Personal Loans Made Simple: What You Need to Know

Looking for a personal loan but not sure where to start? You’re not alone. Whether you need cash for a big purchase, want to combine debt, or are facing an emergency, the right loan can make a huge difference. In this guide we’ll break down the most common loan types, the key factors banks look at, and practical steps you can take right now to improve your chances of approval.

What Lenders Really Look For in 2025

The first thing banks check is your credit score. A score above 650 usually opens the door to better rates, but you don’t need a perfect score to get a loan. Lenders also weigh your income, existing debt, and how steady your job is. If you have a solid paycheck and a low debt‑to‑income ratio, you’ll look more trustworthy even with a few credit blemishes.

Another factor is the purpose of the loan. Some banks offer special rates for debt consolidation, while others have “hardship” products for people dealing with sudden loss of income or medical bills. Knowing the exact reason you need the money helps you match with the product that has the lowest cost.

Popular Personal Loan Options and When to Use Them

Debt Consolidation Loans – These let you combine several credit‑card balances into one monthly payment, often at a lower interest rate. If you’re juggling multiple debts, a consolidation loan can simplify budgeting and reduce the total interest you pay.

Hardship Loans – Designed for people hit by unexpected events like job loss or big medical expenses. They typically have more flexible approval criteria, but the interest may be higher. Use them only when you have a clear plan to repay.

Bad Credit Loans – If your score is below 600, some lenders still offer loans, though the rates are steeper. Look for lenders that specialize in low‑score borrowers and compare the full cost, not just the monthly payment.

Easy‑Approval Banks (2024‑2025) – Certain high‑street banks have streamlined applications, quick decisions, and lower documentation requirements. They’re a good choice if you want speed and don’t want to jump through too many hoops.

Now that you’ve seen the main loan types, here are three quick actions you can take today to boost your approval odds:

- Check your credit report for errors and dispute any mistakes.

- Pay down any high‑interest credit‑card balances to lower your debt‑to‑income ratio.

- Gather proof of steady income – recent payslips, tax returns, or a contract.

If you’re still hesitant about taking on debt, there are cash alternatives that don’t involve a loan. Selling unused items, tapping a side gig, or using a peer‑to‑peer lending platform can provide short‑term cash without adding to your credit file.

At the end of the day, the best personal loan is the one that fits your situation, costs the least, and helps you meet your financial goal. Compare interest rates, read the fine print on fees, and make sure the repayment schedule aligns with your cash flow.

Ready to start? Use the insights above to narrow down your choices, get your paperwork in order, and apply with confidence. A well‑chosen personal loan can bring the financial harmony you’re looking for.

Who is the best lender for bad credit in Australia 2026?

Finding the best lender for bad credit in Australia isn't about the lowest rate - it's about fair terms, transparency, and helping you rebuild. Here are the top three lenders in 2026 that actually work with people who have poor credit scores.

Read More >>Is It Hard to Get a $4000 Personal Loan? Here’s What Actually Matters

Getting a $4000 personal loan in Australia isn’t impossible - even with bad credit. Learn what lenders really check, where to apply, and how to improve your chances without falling for scams.

Read More >>What is the easiest bank to get approved for a personal loan?

Finding the easiest bank to get approved for a personal loan isn't about big names-it's about lenders who look at your income and spending, not just your credit score. Here's who actually says yes when others say no.

