Archive: 2026/01

What Happens If Your House Is Worth More Than Your Mortgage?

When your house is worth more than your mortgage, you have positive equity. This gives you options like remortgaging to access cash-but it also comes with risks. Learn how to use your home’s value wisely.

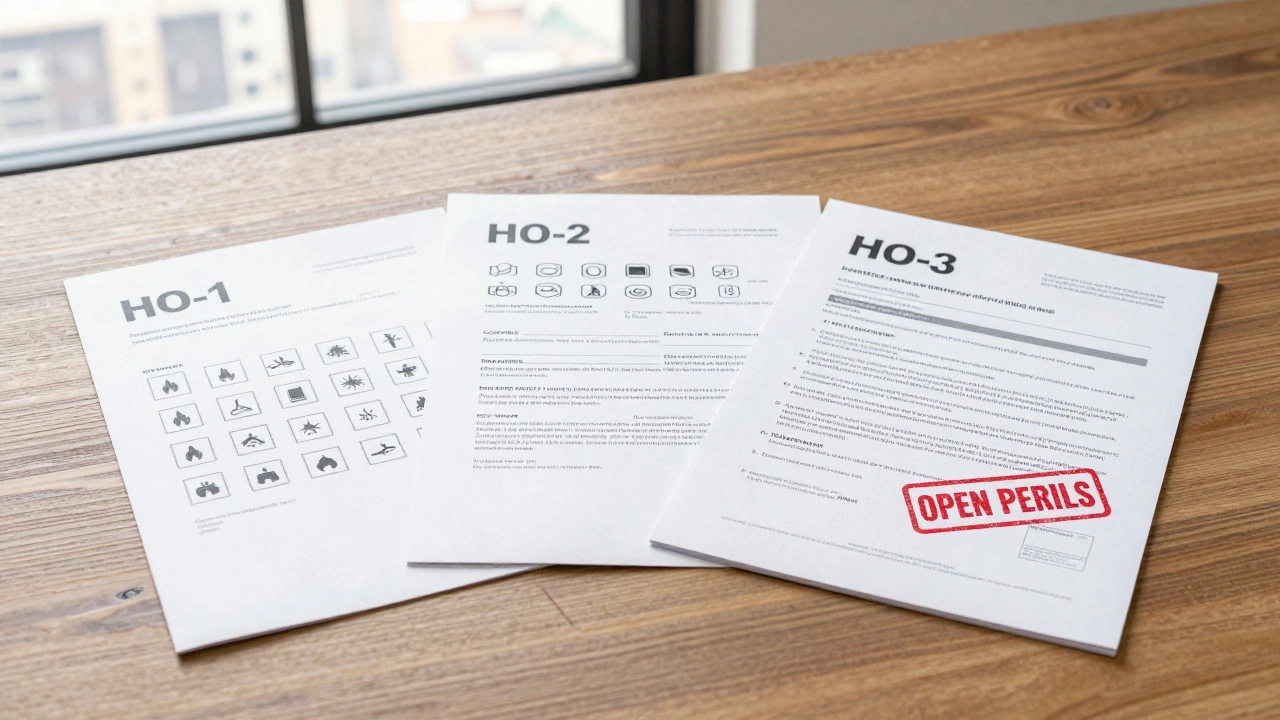

Read More >>What Are the Three Main Types of Homeowners Insurance?

Learn about the three main types of homeowners insurance-HO-1, HO-2, and HO-3-and understand which one offers real protection for your home and belongings. Know what’s covered, what’s not, and how to avoid costly gaps.

