Harmony Financial Services – Your UK Guide to Smart Money Moves

Welcome! Whether you’re saving for a house, planning retirement, or just want a better budget, we’ve got simple, actionable advice. Our team knows the UK market inside out, so you can avoid costly mistakes and make your money work harder.

Tailored Investment Advice

From ISA options to crypto basics, we break down each choice with real‑world examples. Want to know if a Stocks & Shares ISA beats a cash ISA? We compare tax benefits, risks and give you a step‑by‑step plan to pick the right one for your goals.

Complete Financial Planning

We cover everything – mortgage rates, debt consolidation, budgeting tricks and even equity release for retirees. Each article ends with a quick checklist so you can apply what you’ve learned today. No jargon, just clear steps you can use right now.

Start exploring, ask questions, and let us help you hit all the right notes with your finances.

Which Bank Has the Lowest Interest Rate on Vehicle Loans in Australia 2026?

ANZ offers the lowest vehicle loan interest rate in Australia in 2026 at 5.79%, but your credit score, deposit size, and car type affect what you actually pay. Learn how to lock in the best deal and avoid hidden costs.

Read More >>What Is the First Thing to Learn in Crypto?

The first thing to learn in crypto isn't trading or trends - it's securing your private keys. Without proper storage, even small investments can vanish forever. Learn how to use a hardware wallet and protect your seed phrase before buying anything.

Read More >>Are Student Loans Bad for Credit? Here’s What Actually Happens

Student loans aren't automatically bad for credit-they can actually help you build it. The key is making on-time payments. Missed payments hurt, but consistent ones improve your score over time. Learn how student debt affects your credit and how to use it wisely.

Read More >>Does Your Credit Score Go Up When You Consolidate Debt?

Debt consolidation can improve your credit score by lowering credit utilization and simplifying payments-but only if you avoid new debt and keep old accounts open. Learn how it works, when it helps, and when it hurts.

Read More >>What is the #1 credit card to have in 2026?

The American Express Platinum Cashback Card is the top credit card in 2026 for most Australians - offering 2% cashback on all spending with no annual fee. It’s simple, reliable, and pays you back for everyday purchases.

Read More >>Will Credit Score Affect Remortgage? What You Need to Know in 2026

Your credit score plays a major role in remortgaging. A low score can mean higher interest rates, fewer lender options, and thousands in extra costs. Learn how to improve it and secure better deals in 2026.

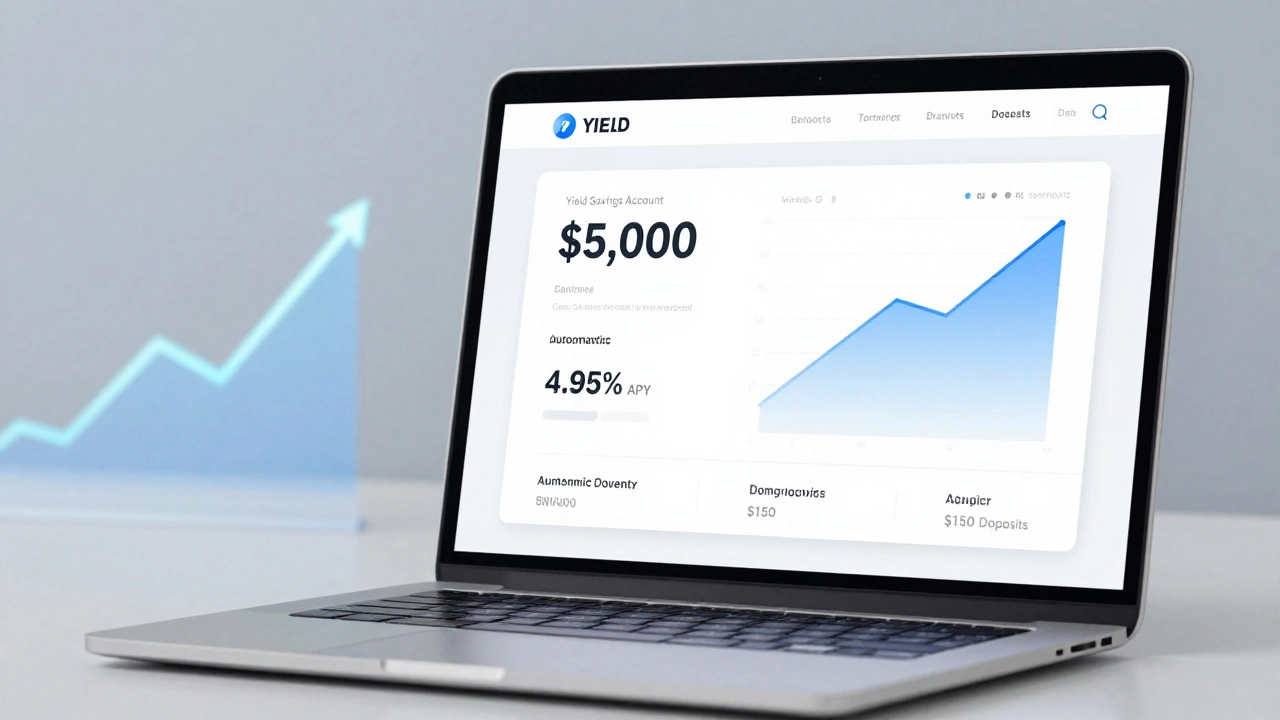

Read More >>How to Double $5000 in Savings Accounts and Realistic Investment Paths

You can double $5,000 without taking big risks - just by using high-yield savings accounts and smart, consistent saving. No crypto, no gambling. Just compound interest and time.

Read More >>What Is the 20-Year Rule for Student Loans?

The 20-year rule for student loans offers forgiveness after two decades of income-driven payments-but only for federal loans and under specific plans. Learn who qualifies, how taxes affect forgiveness, and what steps to take now to avoid surprises.

Read More >>Who is the best lender for bad credit in Australia 2026?

Finding the best lender for bad credit in Australia isn't about the lowest rate - it's about fair terms, transparency, and helping you rebuild. Here are the top three lenders in 2026 that actually work with people who have poor credit scores.

Read More >>How to Invest in Cryptocurrency for Beginners: A Simple Step-by-Step Guide

Learn how to start investing in cryptocurrency as a beginner with simple steps: choose a trusted exchange, buy small amounts, use a secure wallet, diversify wisely, and stay aware of taxes. No hype, just clear guidance.

Read More >>How Much Bitcoin Can You Buy With $1000 in 2026? A Simple Guide

Find out exactly how much Bitcoin $1000 buys today. Learn about price fluctuations, fees, and steps to purchase Bitcoin with $1000 in 2026.

Read More >>Which homeowners insurance company has the highest customer satisfaction?

Amica Mutual leads in customer satisfaction for homeowners insurance in 2025, offering faster claims, better communication, and personalized service. Learn why mutual insurers outperform big names and how to choose the right provider for your needs.

Read More >>