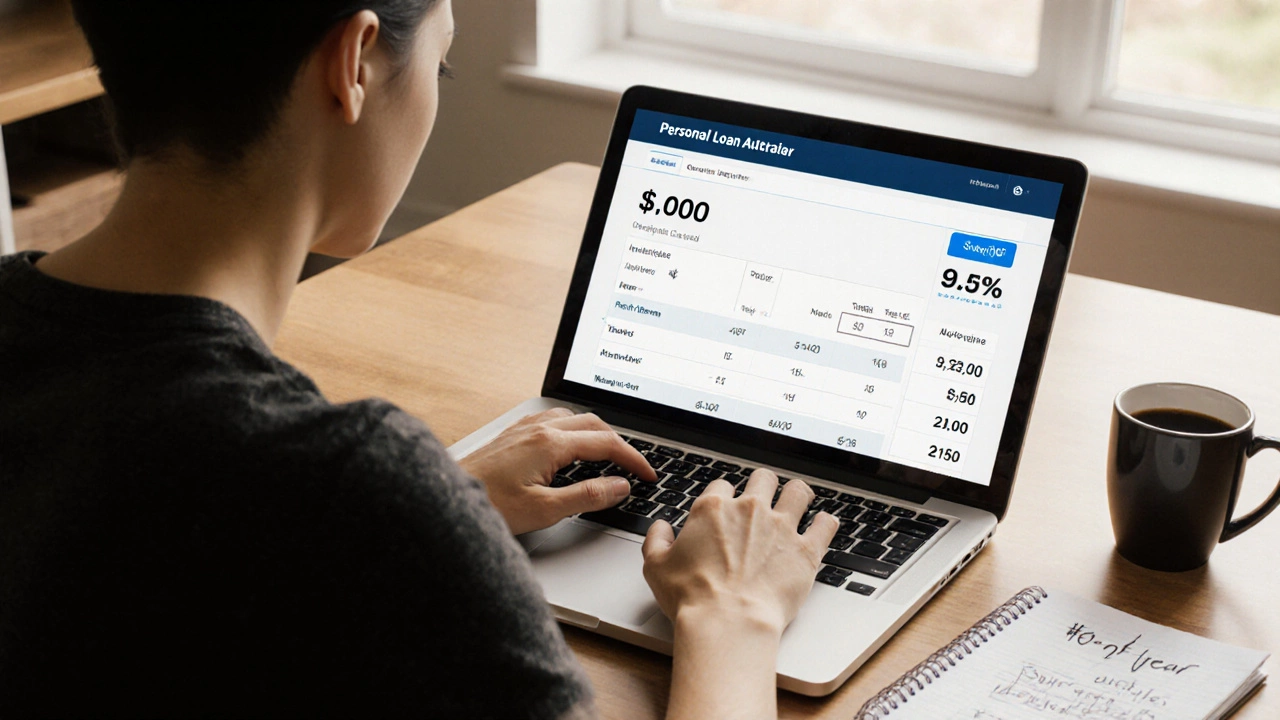

Read More >>What Would Payments Be on a $5000 Personal Loan? Rates, Terms, and Real Examples

Find out exactly how much you'd pay monthly on a $5000 personal loan in Australia. See real rates, terms, and repayment examples from top lenders - plus tips to avoid costly mistakes.

Read More >>Upstart Personal Loans: Reliability Review 2025

Explore Upstart's reliability, approval rates, APRs, funding speed, and how it compares to LendingClub and Prosper for personal loans in 2025.

Read More >>Are Hardship Loans Legit? A Straight‑Forward Guide for Australians

Learn how to tell if hardship loans are genuine, spot scams, verify lenders, and explore safer alternatives-essential advice for Australians facing financial emergencies.

Read More >>Debt Consolidation Loans From UK Banks: Options & What To Expect

Banks in the UK do offer debt consolidation loans, but approval and terms can vary widely. Find out who qualifies, how these loans work, and tips for getting the best deal.

Read More >>Credit Score Needed for a Bank Loan: What Really Matters

Wondering what credit score you need to qualify for a bank loan? This article breaks down the numbers banks actually want to see, why they care, and what to do if your score isn't perfect. Learn how credit scores affect loan approval and interest rates, and discover insider tips to boost your chances. Get the facts so you can walk into the bank ready and confident.

Read More >>Hardship Loan: What It Really Means and How It Can Help

A hardship loan is a special kind of personal loan designed for people facing sudden financial trouble, like job loss or big medical bills. This article breaks down exactly how hardship loans work, who qualifies, and where to find them. Expect practical advice on using them wisely and avoiding hidden traps. Real talk, real facts—so you can decide if this is a smart move when life throws you off track. Clear tips and examples make it easy to decide if a hardship loan fits your situation.

Read More >>Are Personal Loans Hard to Get? What Really Matters in 2025

Wondering if personal loans are tough to qualify for? It usually depends on a few key things like your credit score, income, and current debts. This article breaks down what lenders actually look at in 2025 and how you can boost your odds of getting approved. I'll share some common roadblocks and practical ways to work around them. You'll get the facts, plus tips to avoid wasting time on the wrong applications.

Read More >>What is a Ghost Loan? Understanding the Hidden World of Unseen Debt

Ghost loans are the hidden personal loans that may not be visible on your credit report but can impact your financial standing. Understanding how they work, recognizing the risks, and knowing how to deal with them is crucial. Learn practical tips to safeguard yourself from unforeseen loans and manage your financial health effectively.

Read More >>How to Get Cash without a Loan: Practical Alternatives

Finding yourself in a pinch without the option of securing a loan can be daunting, but don't worry—there are practical ways to access cash. From selling unused items to tapping into peer-to-peer lending, various alternatives are available. Consider side gigs or cash advances from your job as viable options. It's about being resourceful and exploring every avenue. This guide dives into cash solutions when loans aren't on the table.

Read More >>