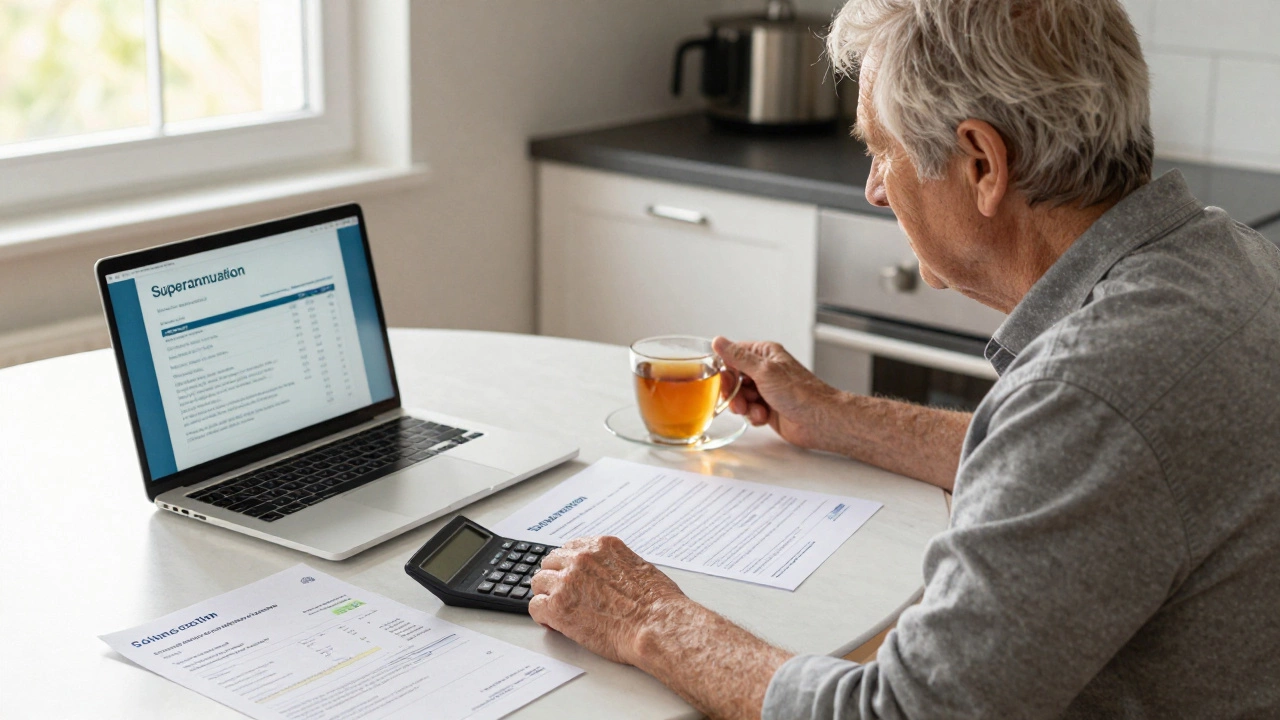

Read More >>Are Pension Plans Obsolete in 2026?

Pension plans aren't obsolete-but they're not enough anymore. Superannuation is just the start. In 2026, you need multiple income streams to retire comfortably. Here's how to build one.

Read More >>Is It Hard to Get a $4000 Personal Loan? Here’s What Actually Matters

Getting a $4000 personal loan in Australia isn’t impossible - even with bad credit. Learn what lenders really check, where to apply, and how to improve your chances without falling for scams.

Read More >>At What Point Can You Pull Equity Out of Your Home?

You can pull equity out of your home once you have at least 20% ownership, but the real question is whether it makes sense. Learn the three main ways Australians access home equity-and when to avoid it.

Read More >>What Are the Negative Effects of Debt Consolidation?

Debt consolidation can seem like a quick fix, but it often hides hidden costs, longer repayment terms, and risks to your credit score and assets. Learn the real downsides and when it actually helps.

