Author: Evelyn Waterstone - Page 2

How to Invest in Cryptocurrency for Beginners: A Simple Step-by-Step Guide

Learn how to start investing in cryptocurrency as a beginner with simple steps: choose a trusted exchange, buy small amounts, use a secure wallet, diversify wisely, and stay aware of taxes. No hype, just clear guidance.

Read More >>How Much Bitcoin Can You Buy With $1000 in 2026? A Simple Guide

Find out exactly how much Bitcoin $1000 buys today. Learn about price fluctuations, fees, and steps to purchase Bitcoin with $1000 in 2026.

Read More >>Which homeowners insurance company has the highest customer satisfaction?

Amica Mutual leads in customer satisfaction for homeowners insurance in 2025, offering faster claims, better communication, and personalized service. Learn why mutual insurers outperform big names and how to choose the right provider for your needs.

Read More >>What Credit Score Do You Need to Consolidate Debt in 2026?

You don't need a perfect credit score to consolidate debt - just one above 650. Learn the real numbers, what lenders look for, and how to actually get out of debt without falling deeper.

Read More >>What Happens If Your House Is Worth More Than Your Mortgage?

When your house is worth more than your mortgage, you have positive equity. This gives you options like remortgaging to access cash-but it also comes with risks. Learn how to use your home’s value wisely.

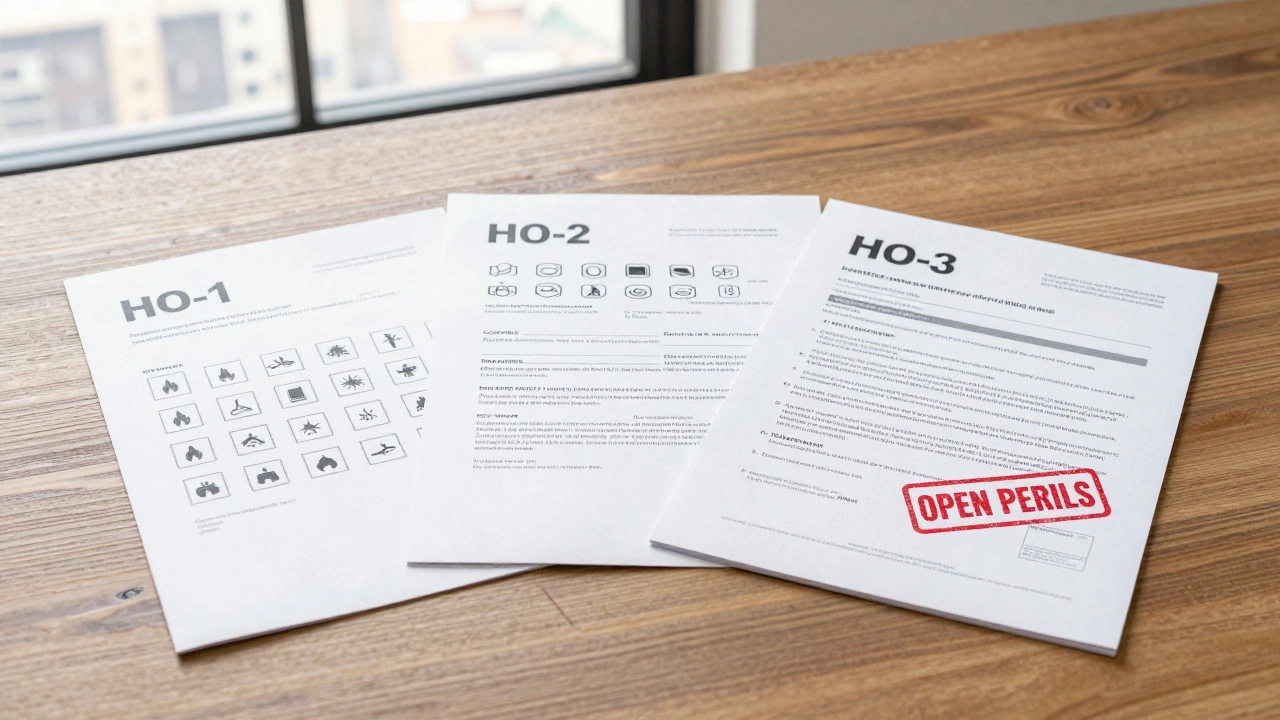

Read More >>What Are the Three Main Types of Homeowners Insurance?

Learn about the three main types of homeowners insurance-HO-1, HO-2, and HO-3-and understand which one offers real protection for your home and belongings. Know what’s covered, what’s not, and how to avoid costly gaps.

Read More >>Are Pension Plans Obsolete in 2026?

Pension plans aren't obsolete-but they're not enough anymore. Superannuation is just the start. In 2026, you need multiple income streams to retire comfortably. Here's how to build one.

Read More >>Is It Hard to Get a $4000 Personal Loan? Here’s What Actually Matters

Getting a $4000 personal loan in Australia isn’t impossible - even with bad credit. Learn what lenders really check, where to apply, and how to improve your chances without falling for scams.

Read More >>At What Point Can You Pull Equity Out of Your Home?

You can pull equity out of your home once you have at least 20% ownership, but the real question is whether it makes sense. Learn the three main ways Australians access home equity-and when to avoid it.

Read More >>What Are the Negative Effects of Debt Consolidation?

Debt consolidation can seem like a quick fix, but it often hides hidden costs, longer repayment terms, and risks to your credit score and assets. Learn the real downsides and when it actually helps.

Read More >>What Is the Most You Can Get on Equity Release?

Learn how much you can realistically get from equity release in Australia. Factors like age, home value, health, and location determine your maximum payout - with some homeowners accessing over $500,000.

Read More >>What Credit Score Do You Need to Get 0% Interest on a Car?

To get 0% interest on a car in Australia, you typically need a credit score of 750 or higher - ideally above 833. Learn what lenders look for, how to improve your score, and how to avoid common traps with car finance deals.

Read More >>