tighter grip. Put 75% of your take‑home pay toward needs (rent, utilities, groceries), 15% toward wants (streaming, dining out), and the remaining 10% into savings or debt repayment. Our "75‑15‑10 Rule: Simple Budgeting That Actually Works" post explains why this split can help you stay disciplined without feeling deprived.

Adjust the percentages to match your situation – the goal is to have a clear, repeatable pattern. It’s easier to stick with a rule you understand and trust.

Got a specific income target, like $4,000 a month? Our "How to Budget $4000 a Month Without Stress" piece breaks down real‑life examples, showing you where to trim and where to enjoy a little freedom.

Don’t forget the power of small, consistent savings. Even $100 a month can grow into a solid nest egg over 30 years. The "How Much Will I Have If I Save $100 a Month for 30 Years?" article shows the math in plain language and offers tips to keep the habit alive.

Staying on track isn’t about perfection; it’s about habit. Use one of our "Budgeting Tips: What Is the Best Advice for Budgeting?" articles to learn quick tricks like automating transfers, tracking expenses with a simple app, or setting weekly spending caps.

When you end a month with extra cash, you’ve created a surplus – sometimes called leftover budget. Our "Deciphering the Mystery: What Is Leftover Budget Called?" guide helps you turn that surplus into a savings cushion or investment boost.

Want a step‑by‑step roadmap? The "4 Steps to Better Budgeting" post lays out a clear path: assess habits, set realistic targets, monitor progress, and adjust as needed. Follow these steps, and budgeting becomes less of a chore and more of a confidence builder.

Remember, the best budget is the one you actually use. Pick a method that feels natural, set up reminders, and celebrate small wins. With the right approach, you’ll see money flowing toward the things that matter most – whether that’s a debt‑free life, a travel fund, or simply peace of mind.

How much money should I have after bills? A realistic guide for Australian households

After paying bills, how much should you have left? In Australia today, most people are left with little to nothing. This guide shows realistic targets, real examples, and practical steps to build a safety net-even on a tight budget.