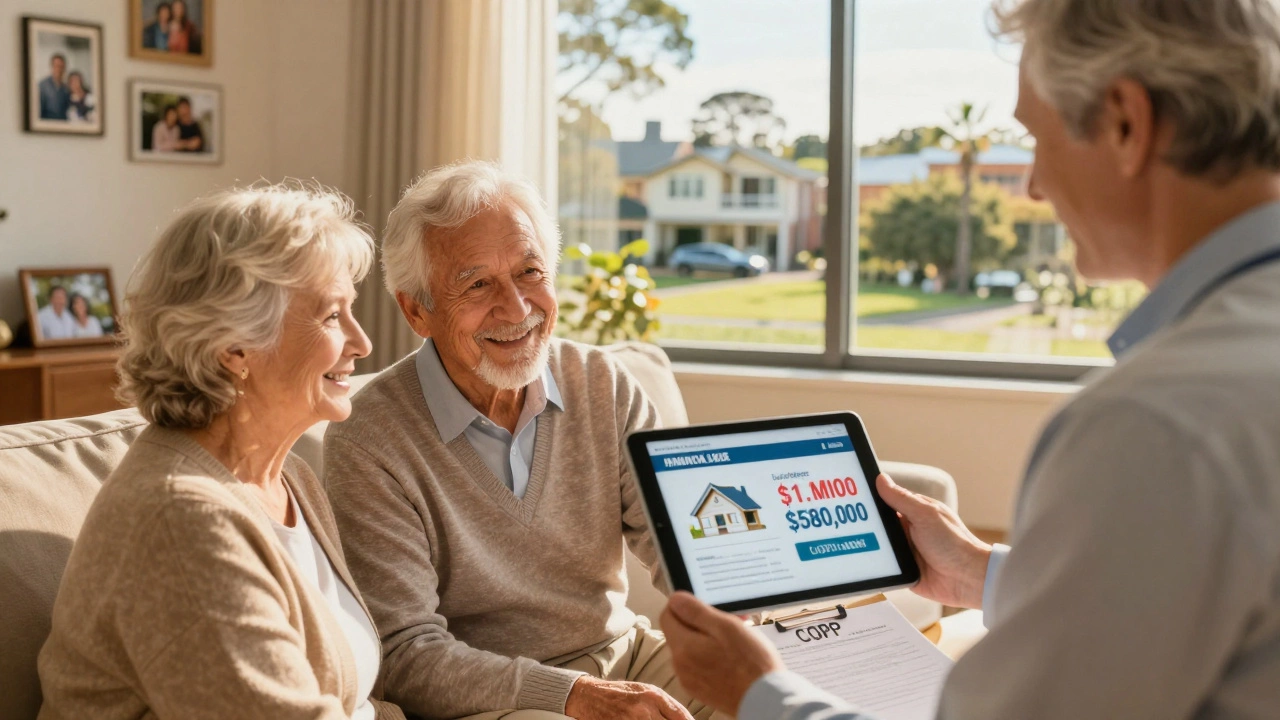

Read More >>What Is the Most You Can Get on Equity Release?

Learn how much you can realistically get from equity release in Australia. Factors like age, home value, health, and location determine your maximum payout - with some homeowners accessing over $500,000.

Read More >>What Credit Score Do You Need to Get 0% Interest on a Car?

To get 0% interest on a car in Australia, you typically need a credit score of 750 or higher - ideally above 833. Learn what lenders look for, how to improve your score, and how to avoid common traps with car finance deals.

Read More >>What to Do When No One Will Give You a Loan: Real Steps for Debt Relief in Australia

If you've been denied a loan in Australia, you're not out of options. Learn how to fix your credit, use free debt counselling, and avoid dangerous alternatives like payday lenders. Real steps for recovery without borrowing more.

Read More >>What Is a Good Monthly Retirement Income in Australia?

A good monthly retirement income in Australia ranges from $2,500 for a frugal lifestyle to $7,000+ for comfort. Most retirees need $4,000-$6,000, combining super, Age Pension, and part-time work. Planning ahead is key.

Read More >>What Is the Rule Never Lose Money Buffett? The Simple Truth Behind Warren Buffett's #1 Investment Principle

Warren Buffett's rule to never lose money isn't about avoiding risk-it's about avoiding stupid mistakes. Learn how to apply his simple, powerful strategy to protect your investments and build wealth over time.

Read More >>What Are the Three Main Types of Life Insurance?

Learn the three main types of life insurance - term, whole, and universal - and which one fits your financial goals. Avoid overpaying and choose the right coverage for your family’s needs.

Read More >>