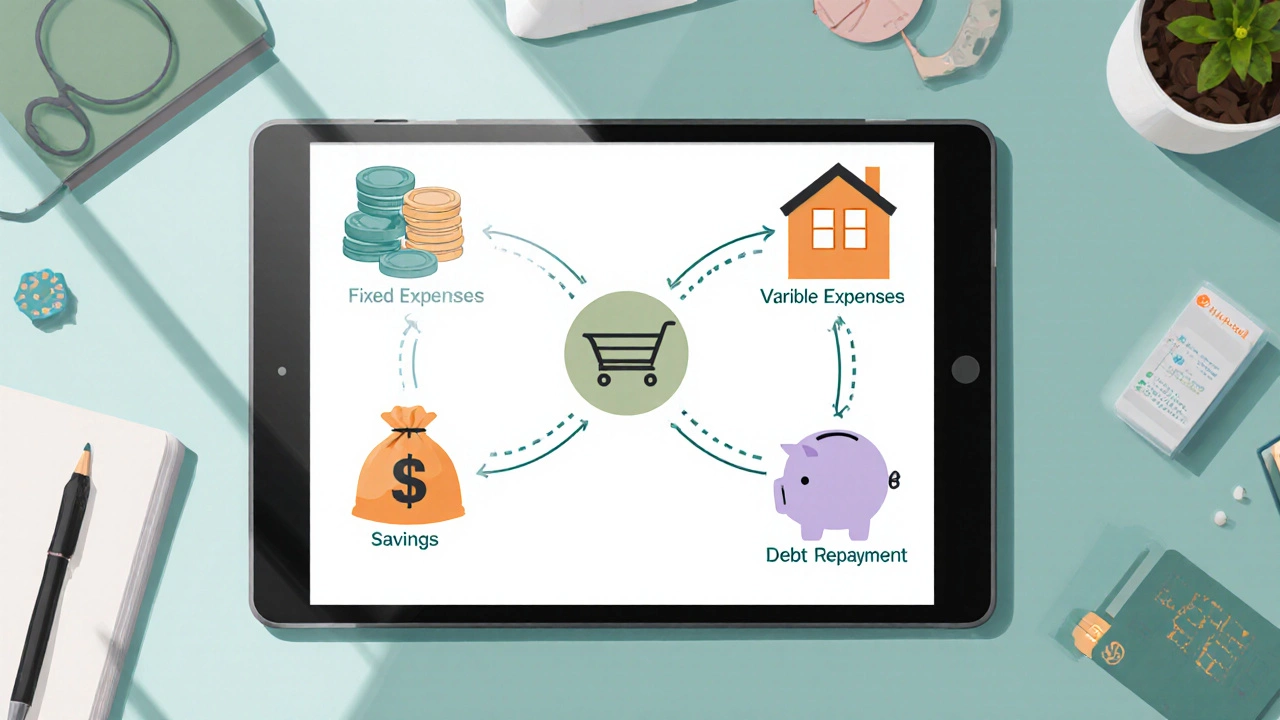

Read More >>5 Essential Elements Every Budget Needs

Learn the five fundamental parts of any budget-income, fixed and variable expenses, savings, and debt repayment-and how to use them for real financial control.

Read More >>3 R's of a Good Budget: Simple Tips for Smarter Money Management

Learn the 3 R's of a good budget-Reality, Reserve, Review-and how to apply them for smarter money management and a solid emergency fund.

Read More >>Top 3 Budget Priorities to Master Your Money

Learn the three core budget priorities-essential expenses, emergency fund, and debt or goal savings-and how to allocate income for lasting financial stability.

Read More >>Simple Basic Budget Setup: Your Guide to Smart Money Management

Learn exactly what a good basic budget looks like, plus easy tips, proven structures, and real strategies regular people use to get finances under control.

Read More >>How to Budget $4000 a Month Without Stress: Smart Tips for Financial Success

Learn how to budget $4000 a month with real-life tips, examples, and smart strategies. Stretch your cash, save, and enjoy life—all while staying stress-free.

Read More >>75-15-10 Rule: Simple Budgeting That Actually Works

The 75-15-10 rule is a practical way to split your income for smarter budgeting. It suggests putting 75% to needs, 15% to wants, and 10% to savings or debt payments. This article breaks down how the rule works, where it comes from, and who it might help the most. You'll also find tips for making the numbers work in real life and common mistakes to avoid. If other budgeting methods have left you confused, this approach could be the refresher you need.

Read More >>How Much Will I Have If I Save $100 a Month for 30 Years?

Ever wondered what stashing away $100 each month for 30 years could do for you? This article breaks down the numbers, shows you how interest really works, and uncovers some sneaky ways your money can grow faster. There's math, but it's simple—promise! You'll also get smart tips to make your savings plan actually stick, plus a peek at what that pile of cash could do for your life.

Read More >>Simplest Budgeting Method: 50/30/20 Rule Explained

Tired of feeling overwhelmed by complex budgeting tools? The 50/30/20 rule offers a straightforward way to manage your money without spreadsheets or apps. We'll break down how this budgeting method works, show you why it sticks for so many people, and help you spot common pitfalls. Get ready for practical steps and smart tips to make budgeting actually work in your life. Less math, more freedom.

Read More >>Budgeting Tips: What Is the Best Advice for Budgeting?

Budgeting can feel like a chore, but with the right advice, it becomes a powerful tool to manage your money. This article breaks down practical strategies anyone can use to start budgeting, stick to it, and actually enjoy the process. Get concrete tips on tracking your expenses, setting realistic goals, and using the best tools for the job. Whether you're new to budgeting or need help with discipline, this guide keeps it straightforward and actionable. A little prep can make a big difference in your wallet.

Read More >>4 Steps to Better Budgeting

Budgeting can seem daunting, but breaking it down into simple steps makes it manageable. Discover four straightforward steps to improve your budgeting skills, making it easier to track spending, save money, and achieve financial goals. From understanding your spending habits to setting realistic financial targets, this guide provides practical tips to help you take control of your finances. Learn how to make budgeting a stress-free part of your life.

Read More >>Deciphering the Mystery: What Is Leftover Budget Called?

Ever found yourself with extra money at the end of the month and wondered what to call it? That's your leftover budget, often referred to as a budget surplus or savings cushion. This article dives into the essentials of understanding and effectively using this surplus to boost your financial health. Covering practical tips, strategies, and common pitfalls, it's your guide to making the most of your budget surplus without a hitch. Let's uncover the potential of your leftover budget.

Read More >>